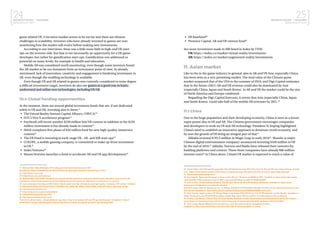

The 2017 report by Business Finland and Neogames explores the current and future landscape of virtual reality (VR) and augmented reality (AR), highlighting trends, technology advancements, and market challenges. It discusses the fragmented nature of the consumer VR market, the technological demands for better user experiences, and the need for more affordable casual VR devices to reach mainstream audiences. The report identifies the continued potential for VR in gaming despite early struggles, emphasizing the importance of understanding user expectations and addressing market demands.