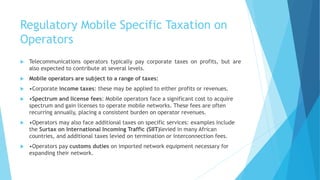

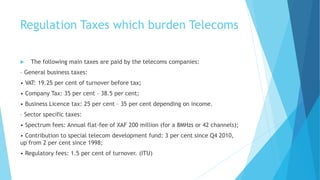

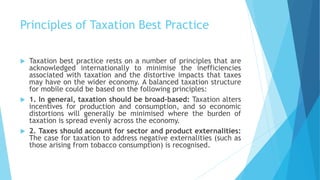

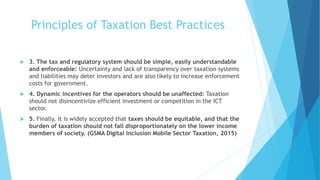

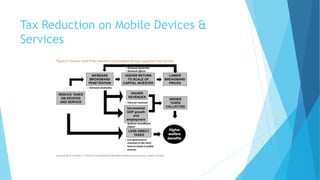

This document discusses taxation in the mobile sector. It notes that while mobile networks can benefit socioeconomic development by creating jobs and improving lives, sector-specific taxes levied on both consumers and operators can burden the mobile industry. Such taxes can increase prices and cause inefficiencies. The document recommends that taxation follow principles like being broad-based, accounting for externalities, not discouraging investment or competition, and being equitable. It suggests removing value-added tax on mobile handsets could boost access, GDP growth, and internet usage.