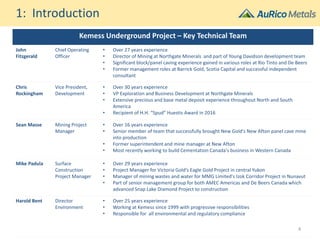

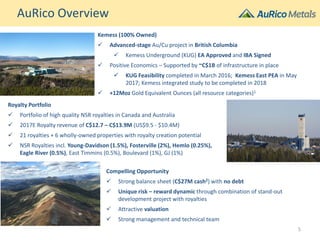

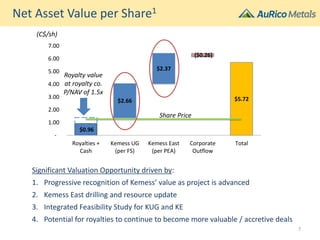

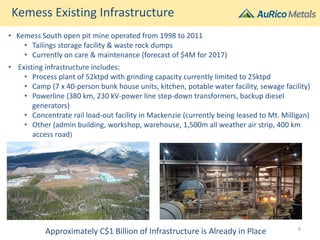

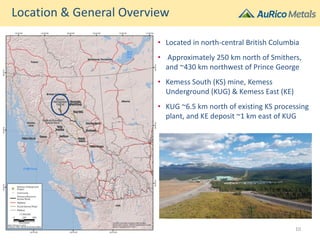

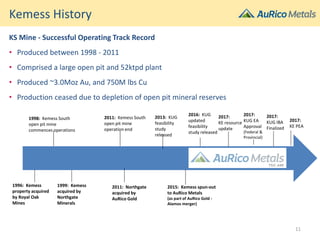

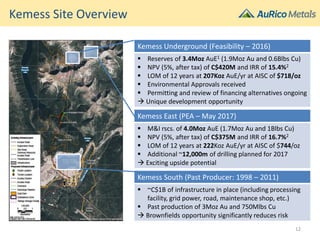

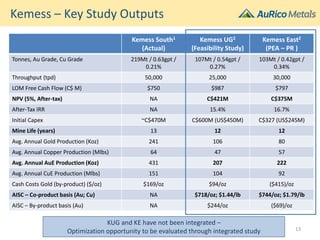

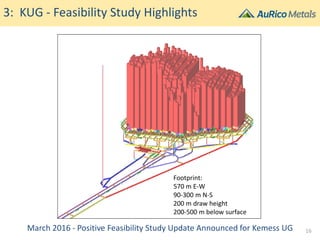

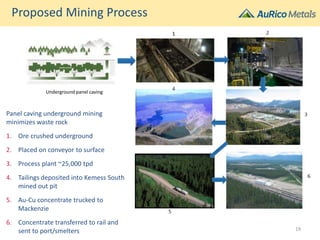

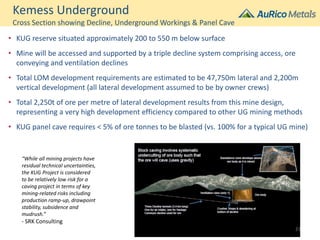

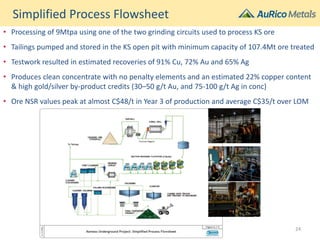

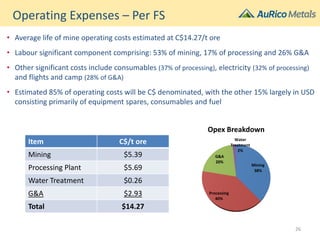

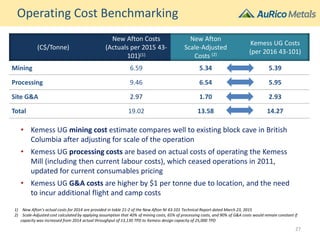

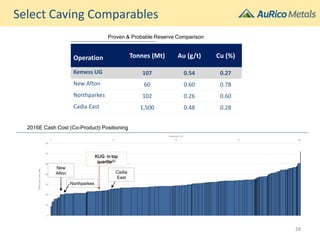

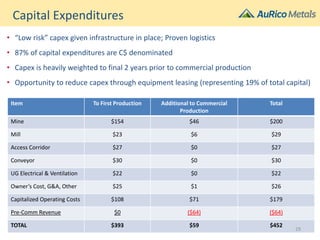

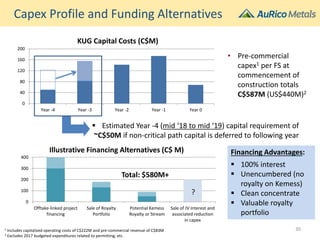

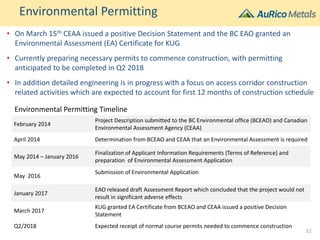

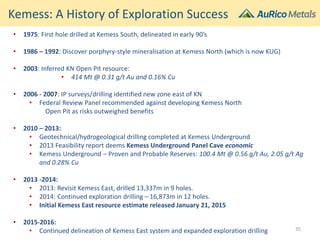

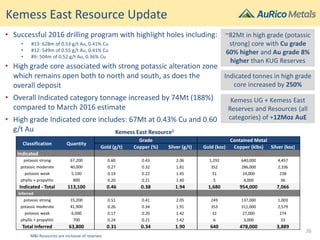

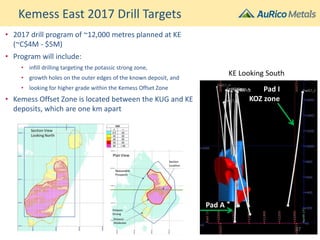

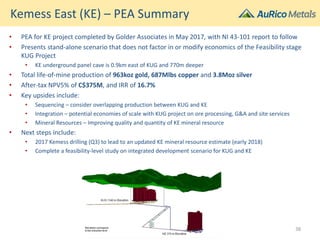

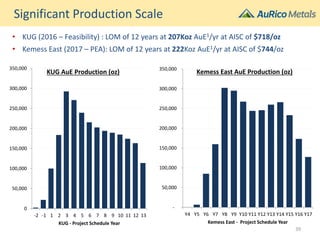

