Mf0010 & security analysis and portfolio management

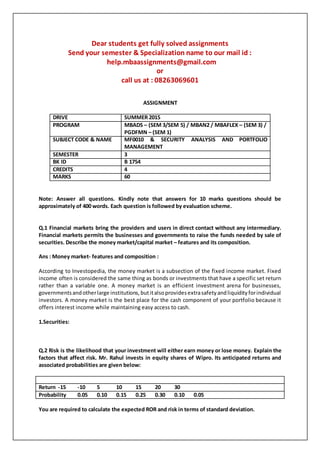

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : help.mbaassignments@gmail.com or call us at : 08263069601 ASSIGNMENT DRIVE SUMMER 2015 PROGRAM MBADS – (SEM 3/SEM 5) / MBAN2 / MBAFLEX – (SEM 3) / PGDFMN – (SEM 1) SUBJECT CODE & NAME MF0010 & SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT SEMESTER 3 BK ID B 1754 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. Q.1 Financial markets bring the providers and users in direct contact without any intermediary. Financial markets permits the businesses and governments to raise the funds needed by sale of securities. Describe the money market/capital market – features and its composition. Ans : Money market- features and composition : According to Investopedia, the money market is a subsection of the fixed income market. Fixed income often is considered the same thing as bonds or investments that have a specific set return rather than a variable one. A money market is an efficient investment arena for businesses, governmentsandotherlarge institutions,butitalsoprovidesextrasafetyandliquidityforindividual investors. A money market is the best place for the cash component of your portfolio because it offers interest income while maintaining easy access to cash. 1.Securities: Q.2 Risk is the likelihood that your investment will either earn money or lose money. Explain the factors that affect risk. Mr. Rahul invests in equity shares of Wipro. Its anticipated returns and associated probabilities are given below: Return -15 -10 5 10 15 20 30 Probability 0.05 0.10 0.15 0.25 0.30 0.10 0.05 You are required to calculate the expected ROR and risk in terms of standard deviation.

- 2. Ans : Factors that affect risk : 1. The actual investment you're considering: Different investments carry different levels of risk. All investments involve a degree of risk and returns can never be guaranteed so it is important to choose investments that suit your circumstances.Belowisatable thatillustratesarange of investmenttypesandtheirassociated risks 2. Your risk capital: Risk capital is money available to invest or Q.3 Explain the business cycle and leading coincidental & lagging indicators. Analyse the issues in fundamental analysis. Ans : Explanation of business cycle: The term businesscycle (oreconomiccycle orboom-bustcycle) referstoeconomy-wide fluctuations in production, trade and economic activity in general over several months or years in an economy organizedonfree-enterpriseprinciples.The businesscycle isthe upwardanddownwardmovements of levelsof GDP(grossdomesticproduct) andreferstothe periodof expansions and contractions in the level of economic activities (business fluctuations) around its long-term growth trend. These fluctuations occur around a long-term growth trend, and typically involve shifts over time between periods of relatively rapid economic growth (an expansion or boom), and periods of relative stagnationordecline (a contraction or recession). Business cycles are usually measured by considering the growth rate of real gross domestic product. Despite being termed cycles, these fluctuations in economic activity can prove unpredictable. leading coincidental and lagging indicators : Q.4 Discuss the implications of EMH for security analysis and portfolio management. Ans : The Efficient market Hypothesis (EMH) term appeared in the 1960's thanks to Eugene Fama (Beechey et al., 2000) He defined an efficient market as one that can quickly adjust to the new information. Twenty years later Fama had modified his definition by saying that the market is efficient if it incorporates all the information that is available, it means that efficient markets are actingrationally - relevant information is incorporated and there are no systematic errors made by investors. In 1968 Jensen noticed that the information access cost should be considered. He proposed a definition of a weak market efficiency according to which market reflects every information that influences it and which cost of access is lower that its maximum usefulness. EMH and Technical Analysis: Q.5 Explain about the interest rate risk and the two components in it.

- 3. An investor is considering the purchase of a share of XYZ Ltd. If his required rate of return is 10%, the year-end expected dividend is Rs. 5 and year-end price is expected to be Rs. 24, Compute the value of the share. Ans : Introduction of interest rate risk : Interest rate risk is the risk that arises for bond owners from fluctuating interest rates. How much interest rate risk a bond has depends on how sensitive its price is to interest rate changes i n the market.The sensitivitydependson two things, the bond's time to maturity, and the coupon rate of the bond.There are a numberof standard calculationsformeasuringthe impactof changinginterest rateson a portfolioconsistingof variousassetsandliabilities. The assessment of interest rate risk is a verylarge topic at banks,thrifts,savingandloans,creditunions,andotherfinance companies, and amongtheirregulators.The widelydeployedCAMELSratingsystemassessesafinancial institution's: (C)apital adequacy, (A)ssets, (M)anagement Capability, (E)arnings, (L)iquidity, and (S)ensitivity to market risk Q.6 Elucidate the risk and returns of foreign investing. Analyse international listing. Ans : Explanation of all the points in risks and returns from foreign investing : Investing internationally has often been the advice given to investors looking to increase the diversificationandtotal return of their portfolio. The diversification benefits are achieved through the additionof low correlationassetsof internationalmarketsthatserve toreduce the overall riskof the portfolio. However, although the benefits of investing internationally are widely accepted theories,manyinvestors are still hesitant to invest abroad. In this article, we'll discuss the reasons why this may be the case and help highlight key concerns for investors so they can make a more informed decision. Transaction Costs: Dear students get fully solved assignments Send your semester & Specialization name to our mail id : help.mbaassignments@gmail.com or call us at : 08263069601