The 2014 Luxury Interactive Benchmarking Study emphasizes the importance of digital engagement for luxury brands to survive in a competitive global ecommerce landscape. Key findings include a significant increase in investments in digital initiatives, with 97% of participants reporting growth in this area, and a strong focus on enhancing mobile strategies and social media engagement. The report highlights the necessity for luxury brands to adapt their marketing strategies to better connect with online consumers and maintain relevance in the evolving digital landscape.

![6

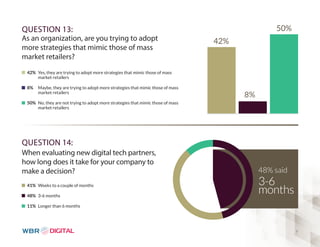

QUESTION 7:

Are you satis ed with the results of your

mobile initiatives (to date)?

54% Yes, they are satisfi ed with the results of their mobile initiatives

42% No, they are not satisfi ed with the results of their mobile initiatives

4% Not Sure, if they are satisfi ed with the results of their mobile initiatives

QUESTION 8:

How are you using social media?

54% said

YES

100

93% Engagement

80

87% PR

53% Customer Service

60

40

20

0

100 93%

80

60

40

20

0

87%

53% 50%

60%

“[Social Media] bring benefi ts because we are speaking directly to our customers in real

time. People believe they’re talking to the [Tommy Hilfi ger] persona, not the brand.”

– Tommy Hilfi ger, Principal and Founder, Tommy Hilfi ger Group (Financo, 2014)

*Percentages not meant to add up to 100%. Respondents may select

more than one option

50% Sales

60% Advertising](https://image.slidesharecdn.com/luxurybenchmark-141015110617-conversion-gate01/85/Luxury-Interactive-Benchmark-2014-6-320.jpg)

![50%

50%

50%

11

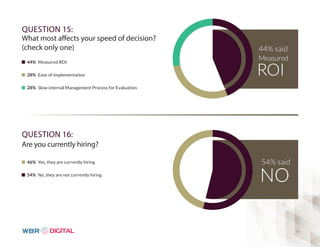

QUESTION 17:

If yes, areas are you hiring for?

(check all that apply)

Strategy/Leadership/Exec Team

Marketing Analytics

Paid Search

Social Media

CRM

Email

SEO

Mobile

40%

20%

40%

30%

0%

*Percentages not meant to add up to 100%. Respondents may select more than one option.

0 10 20 30 40 50

The majority of participants are hiring

for Marketing Analytics, CRM and

Email positions.

“At Luxury Interactive, we found that

there was really rich information in terms

of digital trends and what is going on in

that space for luxury brands.”

– Michelle Peranteau, Director,

Marketing Communications, Baume Mercier

“[Luxury Interactive] is a well-organized

unique conference that presented

insightful topics and good networking

opportunities with an alluring cross

section of retail brands.”

- Stephen Carl, Director, eCommerce, Lafayette 148 New York](https://image.slidesharecdn.com/luxurybenchmark-141015110617-conversion-gate01/85/Luxury-Interactive-Benchmark-2014-11-320.jpg)