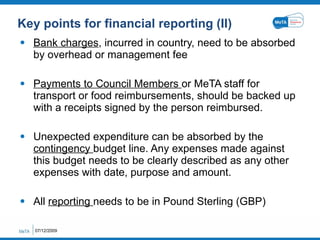

The document outlines the financial reporting objectives and guidelines for MeTA, which is funded by the British government. It states that MeTA must use consistent accounting procedures to record transactions and enable accurate and timely financial reports to be submitted to DFID. The financial reports must be prepared in accordance with Generally Accepted Accounting Principles and questions should be directed to the International Secretariat. Key points include notifying national secretariats of remittances, using exchange rates on receipt dates, reporting expenses by exchange rate, requiring receipts for reimbursements, and reporting in British pounds sterling.

![Thank you! Elodie Brandamir [email_address] Marieke Devillé [email_address] 26/01/10](https://image.slidesharecdn.com/financial-systems-and-reporting-100126070724-phpapp02/85/MeTA-financial-systems-and-reporting-7-320.jpg)