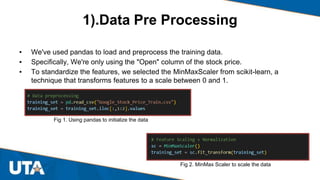

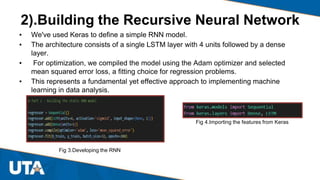

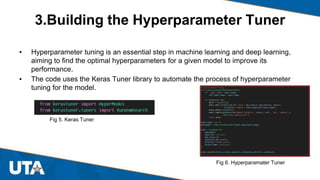

Machine learning can be used to analyze historical stock price data and predict future stock price movements, helping traders make more informed decisions. The student group constructed a recurrent neural network model using Keras and a hyperparameter tuning library to predict stock prices. They preprocessed the data, built the RNN architecture with an LSTM layer and dense layer, tuned hyperparameters to improve performance, trained the model on stock price data, made predictions on test data, and evaluated the model's accuracy using RMSE.