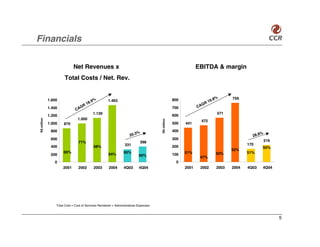

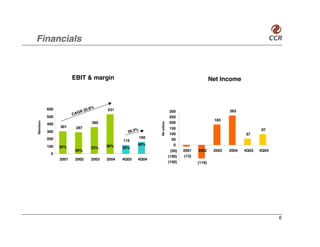

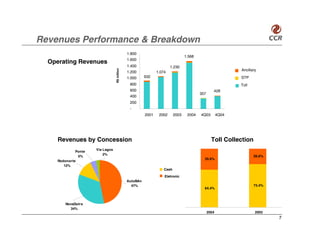

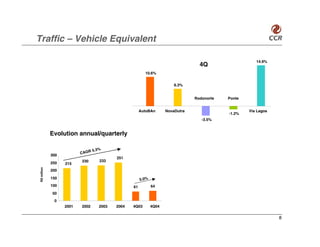

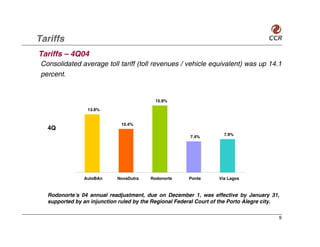

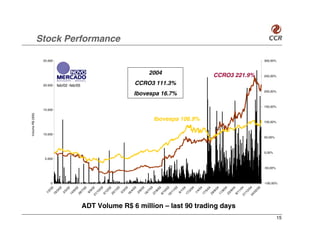

1) CCR reported strong financial results in 2004 with increased traffic, revenues and margins across its concessions.

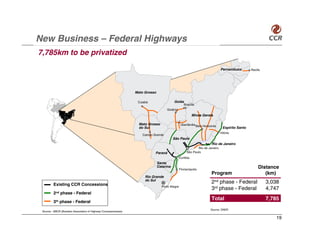

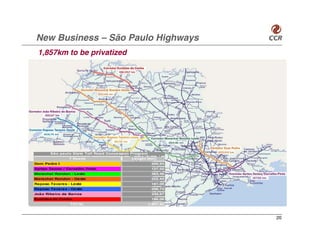

2) Looking forward, CCR sees growth opportunities from bidding on additional federal highway concessions and the large São Paulo state highway privatization program.

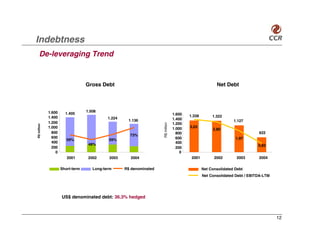

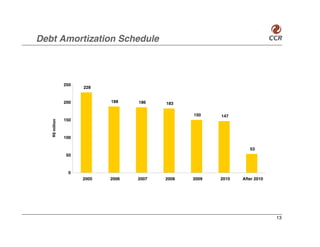

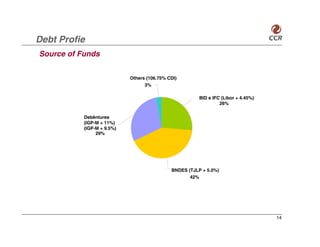

3) CCR maintains a conservative capital structure and dividend policy to support continued growth through new concessions.