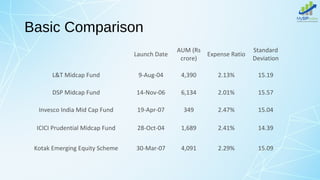

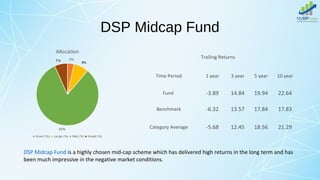

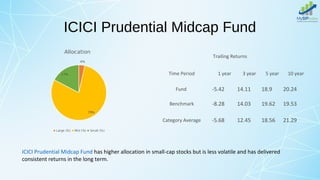

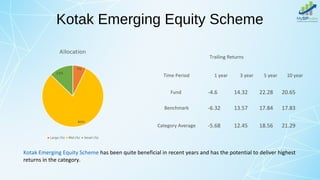

The document discusses mid-cap mutual funds, which invest in equities of mid-cap companies (ranked 100th to 251st by market capitalization) and have the potential for higher returns despite higher risks. It lists top-performing funds for FY 2019-20, including L&T Midcap Fund, DSP Midcap Fund, and Invesco India Mid Cap Fund, providing details on their performance and metrics. It advises investors seeking long-term capital gains to consider these funds, but warns that conservative or short-term investors should avoid them.