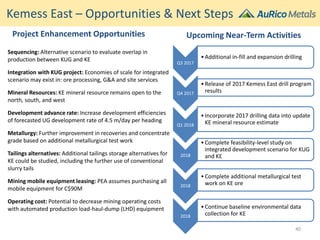

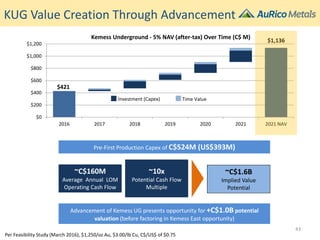

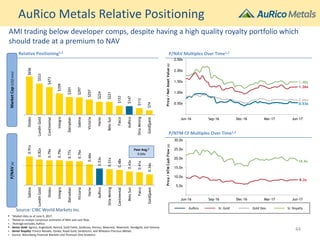

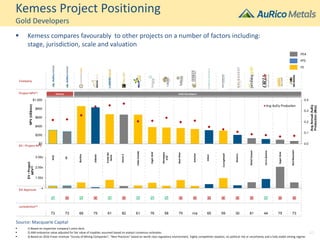

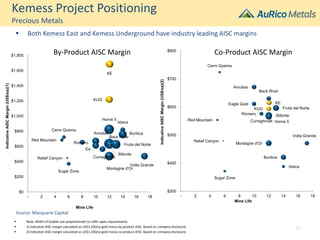

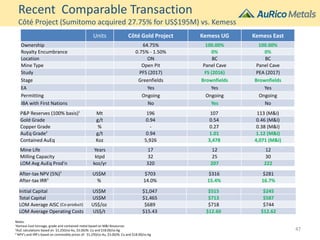

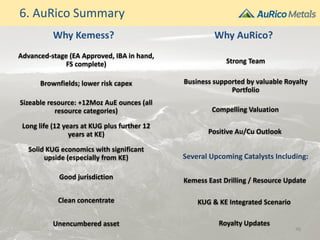

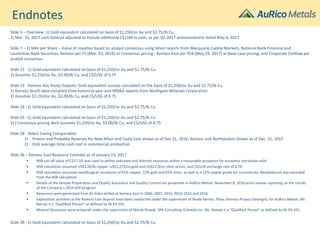

The document provides an overview of the Kemess Project located in British Columbia, Canada. It discusses the positive economics shown in the feasibility study for the Kemess Underground Project, including over 12 million ounces of gold equivalent resources across all categories. It also highlights the Preliminary Economic Assessment results for the Kemess East Project and plans for an integrated feasibility study in 2018. The document outlines AuRico Metal's management team and technical experts for the Kemess Project and provides an overview of the company's royalty portfolio which is projected to generate $12.7-13.9 million in revenue in 2017.