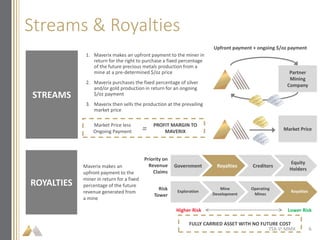

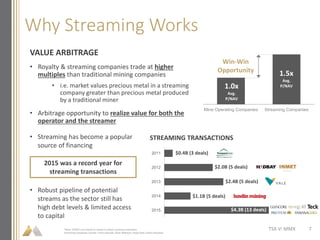

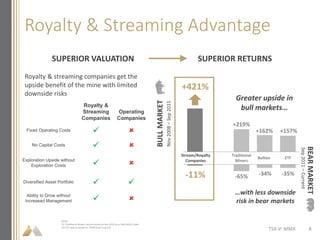

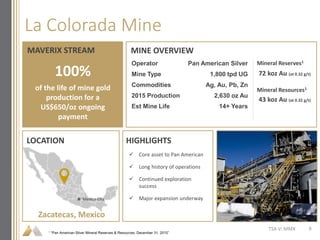

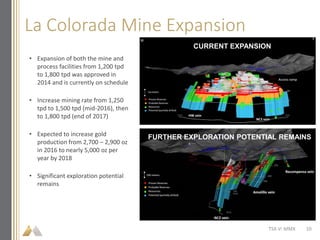

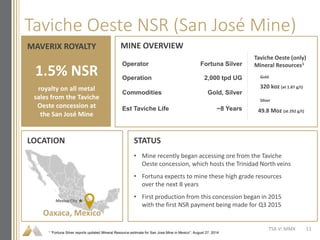

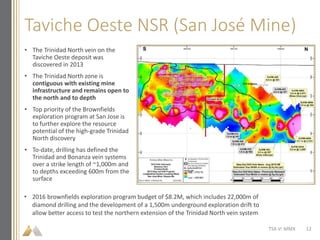

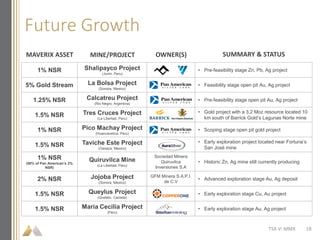

Maverix Metals Inc. is a new streaming and royalty company with 13 assets in its portfolio. It has a market capitalization of around C$100 million and owns two producing assets, two advanced stage assets, and other long term development assets. Maverix has a strong balance sheet with C$5 million in cash and no debt. The company aims to generate cash flow from its current assets and pursue further acquisitions to continue growing in a financially disciplined manner.