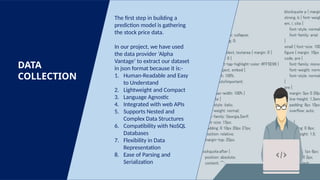

The document discusses stock market investment, focusing on forecasting stock prices using machine learning techniques. It highlights the importance of data collection, preprocessing, model training, feature engineering, and backtesting in building effective stock price prediction models. The document serves as a guide for investors and analysts to enhance decision-making and risk management through automated analysis of market data.