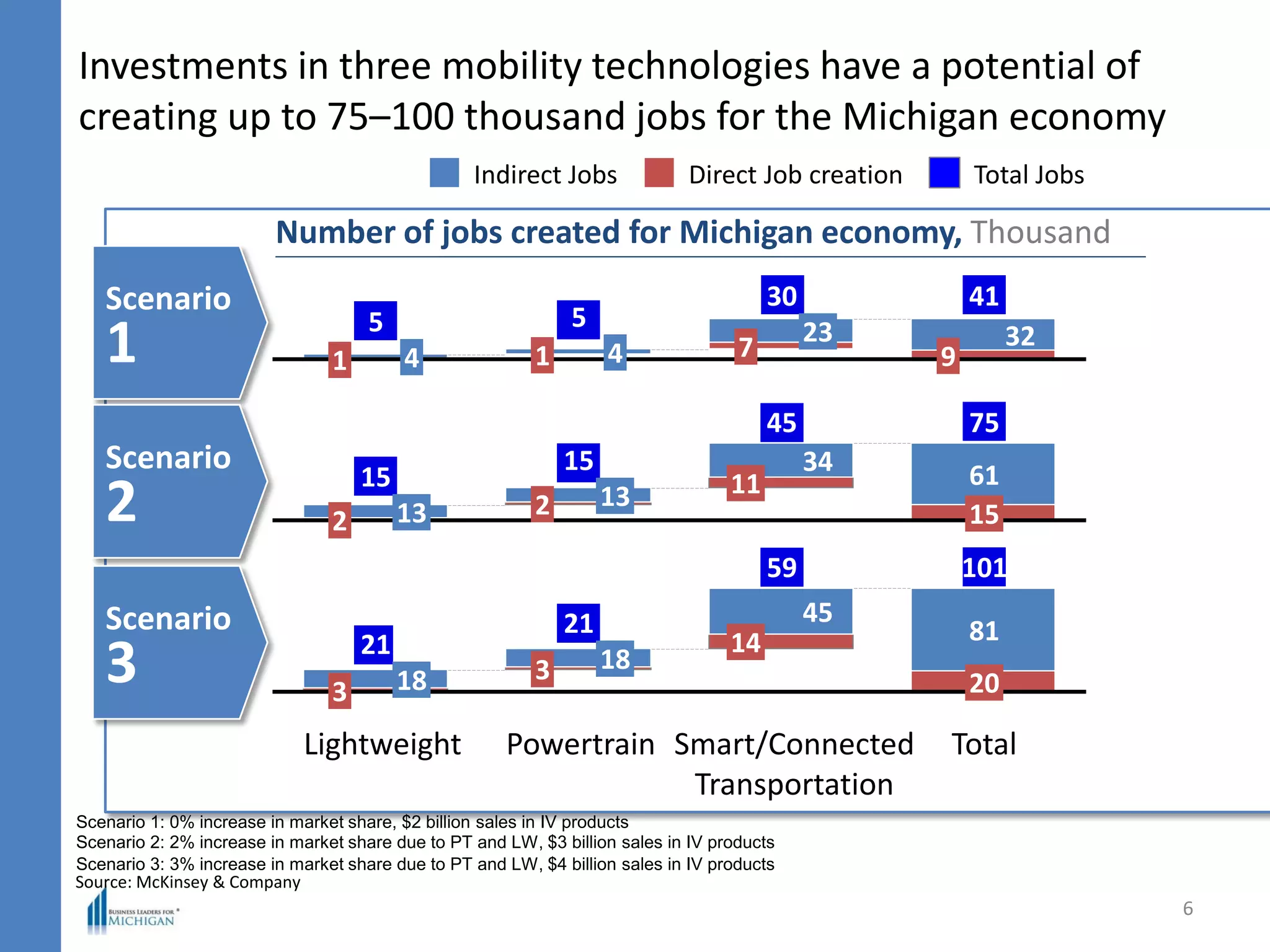

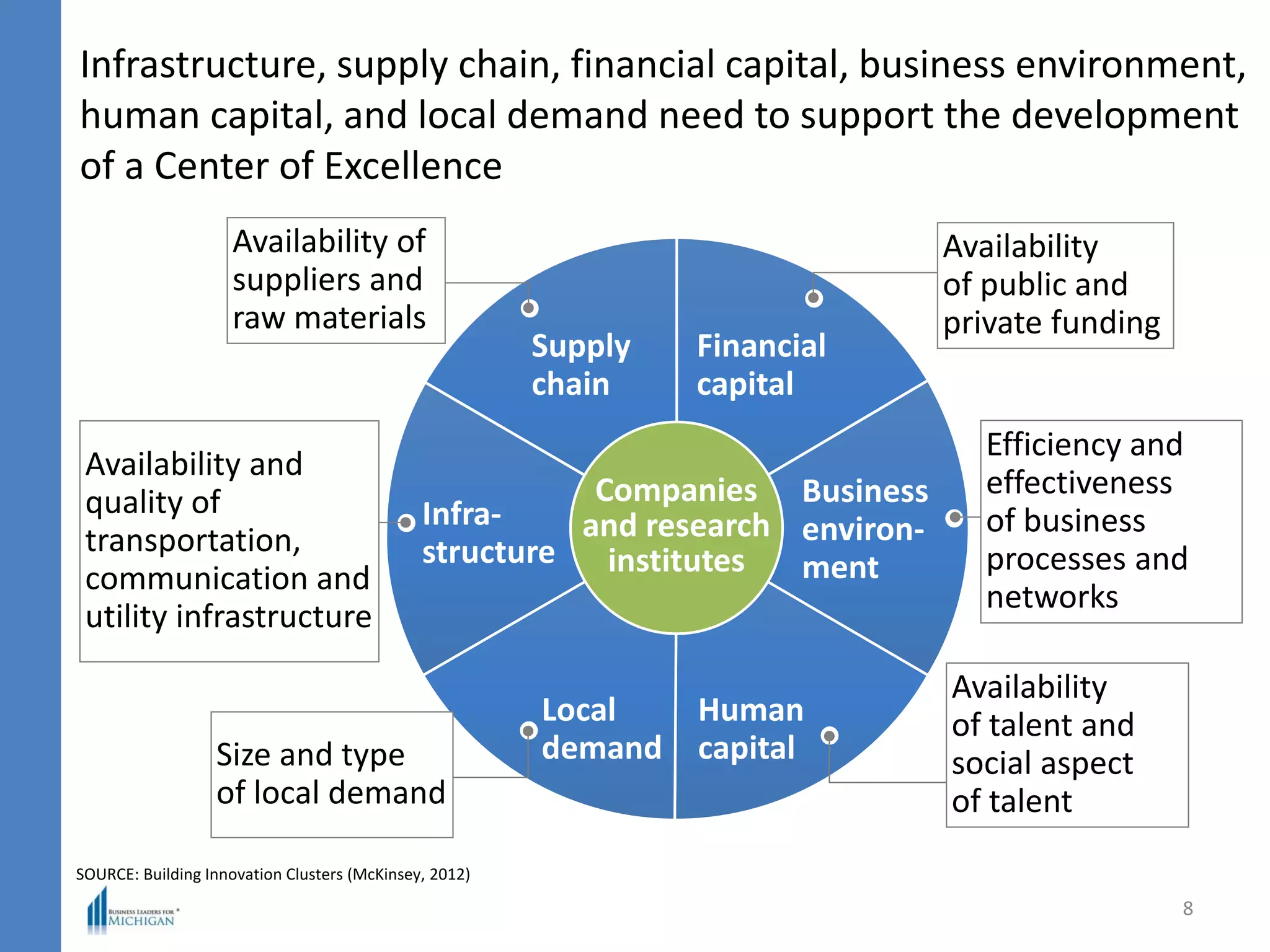

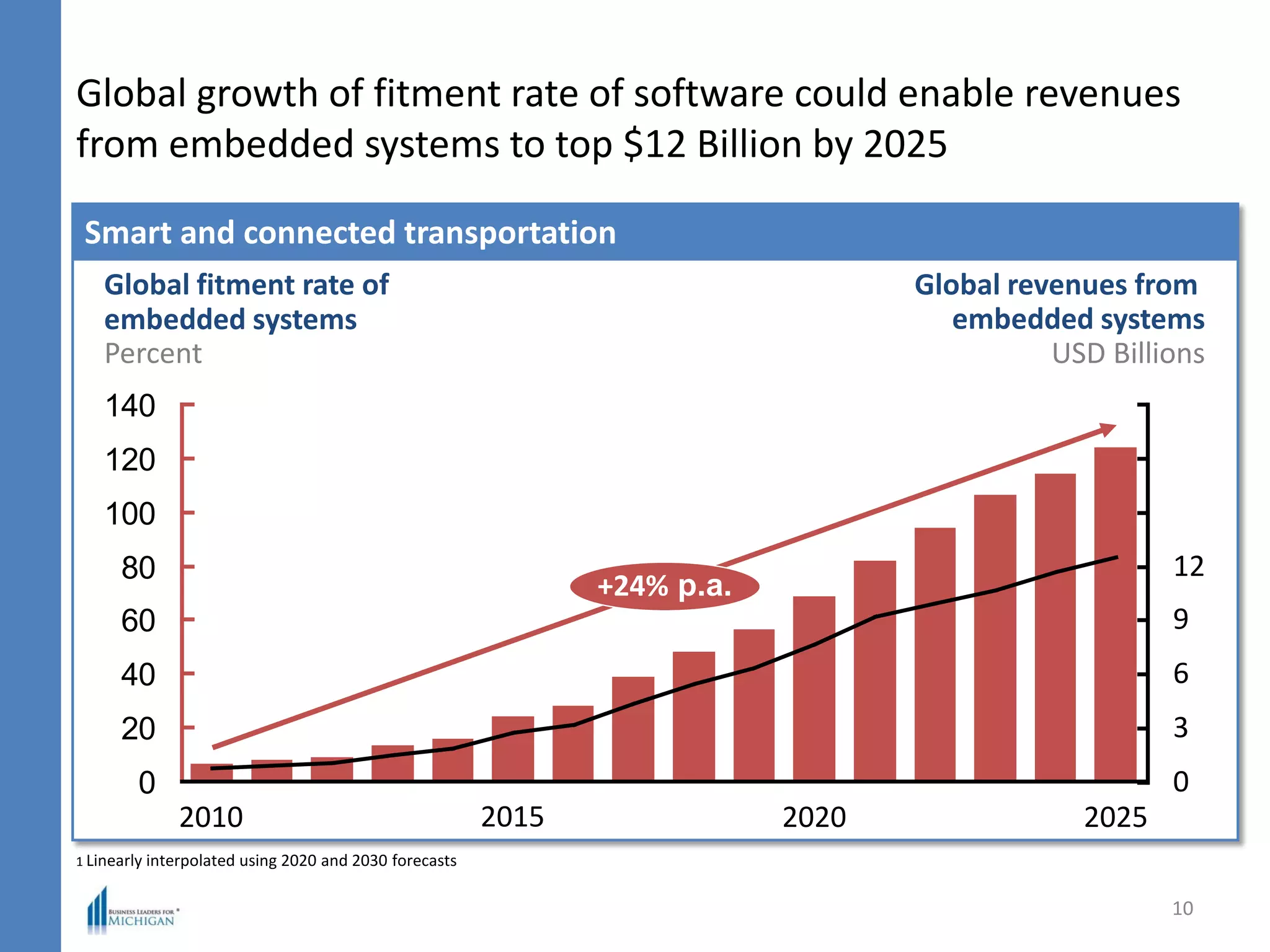

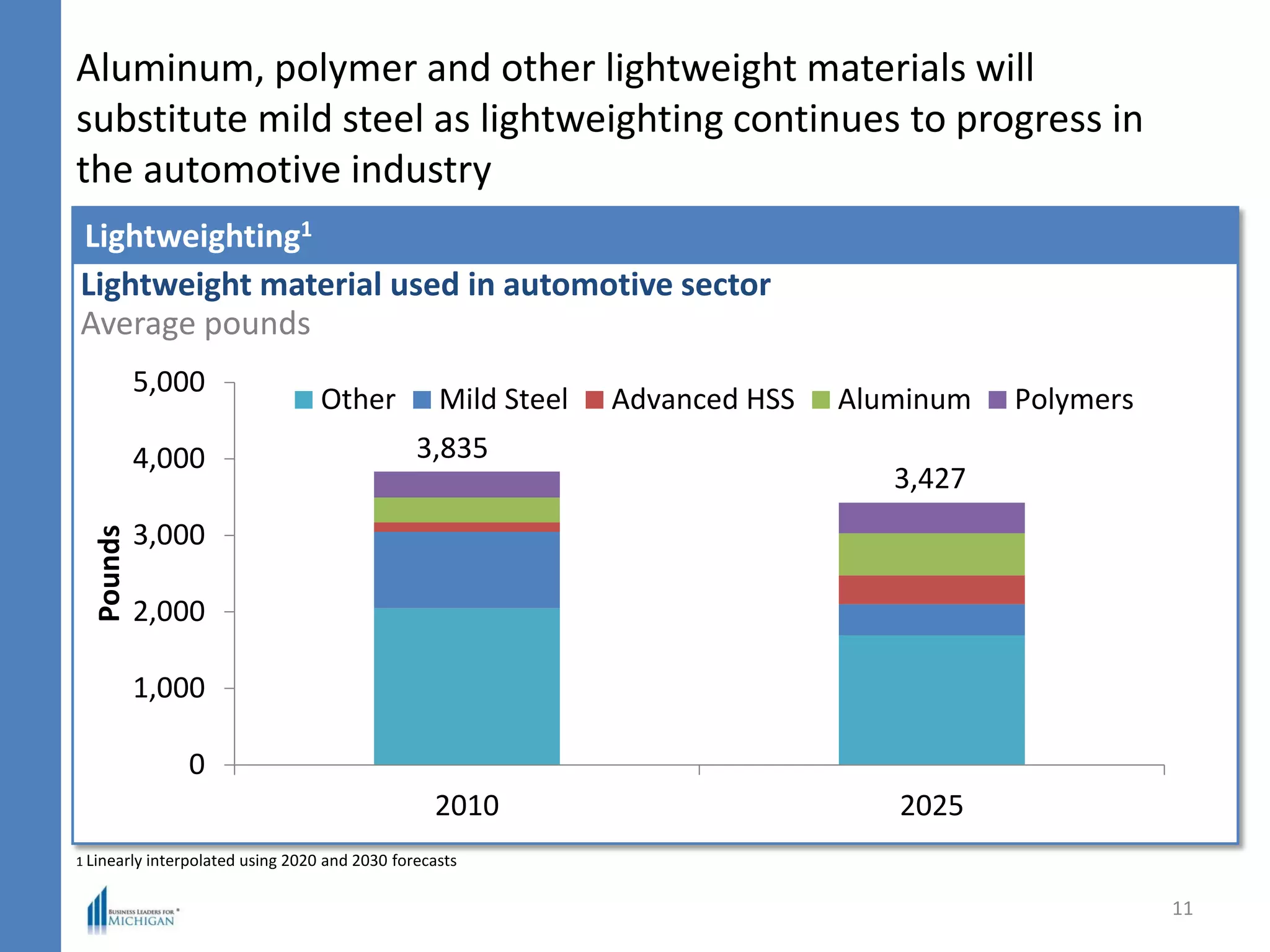

