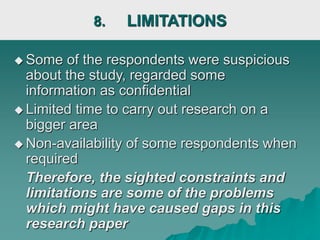

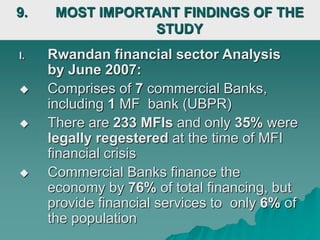

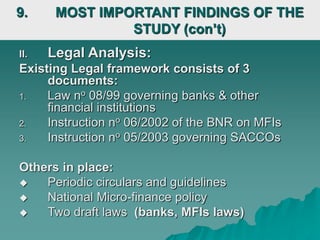

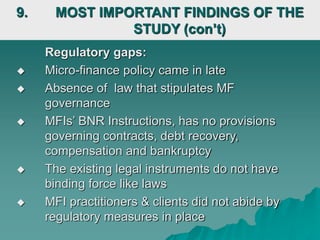

This document summarizes the thesis of Mukakalisa Faith titled "Legal Protection of Micro-Finance Clients in Case of Bankruptcy." The 10-point agenda outlines the thesis structure, including an introduction on microfinance in Rwanda, research objectives to understand legal protections for clients, methodology, and key findings. Major findings noted a lack of binding laws and regulatory gaps contributed to microfinance crises in 2005-2006 when several institutions closed, harming depositors. Recommendations included establishing binding microfinance laws, guarantee funds, deposit insurance, and strengthening regulatory oversight.