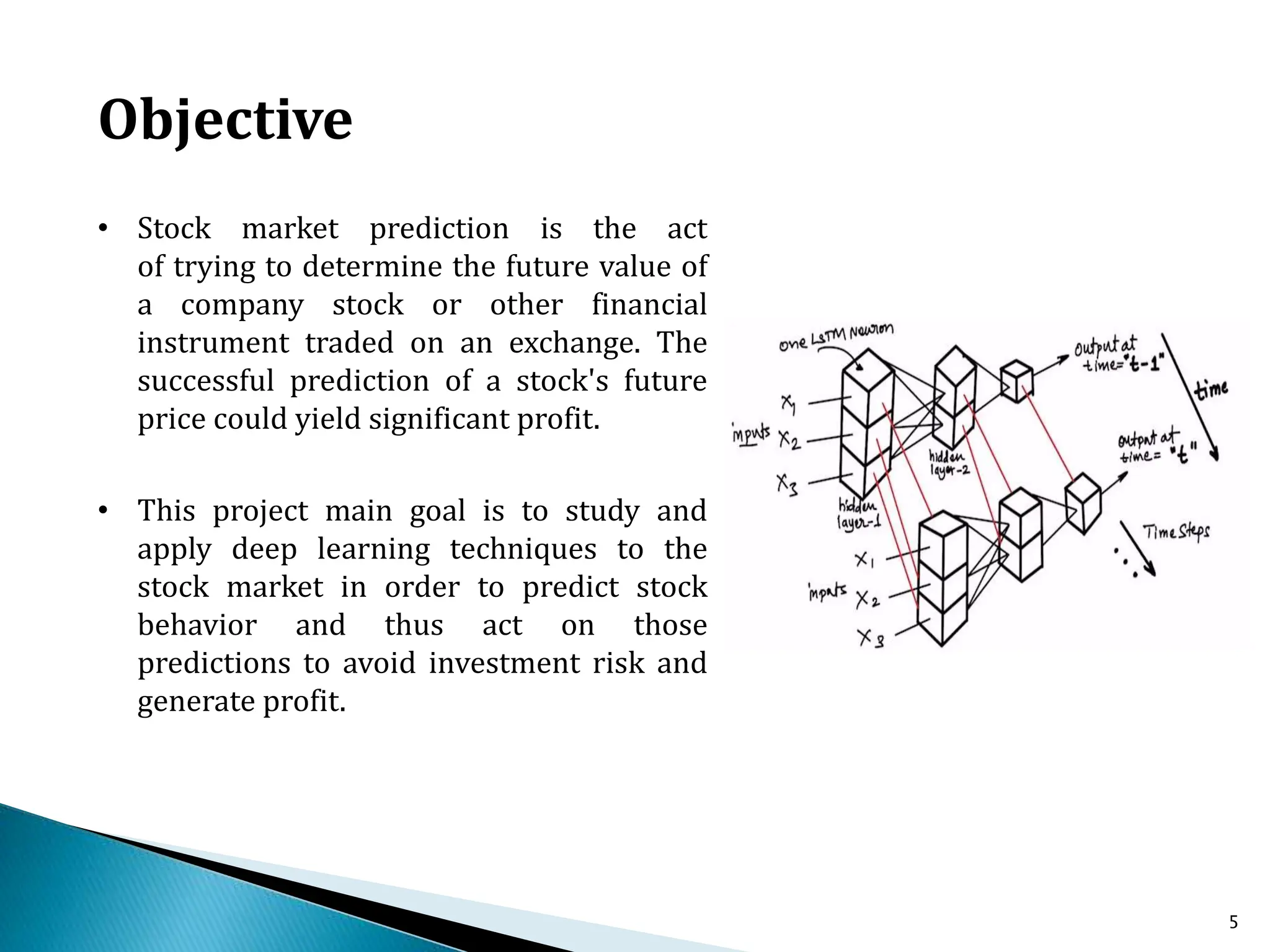

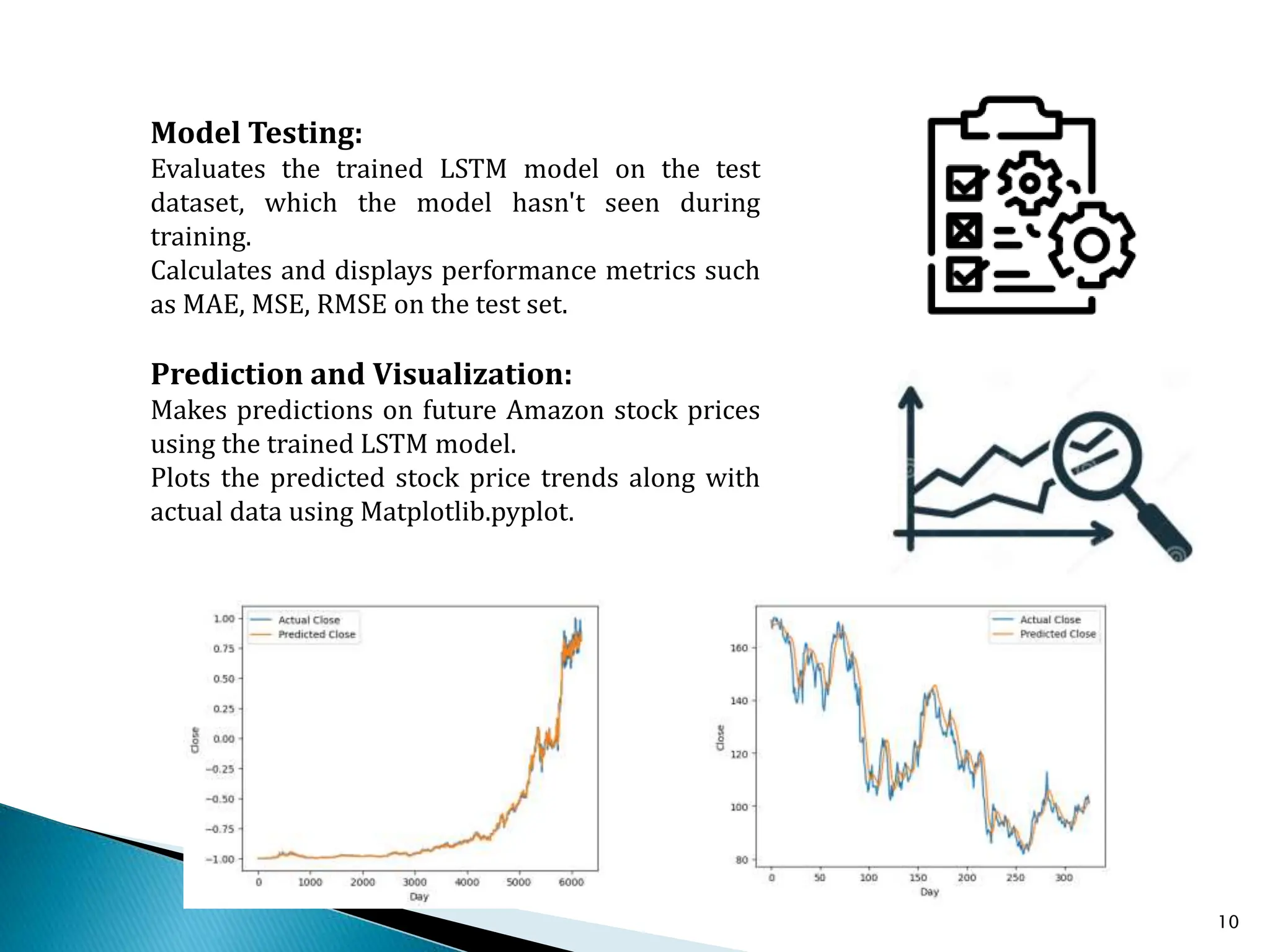

This document describes a project focused on predicting Amazon stock prices using neural networks, specifically employing Long Short-Term Memory (LSTM) models. The aim is to enhance forecasting accuracy by analyzing historical stock data and utilizing deep learning techniques to mitigate investment risks and improve profitability. The project also outlines methodologies for data collection, preprocessing, model training, and future enhancements such as real-time data integration and automated trading strategies.

![13

[1] Raymond Chiong , Zongwen Fan, Zhongyi Hu, and Sandeep Dhakal “A Novel

Ensemble Learning Approach for Stock Market Prediction Based on Sentiment Analysis

and the Sliding Window Method”,2022.

[2] T. Fischer and C. Krauss, “Deep learning with long short-term memory 600

networks for financial market predictions,” Eur. J. Oper. Res., vol. 270, 601 no. 2, pp.

654–669, Dec. 2017. 602

[3] X. Wu, Q. Ye, H. Hong, and Y. Li, “Stock selection model based on 603 machine

learning with wisdom of experts and crowds,” IEEE Intell. 604 Syst., vol. 35, no. 2, pp.

54–64, Mar. 2020. 605 [4] M. Jiang, L. Jia, Z. Chen, and W. Chen, “The two-stage machine

606 learning ensemble models for stock price prediction by combining 607 mode

decomposition, extreme learning machine and improved har- 608 mony search

algorithm,” Ann. Oper. Res., vol. 309, pp. 553–585, 609 Jun. 2020. 610

REFERENCES](https://image.slidesharecdn.com/batch12tsausinglstm-240728174752-bfc2e725/75/Batch_12_TSA_using_LSTM-machine-learning-project-13-2048.jpg)