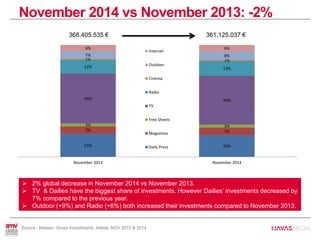

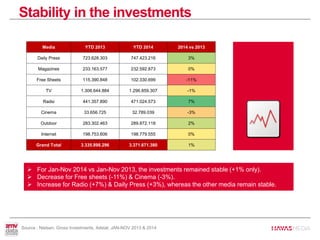

- Media investments in November 2014 decreased 2% compared to November 2013.

- Culture, Tourism, Leisure & Sports saw the most investment, followed by Retail, Food & Services.

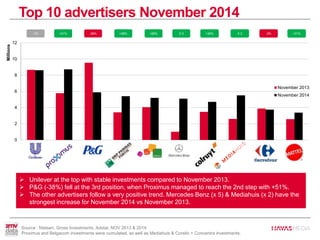

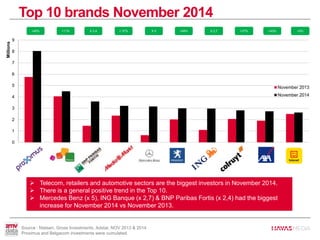

- Unilever remained the top advertiser, while Proximus jumped to second place with a 51% increase in investments compared to November 2013. Telecom, retail, and automotive sectors were the biggest investors overall.