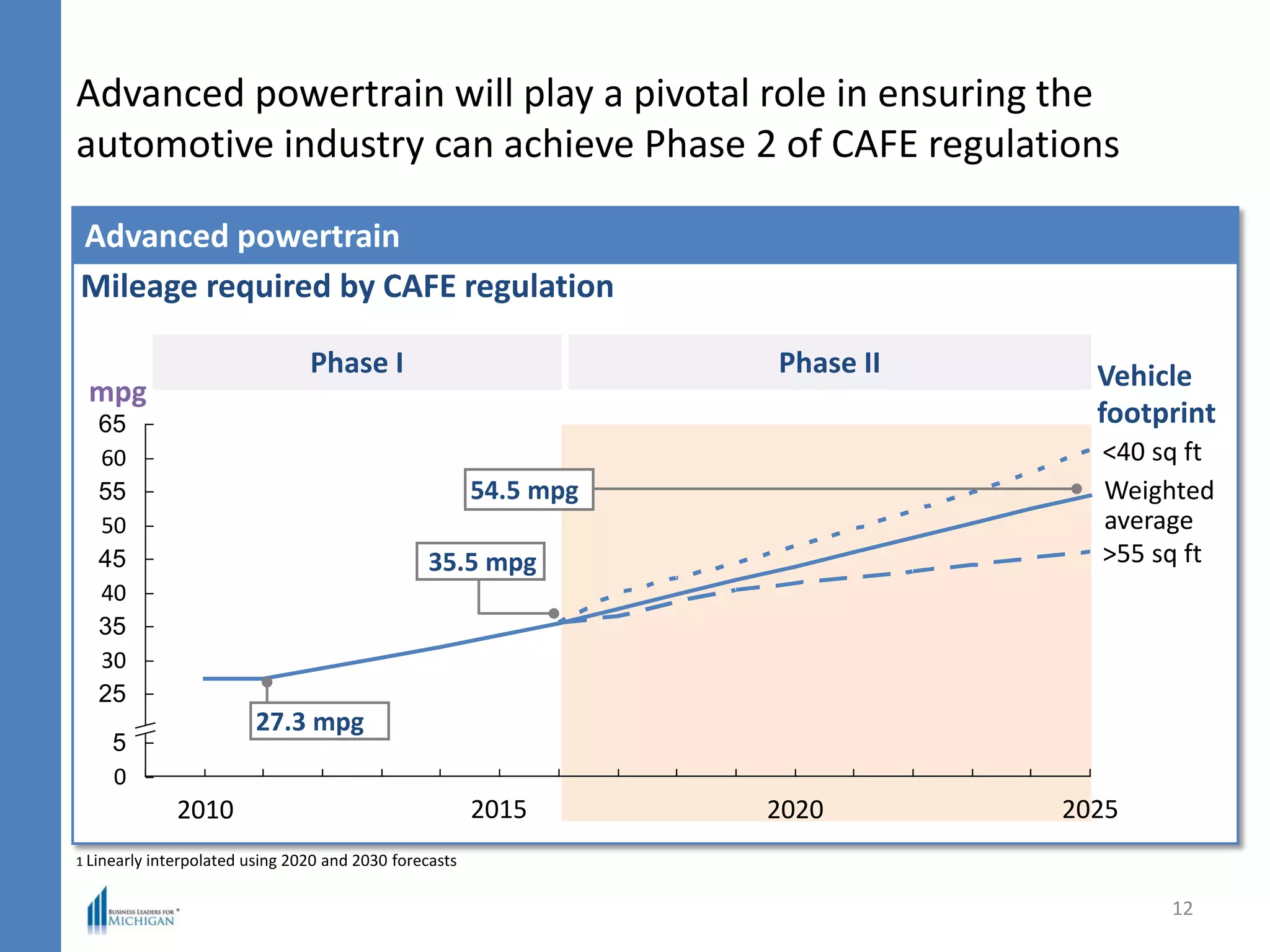

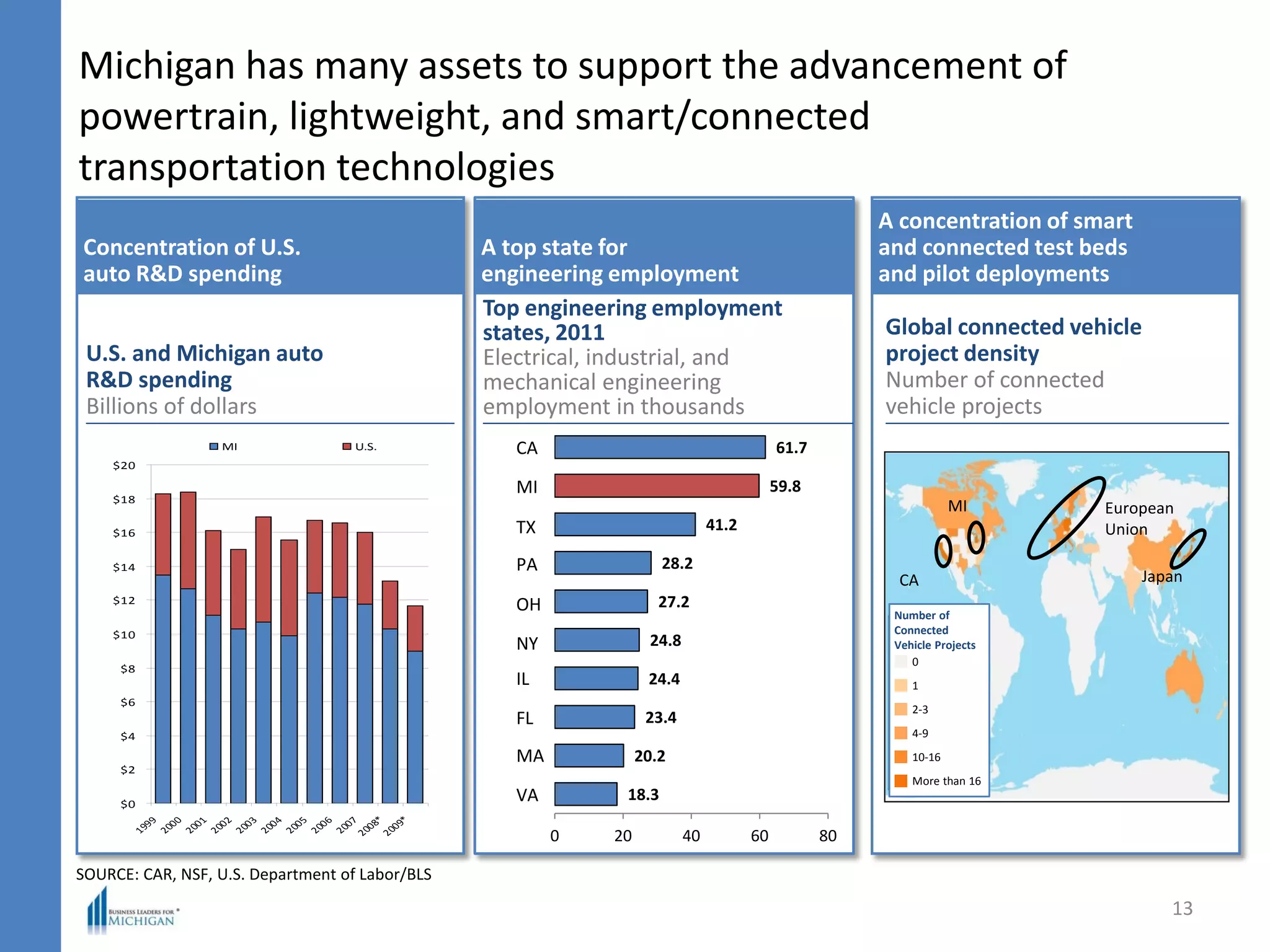

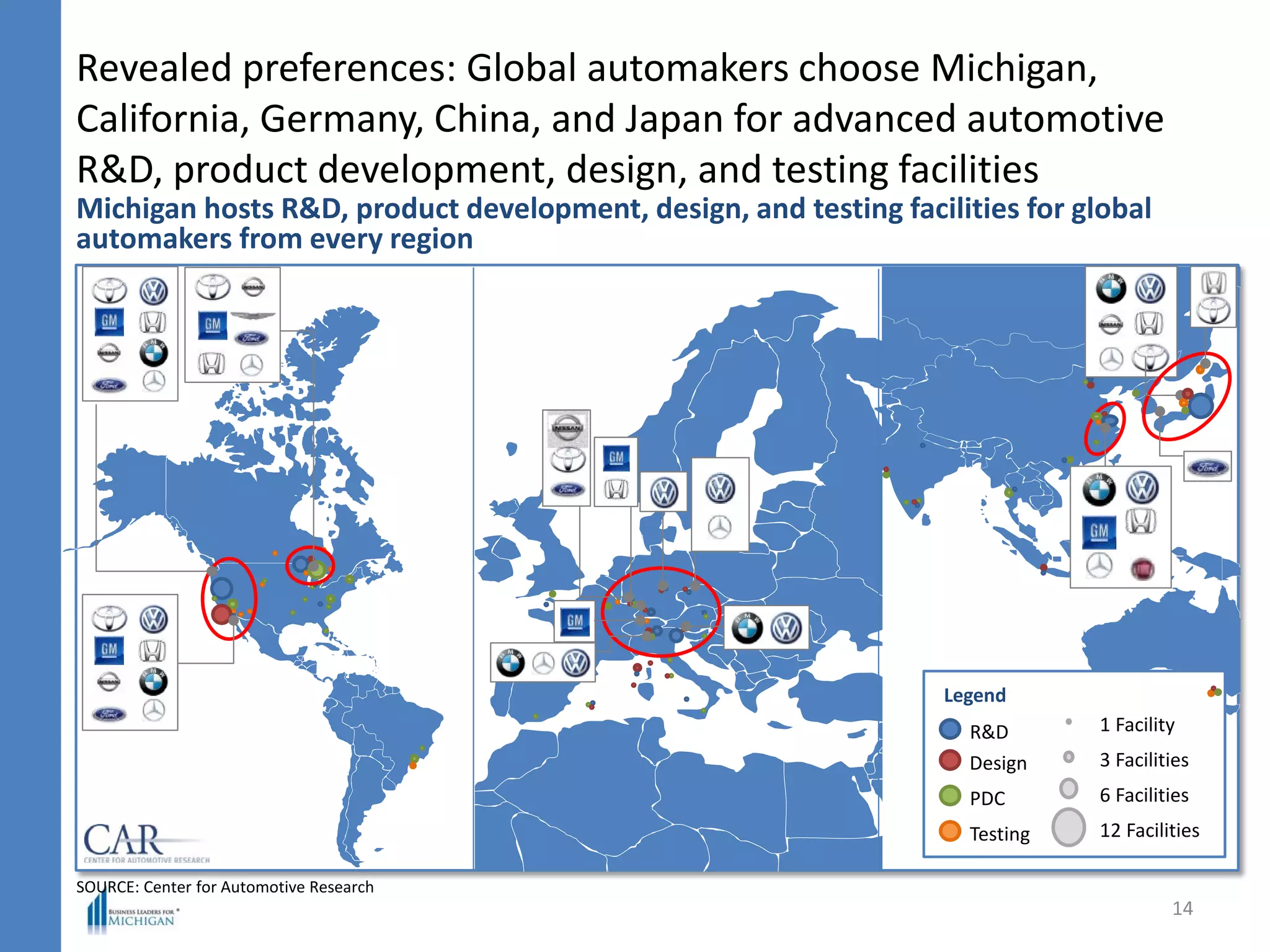

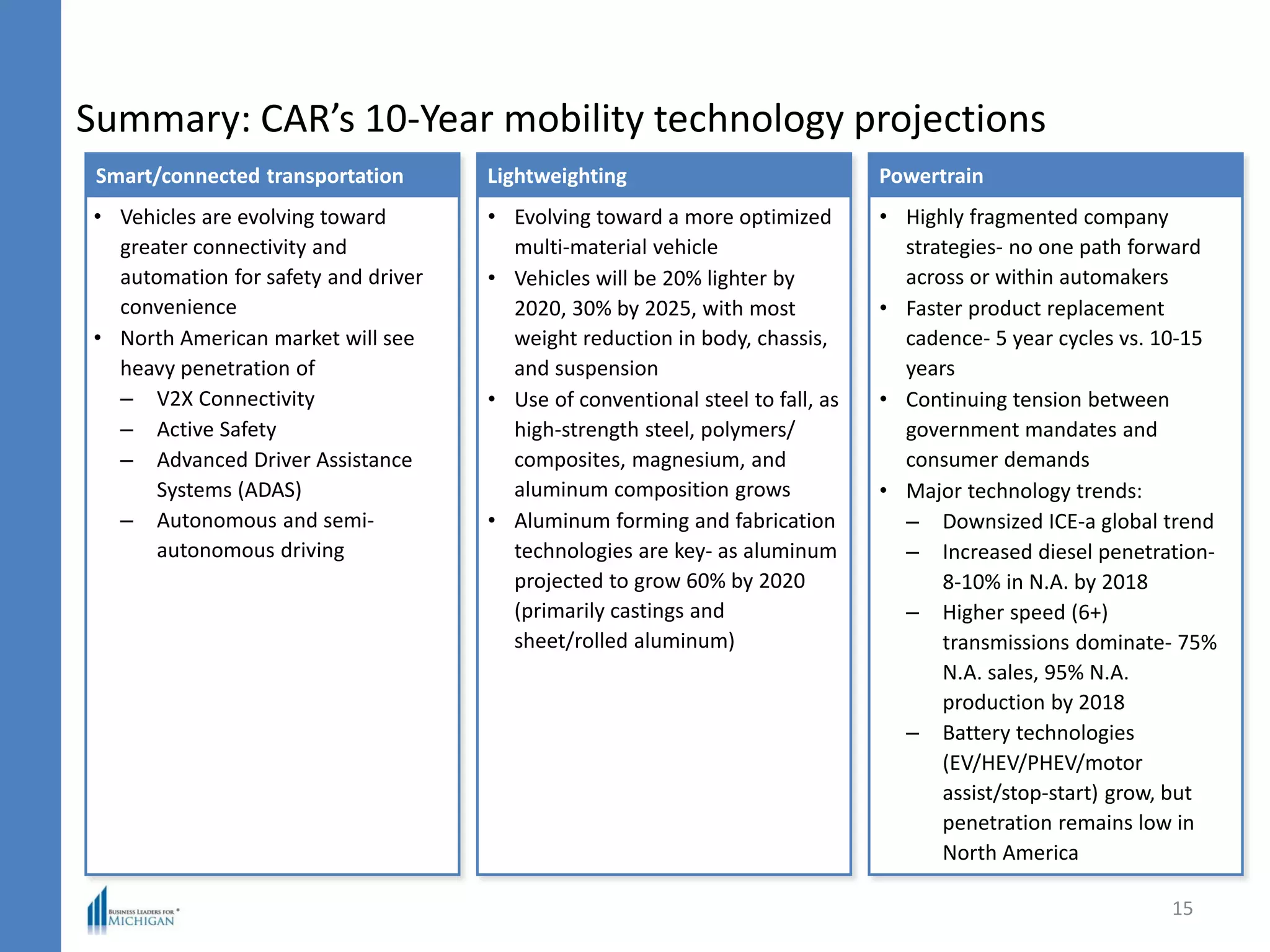

