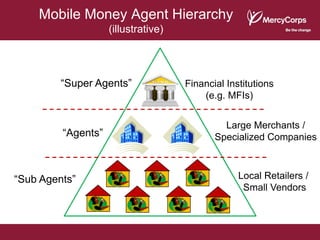

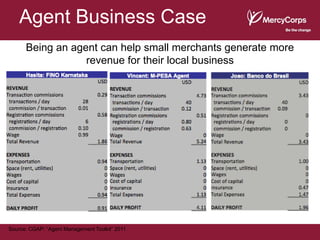

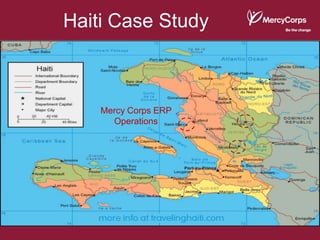

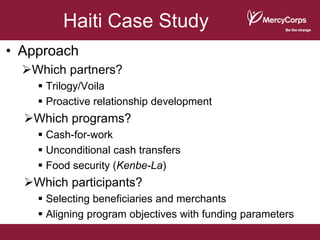

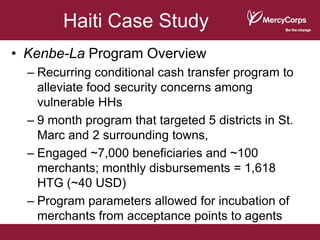

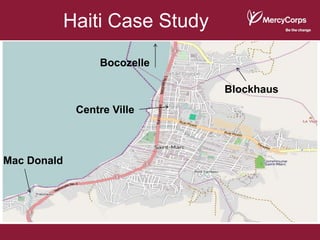

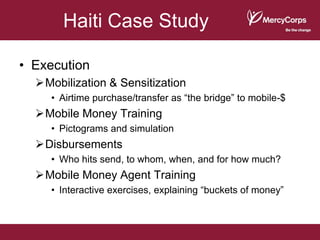

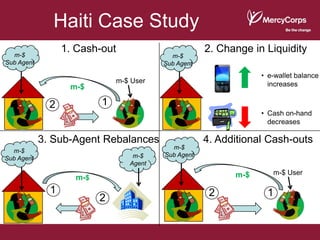

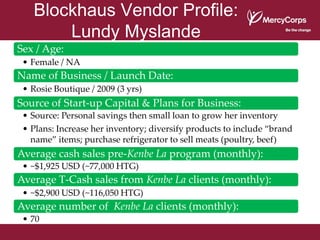

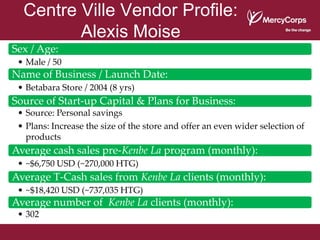

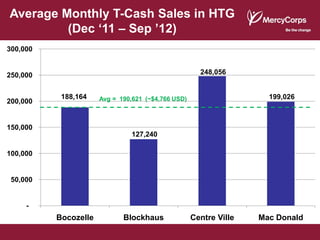

The document explores the role of mobile money agents, defining them as individuals or businesses facilitating cash-in and cash-out transactions for clients, bridging the gap between traditional banks and underserved communities. It presents a case study on Mercy Corps’ efforts in Haiti post-earthquake, emphasizing strategies for financial inclusion, partnerships, and the impact on local merchants through innovative cash transfer programs. Key lessons include agent training and mobilization, as well as potential roles for NGOs in supporting mobile money initiatives.