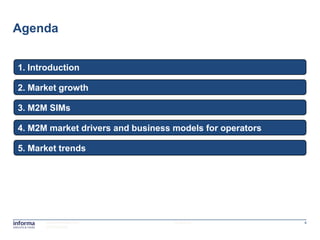

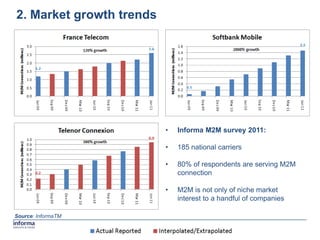

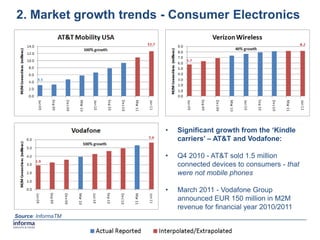

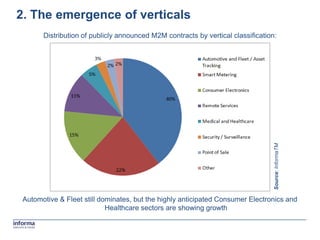

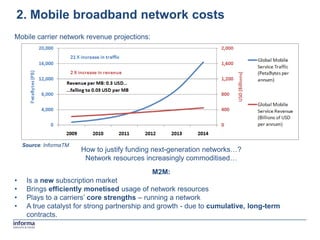

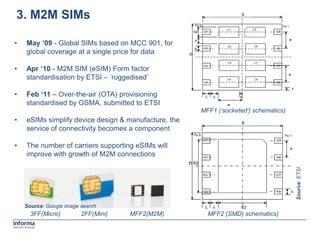

This document discusses mobile carrier trends in the machine-to-machine (M2M) market. It notes that the M2M market is growing significantly and expanding into new verticals like consumer electronics and healthcare. Operators are offering various business models for M2M connectivity including traditional wholesale plans, bundled connectivity, and application-specific plans. The value of M2M connectivity is shifting from the cost of data to value-added services like quality of service guarantees and managed services. The M2M market is also becoming more international in scope.