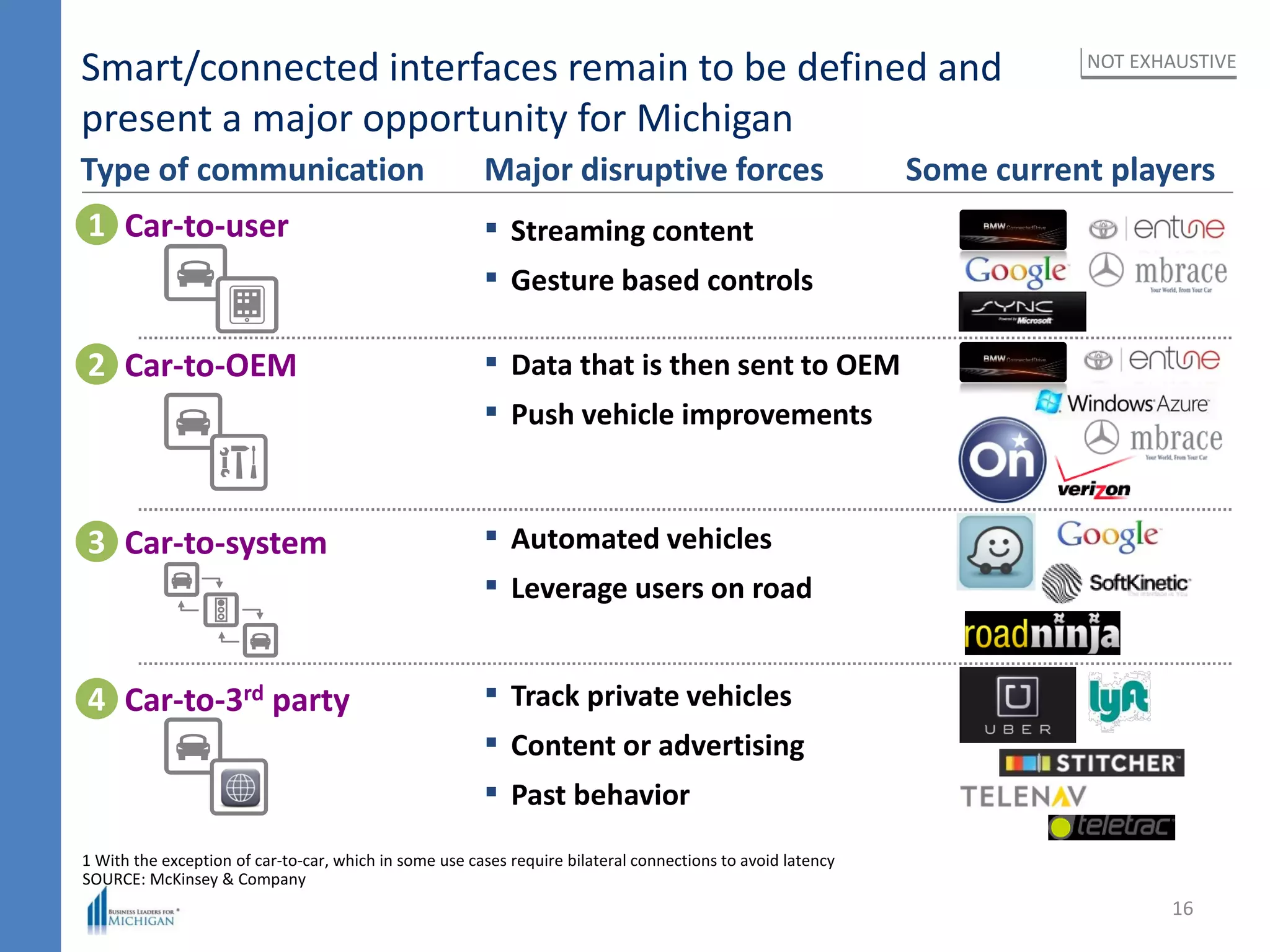

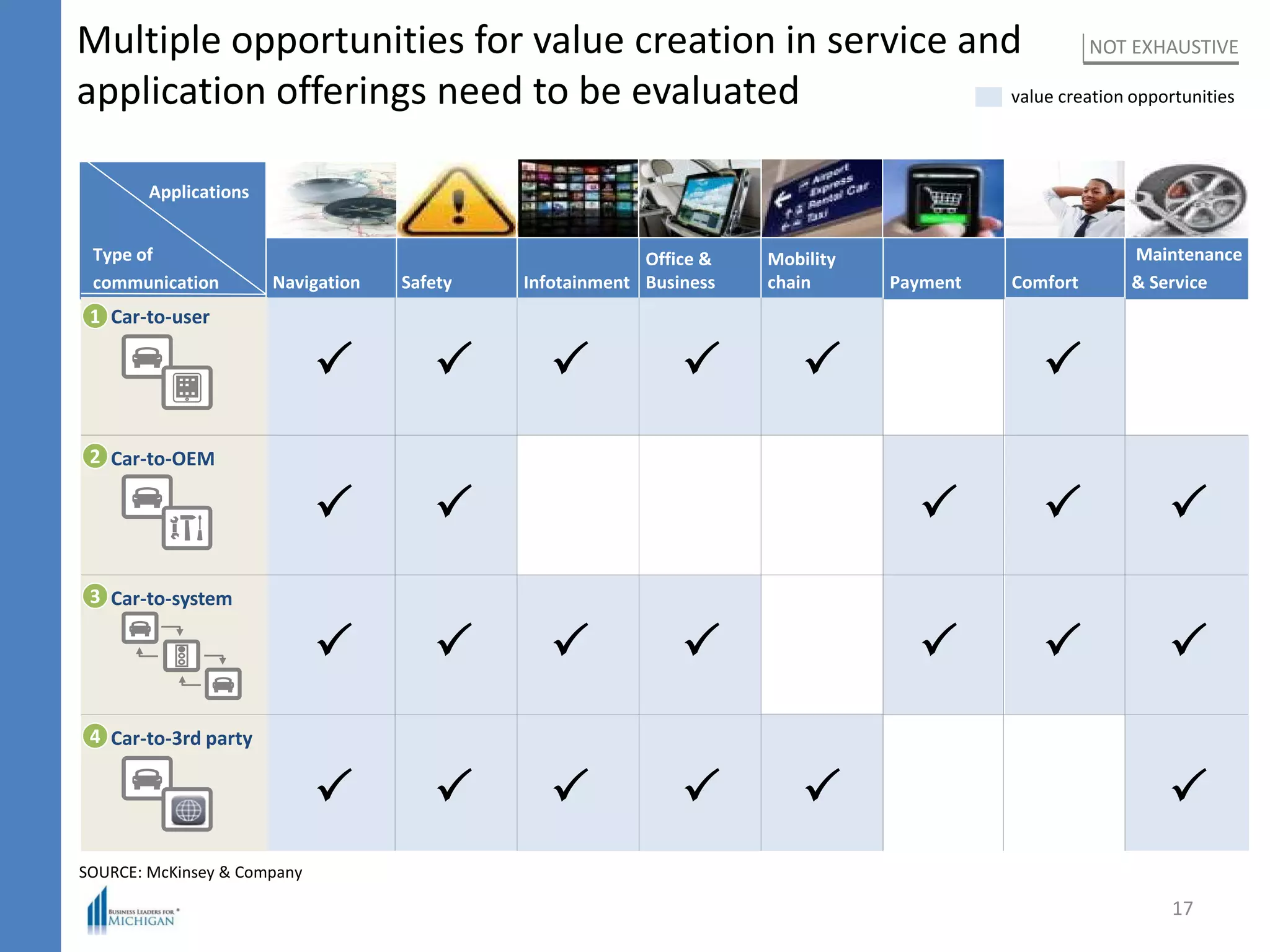

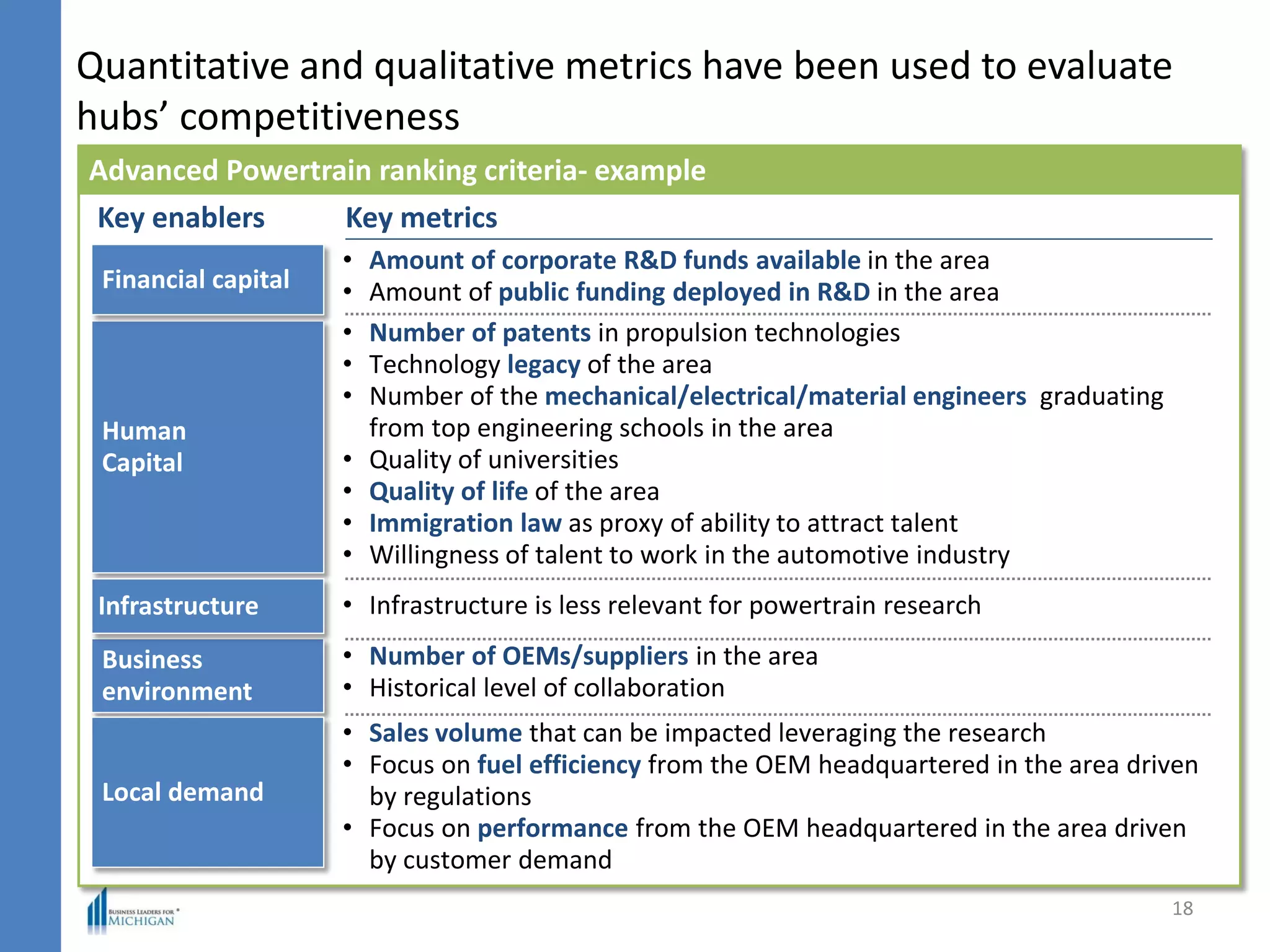

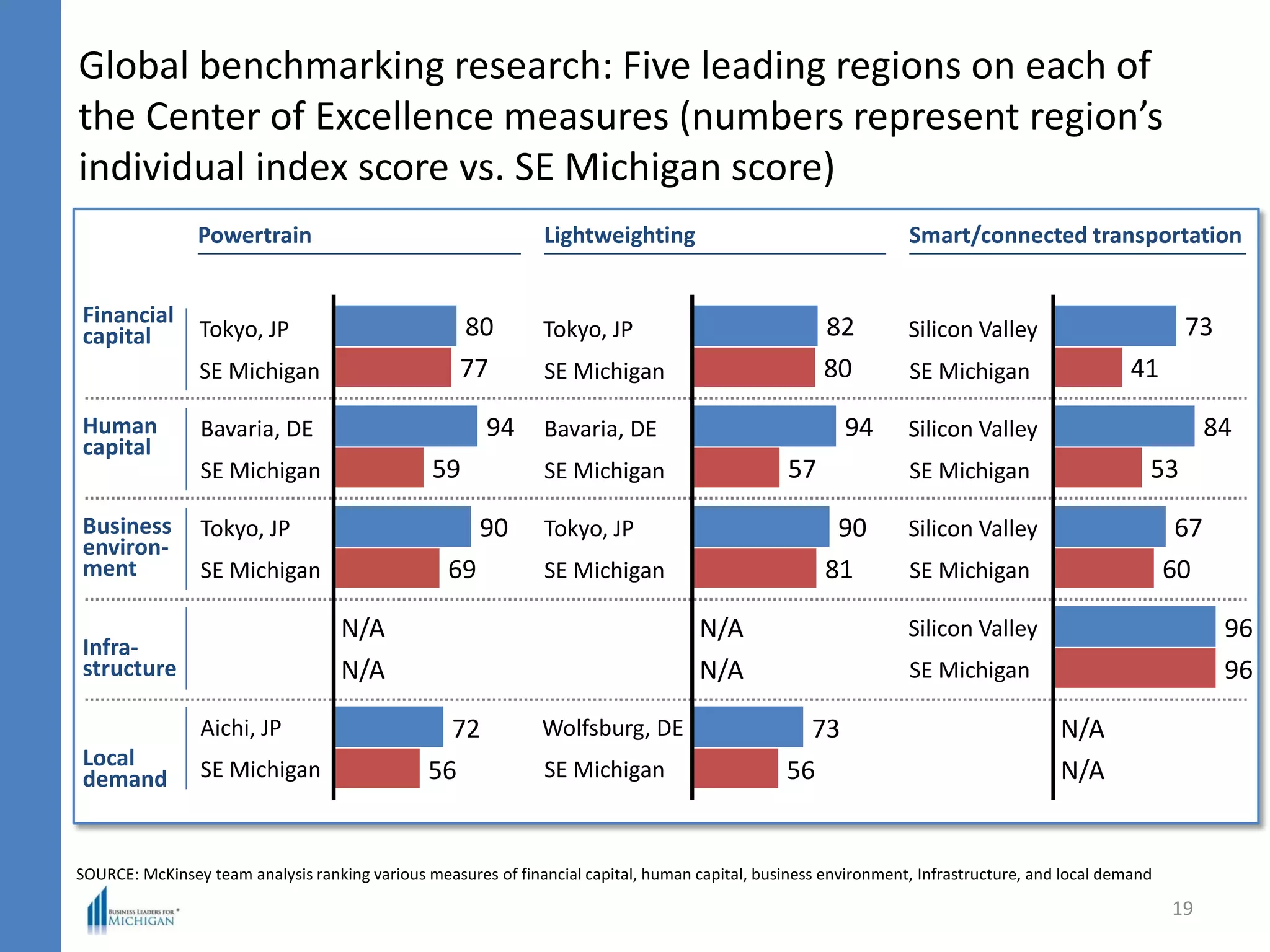

