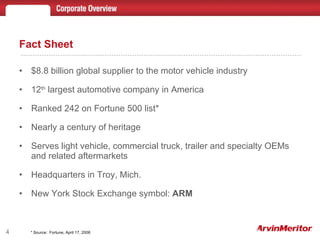

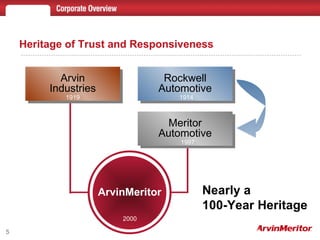

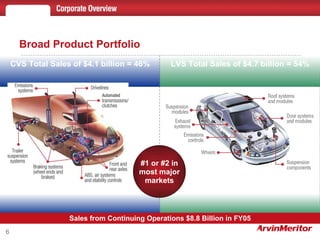

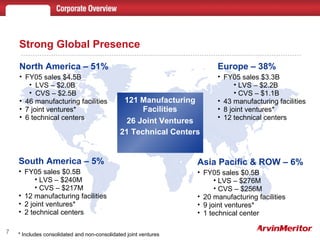

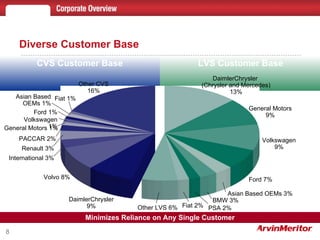

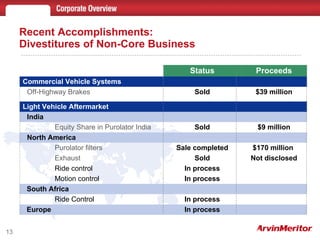

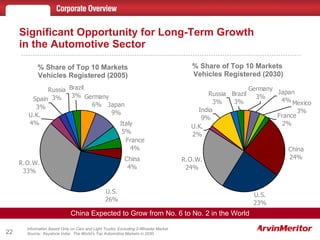

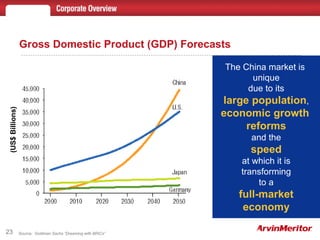

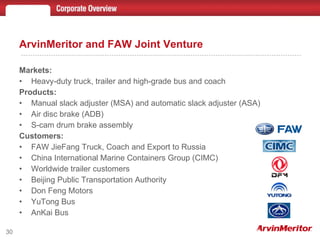

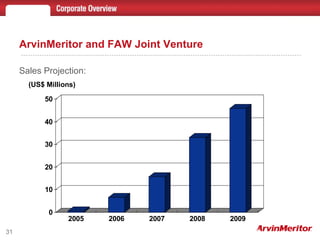

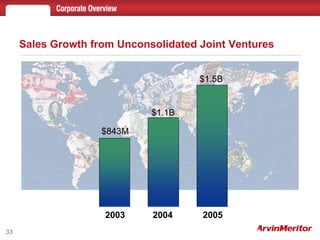

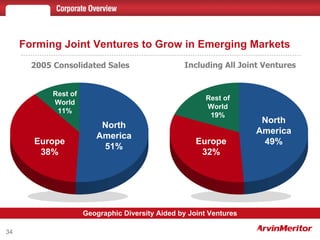

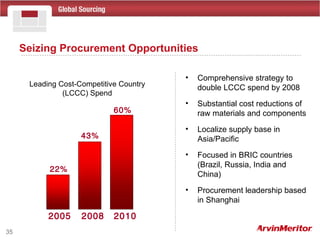

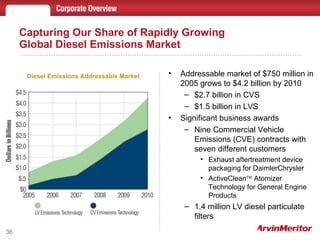

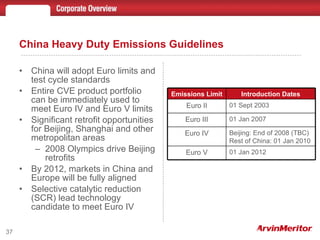

The document is a corporate presentation by ArvinMeritor, outlining their position as a major global supplier in the automotive industry, with a forecast of future business results and discussions of potential risks. It details the company's financial performance, manufacturing facilities, joint ventures, and notable recent accomplishments while emphasizing their commitment to social responsibility and innovative solutions. The document also highlights ArvinMeritor's focus on expanding operations, particularly in emerging markets like China, and the company's strategies for growth and addressing the diesel emissions market.