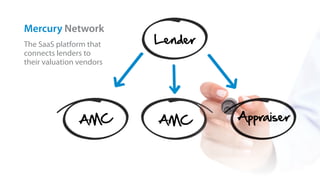

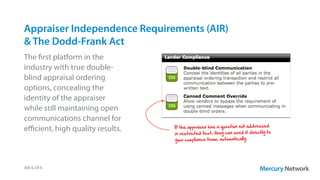

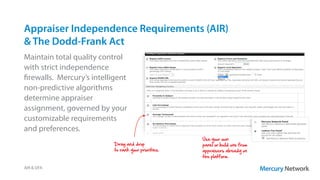

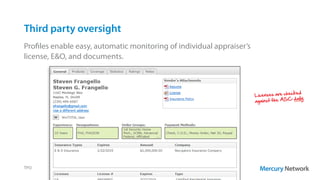

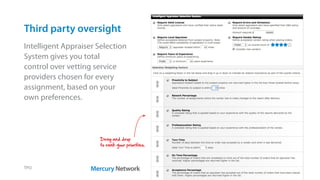

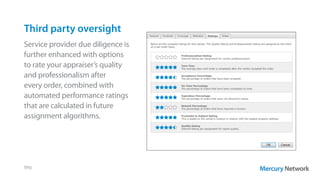

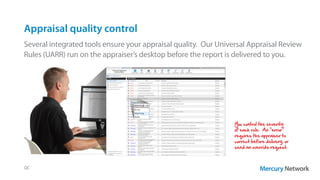

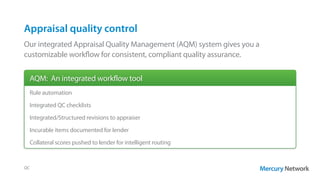

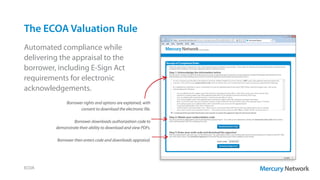

Mercury Network offers a comprehensive SaaS platform that connects lenders with appraisal vendors, ensuring compliance with appraisal independence regulations and quality control standards. The platform is used by over 600 lenders and AMC providers, facilitating the delivery of more than 20,000 appraisals daily with customizable workflows and integrated quality management systems. Key features include an end-to-end audit trail, robust third-party oversight, and comprehensive appraisal quality control to enhance compliance and efficiency.