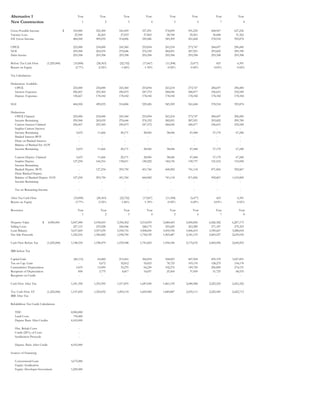

The memorandum analyzes three development alternatives for a historic property site: new construction, full historic rehabilitation, and a hybrid option. A pro forma analysis shows the historic rehabilitation option has the highest internal rate of return at 20.5% and peaks within 5 years, making it the recommended choice as it provides an acceptable return for the developer while supporting local historic preservation goals. The city should be aware the developer may sell the property within 8 years when the IRR begins to decline and use this as leverage to ensure high tenant performance if new ownership takes over.