- The document provides an overview and update of AuRico Metals Inc. in January 2016, including forward-looking statements and cautionary notes.

- It outlines AuRico's diversified royalty portfolio generating cash flow and its development-stage Kemess gold-copper project in British Columbia.

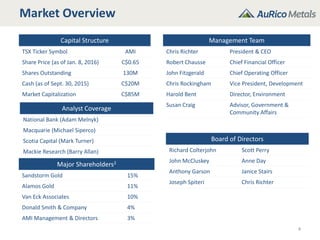

- Details are given on AuRico's capital structure, management team, and two of its most significant royalty assets - the Young-Davidson mine in Ontario and the Fosterville mine in Australia.