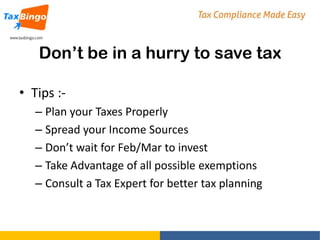

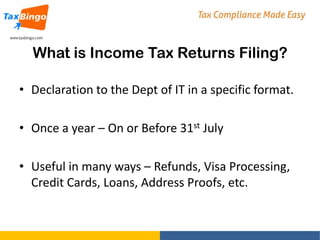

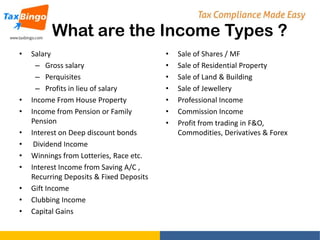

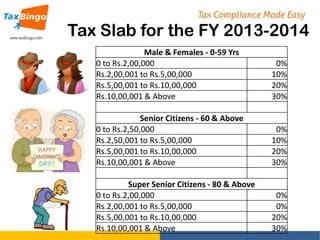

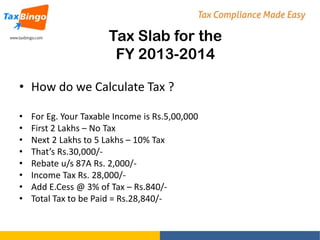

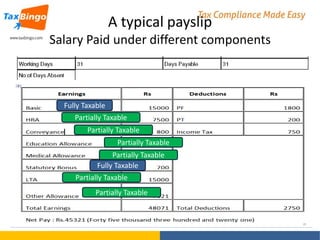

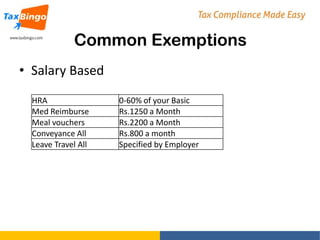

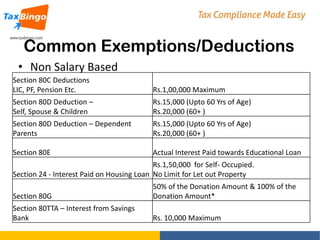

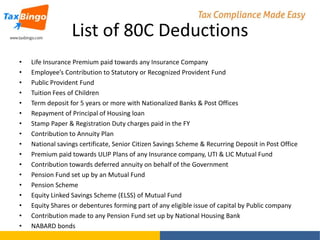

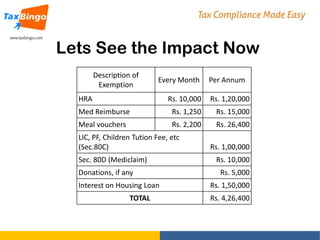

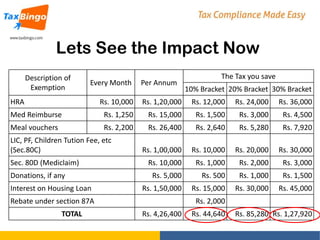

This presentation discusses ways for employees to maximize their take-home pay and minimize taxes. It begins by explaining the basics of taxes and income types that are taxed in India. It then outlines the tax slabs and calculations for the current financial year. Potential exemptions like HRA, medical reimbursements, meal vouchers, insurance premiums and more are listed. An example is provided to show how these can significantly reduce tax liability. National Pension Scheme and tax planning tips are also briefly covered. The presentation concludes by emphasizing the importance of tax compliance through annual income tax return filings.

![Did you Know ?

• Interest on loan taken for residential house

property from 01.04.2013 now Exempt upto

Rs. 1,00,000/- [ Conditions Apply ]

• Rebate of Rs. 2,000/- for Individuals having

Total Income upto Rs. 5,00,000/-](https://image.slidesharecdn.com/maximizeyourtakehome20062012general-131203040339-phpapp02/85/Maximize-your-take-home-20062012-general-18-320.jpg)