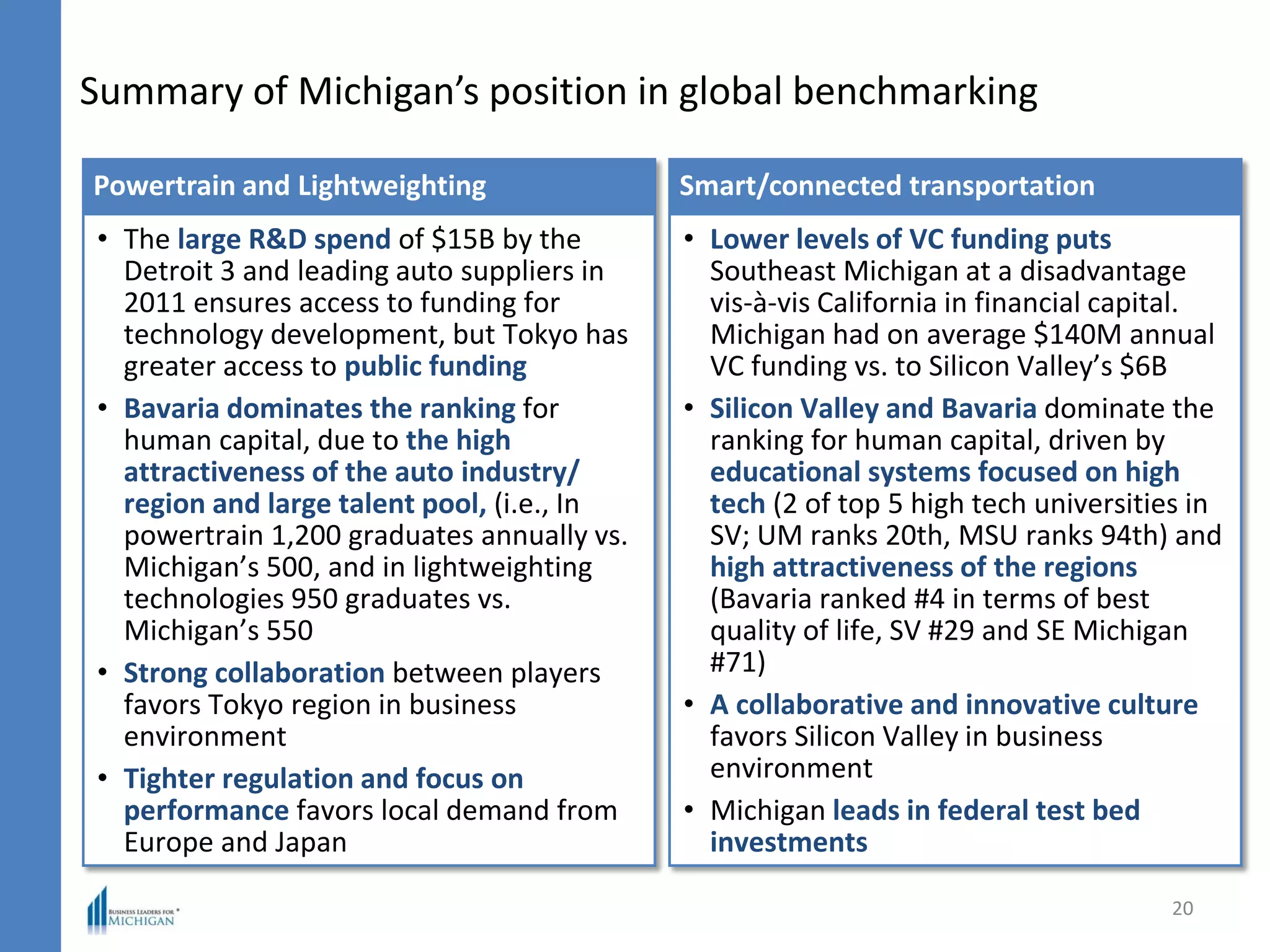

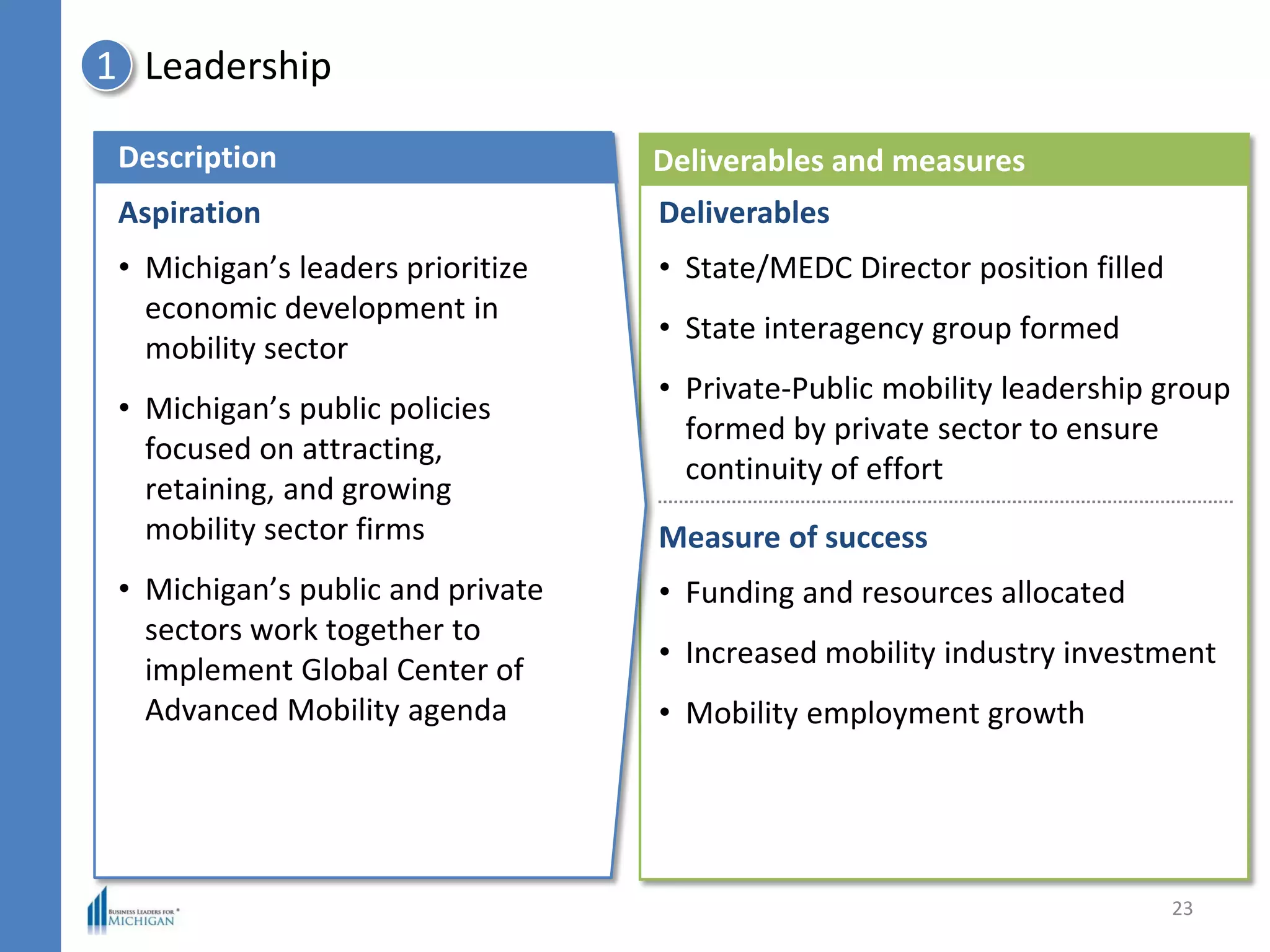

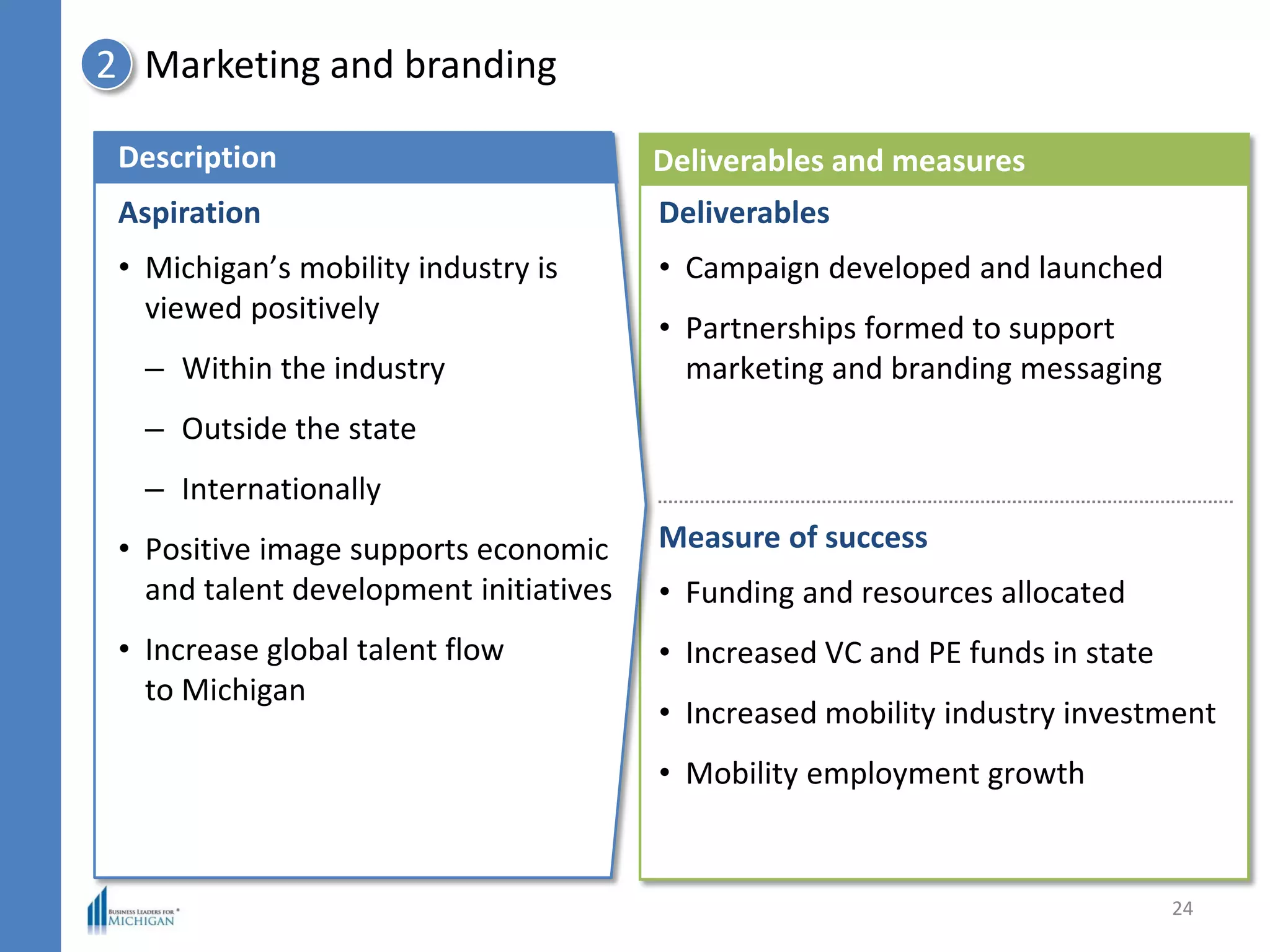

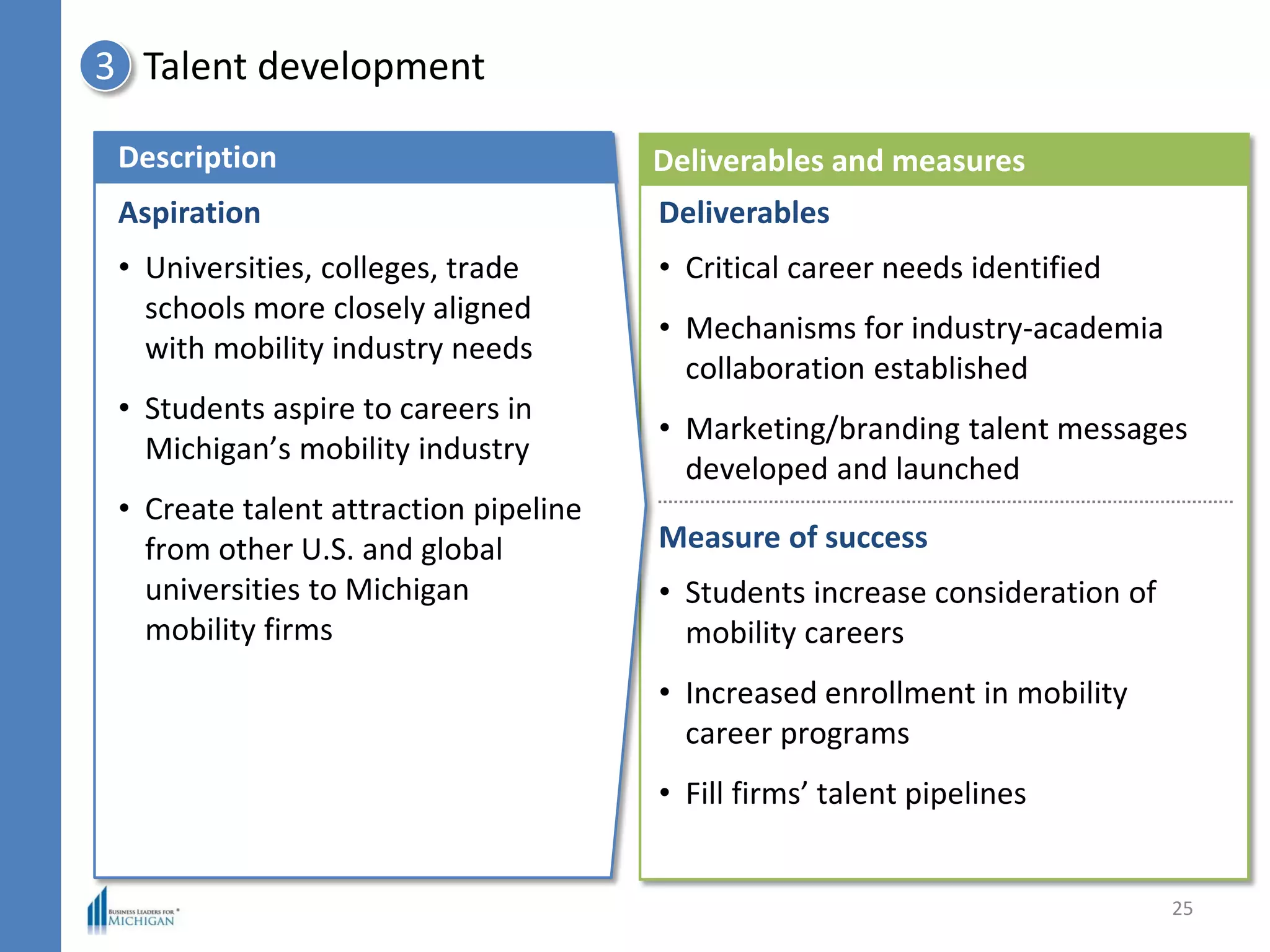

