Ma0038 & banking operations

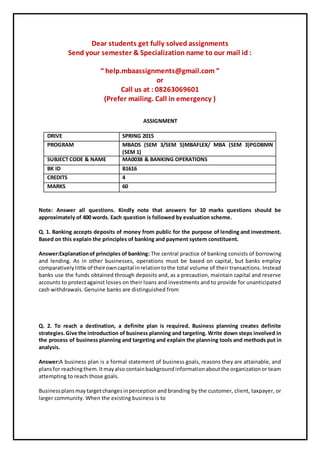

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency ) ASSIGNMENT DRIVE SPRING 2015 PROGRAM MBADS (SEM 3/SEM 5)MBAFLEX/ MBA (SEM 3)PGDBMN (SEM 1) SUBJECT CODE & NAME MA0038 & BANKING OPERATIONS BK ID B1616 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. Q. 1. Banking accepts deposits of money from public for the purpose of lending and investment. Based on this explain the principles of banking and payment system constituent. Answer:Explanationof principles of banking: The central practice of banking consists of borrowing and lending. As in other businesses, operations must be based on capital, but banks employ comparativelylittle of theirowncapital inrelationtothe total volume of their transactions. Instead banks use the funds obtained through deposits and, as a precaution, maintain capital and reserve accounts to protectagainst losses on their loans and investments and to provide for unanticipated cash withdrawals. Genuine banks are distinguished from Q. 2. To reach a destination, a definite plan is required. Business planning creates definite strategies.Give the introduction of business planning and targeting. Write down steps involved in the process of business planning and targeting and explain the planning tools and methods put in analysis. Answer:A business plan is a formal statement of business goals, reasons they are attainable, and plansfor reachingthem.Itmayalso containbackgroundinformationaboutthe organizationor team attempting to reach those goals. Businessplansmaytargetchangesinperception and branding by the customer, client, taxpayer, or larger community. When the existing business is to

- 2. Q. 3. Banks accepts depositsand depositsare repayable to the depositors through the proceeds of investmentand loans.You are supposedto explainthe need for credit policy with bank rates. Also explain the credit process. Answer:Explanationof needforcredit with bank rates:Controllingcreditinthe Economyisamongst the most importantfunctionsof the Reserve Bankof India. The basic and important needs of Credit Control in the economy are- To encourage the overall growth of the “priority sector” i.e. those sectors of the economy which is recognized by the government as “prioritized” depending upon their economic condition or government interest. These sectors broadly totals to around 15 in number. To keep a check over the Q. 4. Write short notes on: a) Interestrate risk:Interestrate riskisthe riskthat arisesforbondowners from fluctuating interest rates.How much interest rate risk a bond has depends on how sensitive its price is to interest rate changesinthe market.The sensitivity depends on two things, the bond's time to maturity, and the coupon rate of the bond.The risk that an investment's value will change due to a change in the absolute level of interestrates,inthe spreadbetweentworates,inthe shape of the yieldcurve or in any other interest rate relationship. Such changes usually affect securities inversely and can be reduced by diversifying (investing in b) On-balance sheet adjustment:Traditionally, banks lend to borrowers under tight lending standards, keep loans on their balance sheets and retain credit risk—the risk that borrowers will default (be unable to repay interest and principal as specified in the loan contract). In contrast, securitization enables banks to remove loans from balance sheets and transfer the credit risk associated with those loans. For example, when a bank has c) Off-balance sheetadjustment:Off-balancesheet(OBS), or Incognito Leverage, usually means an assetor debtor financingactivity not on the company's balance sheet. Some companies may have significant amounts of off-balance sheet assets and liabilities. For example, financial institutions often offer asset management or brokerage services to their clients. The assets managed or brokered as part of these Q. 5.What do you understand by forfaiting? Explain on Forfaiting an export finance option. Write the benefits of exporters from forfaiting. Answer: Intrade finance,forfaitingisthe financial transactioninvolving the purchase of receivables fromexportersbya forfaiter.The forfaitertakeson all the risks associated with the receivables but

- 3. earns a margin.[citation needed] The forfaiter may also be immunized from certain risks if the transactioninvolvespaymentbynegotiableinstrument. The forfaiting is a transaction involving the sale of one of the firm'stransactions.Factoringisalso a financial transaction involving the purchase of financial assets, but factoring Q. 6. ExplainAutomated TellerMachine (ATMs),write the benefitsof ATM. Explain the benefits of leveraging technology. Answer:An automated teller machine or automatic teller machine(ATM, American, Australian, Singaporean, Indian, Maldivian, Hiberno and Sri Lankan English), also known as an automated bankingmachine (ABM,CanadianEnglish),cashmachine,cashpoint,cashline,or colloquially hole in the wall (BritishandSouthAfricanEnglish),isanelectronictelecommunications device that enables the customers of a financial institution to perform financial transactions without the need for a human cashier, clerk or bank teller. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency )