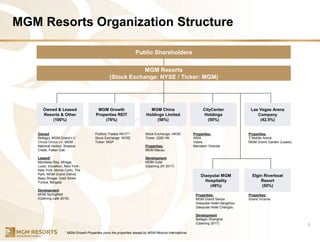

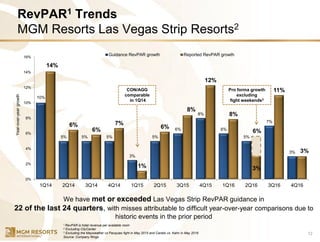

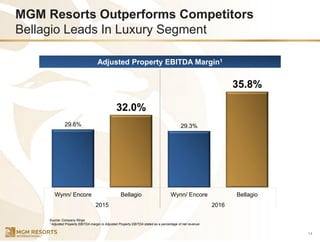

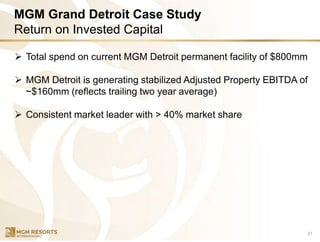

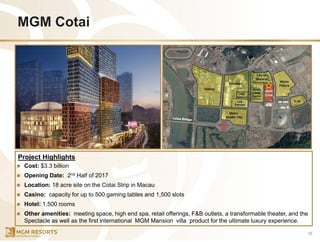

MGM Resorts International provided an investor presentation in March 2017. The presentation highlights that over the past 3 years, MGM has significantly improved its balance sheet through transactions like MGP and asset sales, initiated operational initiatives to grow profits, and pursued strategic growth opportunities. Looking forward, MGM plans to continue operational improvements, further strengthen its balance sheet, pursue strategic initiatives like developing MGM Cotai and MGM Springfield, and increase shareholder value.