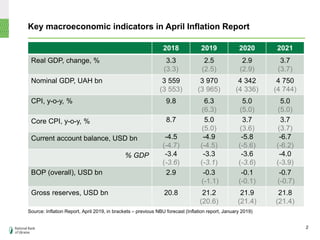

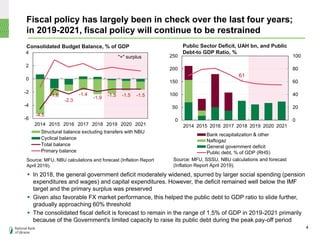

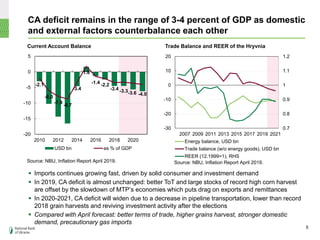

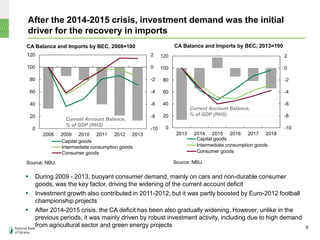

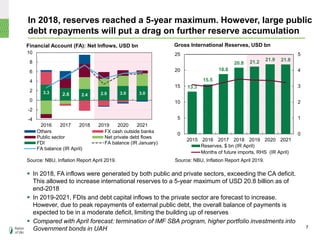

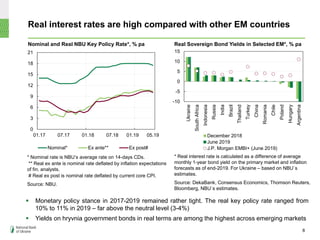

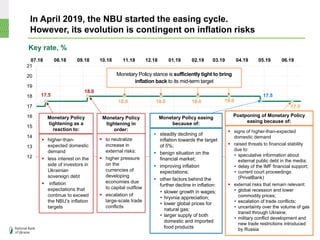

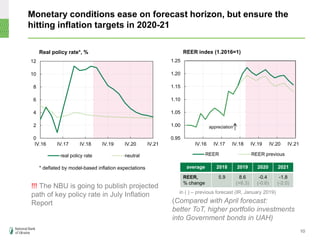

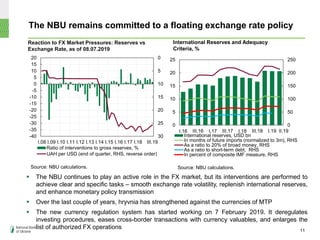

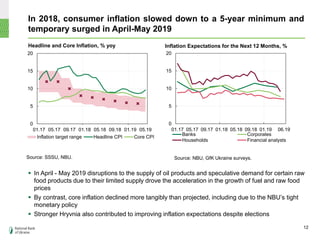

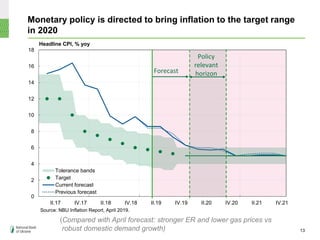

The document provides a macroeconomic forecast and update on monetary policy for Ukraine. It summarizes key indicators for 2018-2021, including real GDP growth of 2.5% in 2019 slowing from 3.3% in 2018 before picking up in future years. Inflation is forecast to remain around the 5% target. Fiscal policy will continue to be restrained with the budget deficit around 1.5% of GDP. The current account deficit is projected to remain in the 3-4% range despite counterbalancing domestic and external factors. Monetary policy has been tight but began easing in 2019 to ensure hitting inflation targets while monetary conditions ease over the forecast horizon.