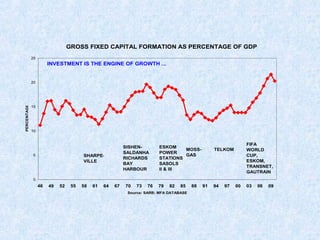

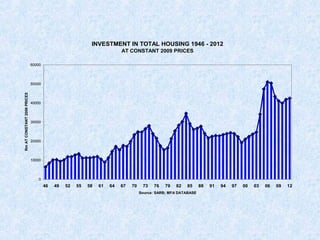

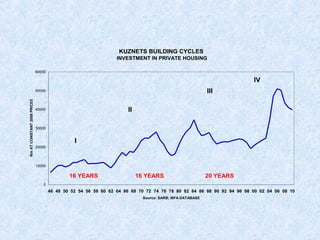

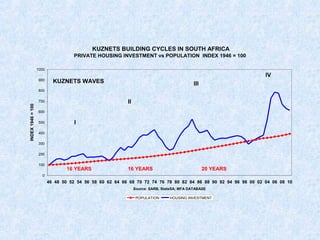

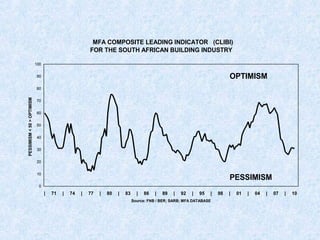

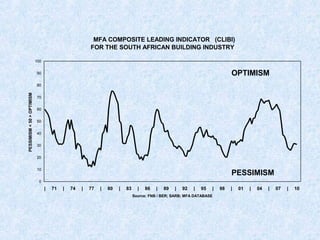

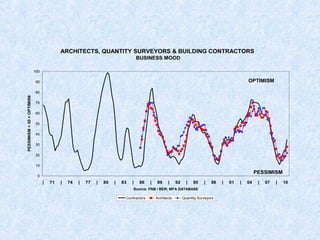

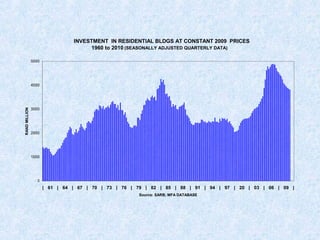

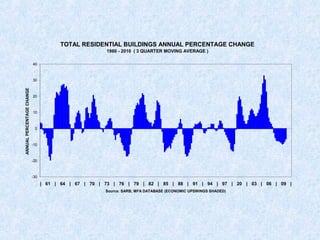

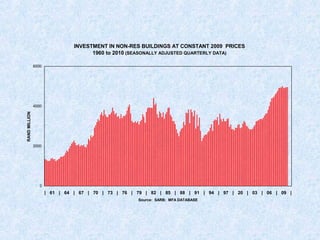

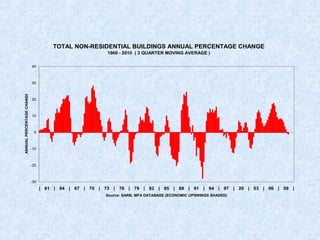

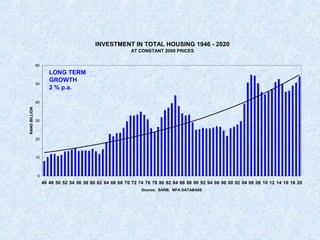

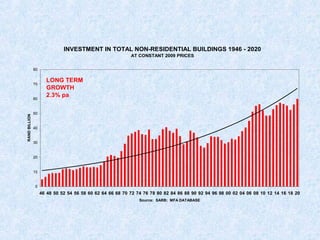

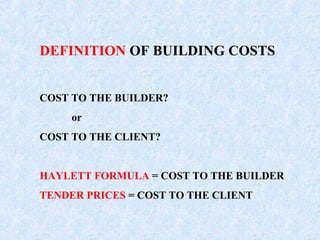

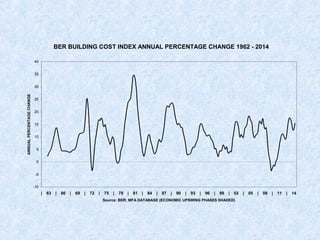

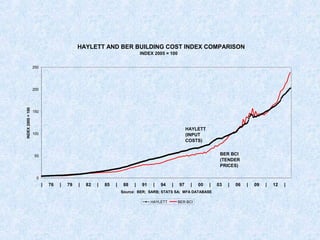

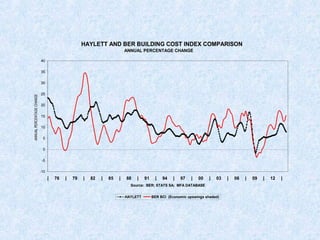

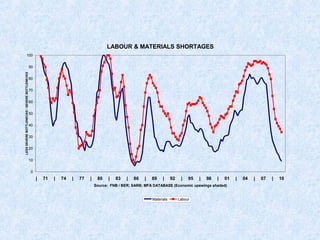

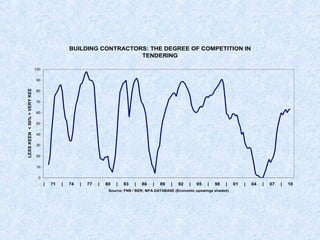

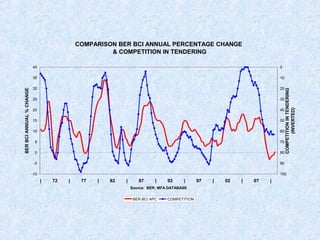

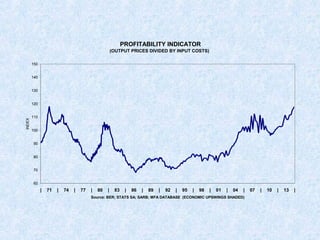

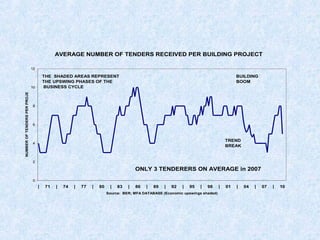

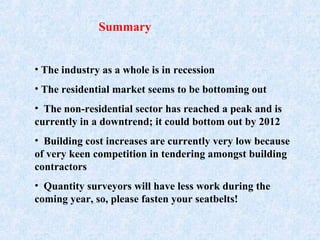

This document summarizes trends in the South African building industry based on a presentation given by Dr. Johan Snyman. It finds that the residential and non-residential building sectors follow different cycles, with the residential sector bottoming out from a recession while the non-residential sector is projected to bottom out by 2012. Building costs are currently increasing very slowly due to high competition among contractors for projects. The quantity surveying profession is expected to have less work over the coming year as the industry experiences a downturn.