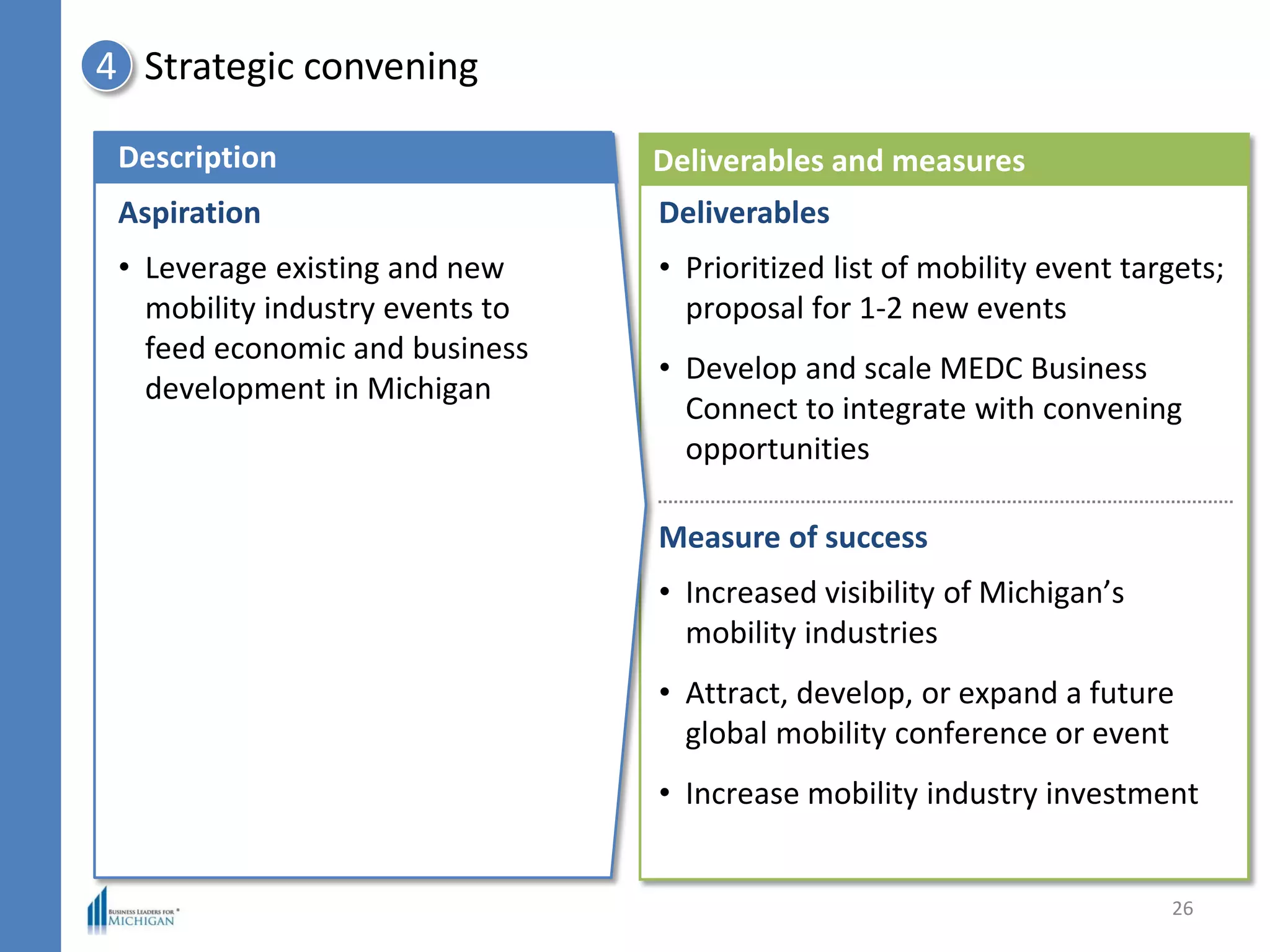

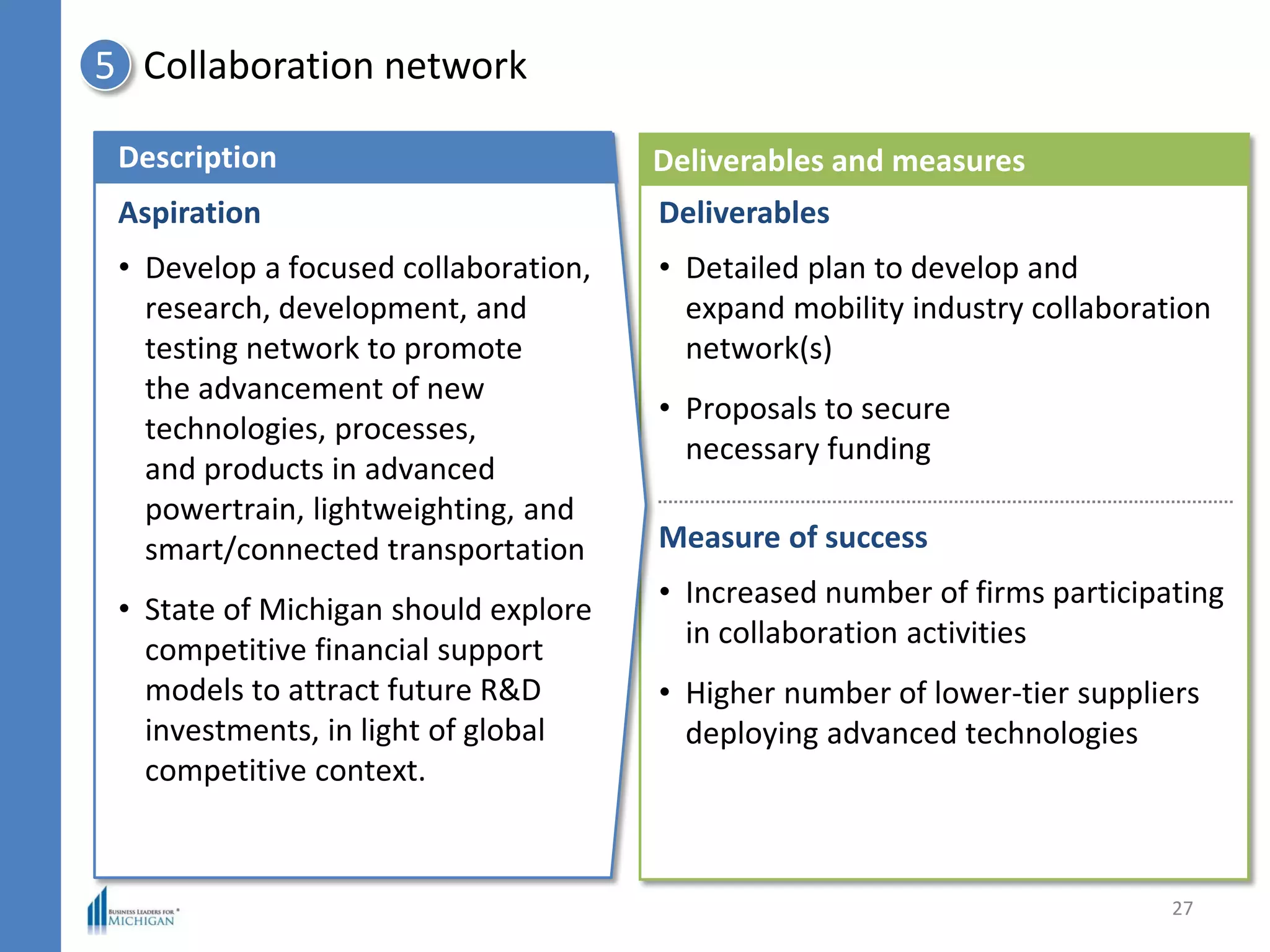

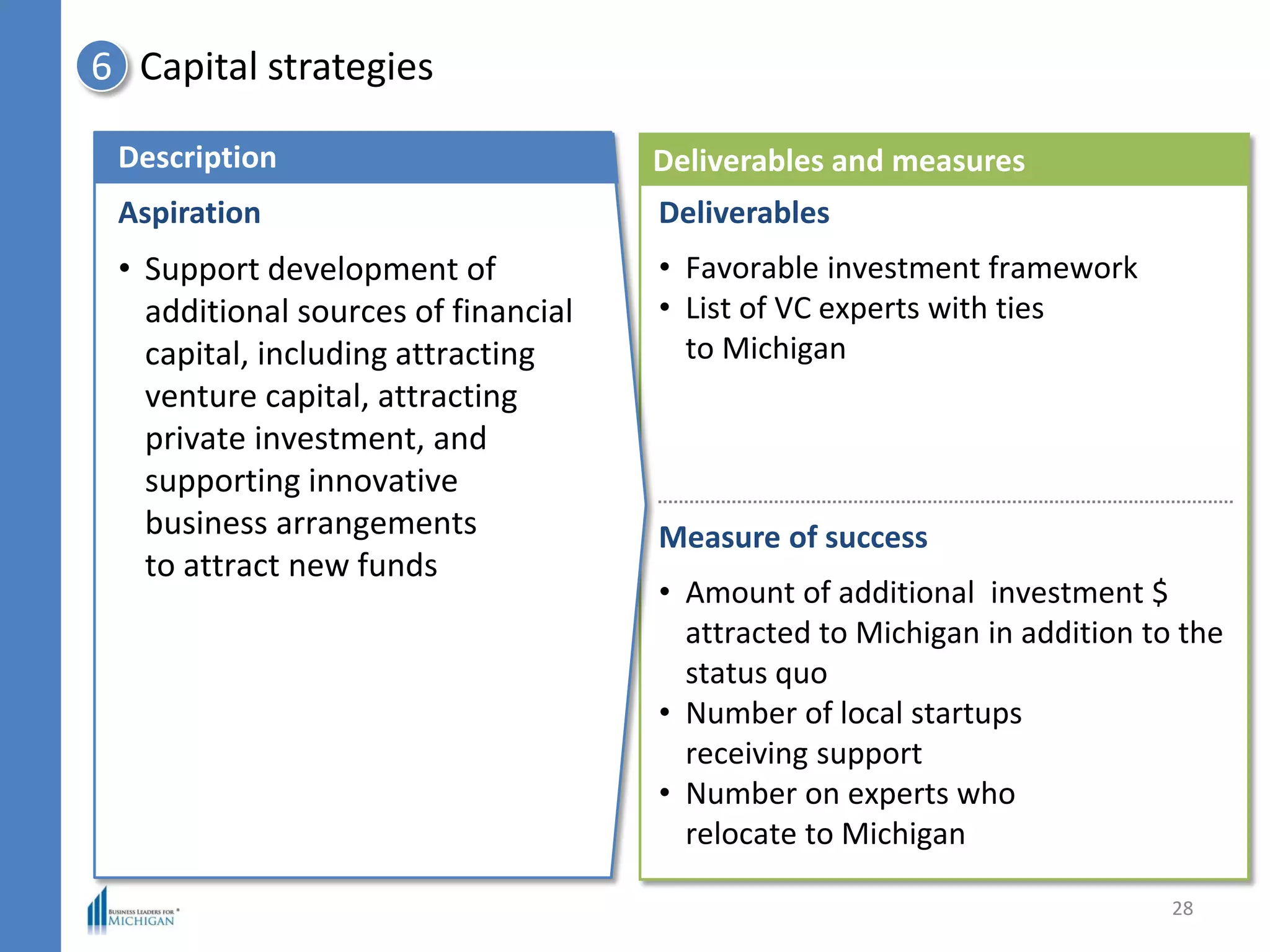

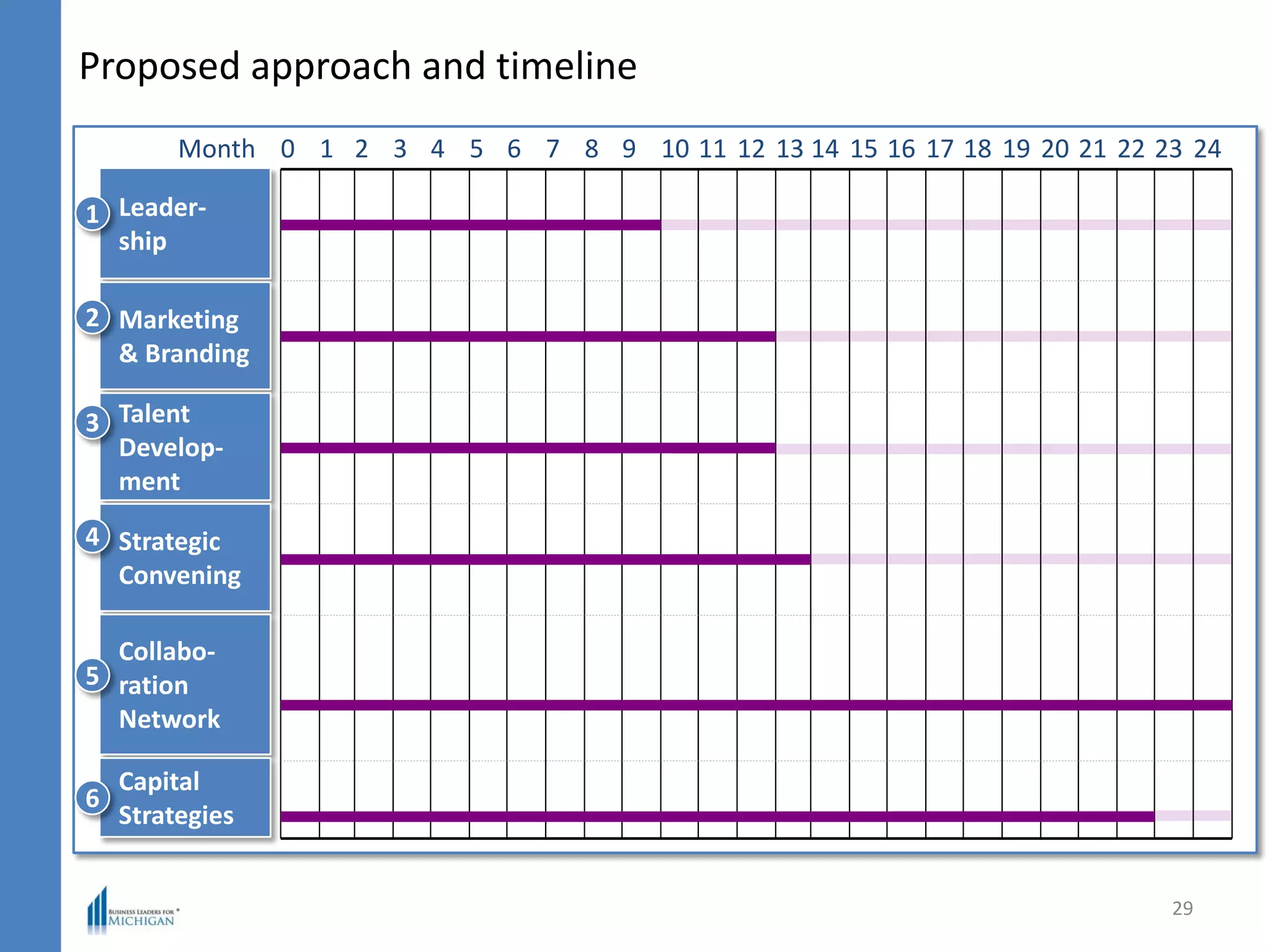

The document outlines a strategy to position Michigan as a global center for advanced mobility, focusing on advanced powertrain, lightweight materials, and smart/connected transportation. It identifies Michigan's strengths in capital availability and OEM concentration, while highlighting challenges such as talent development and innovation growth. Recommended actions include leadership, marketing, collaboration, and capital attraction to foster long-term growth in the automotive sector.