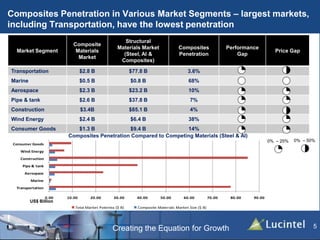

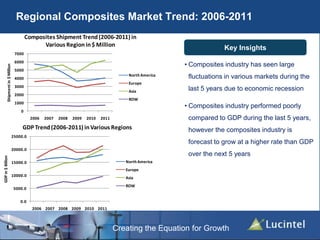

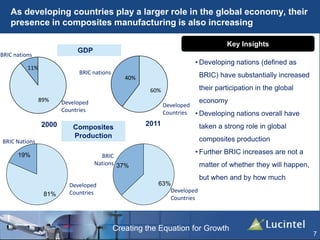

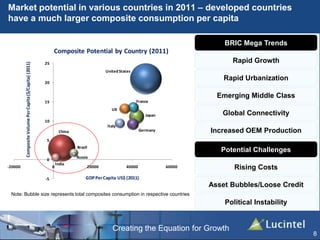

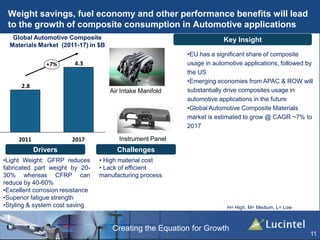

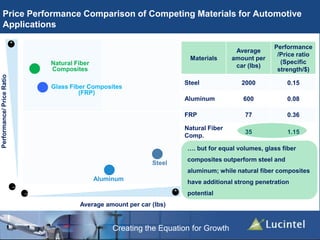

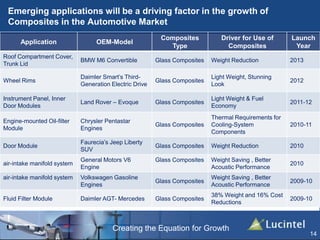

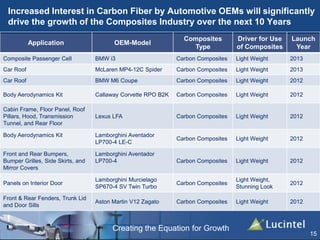

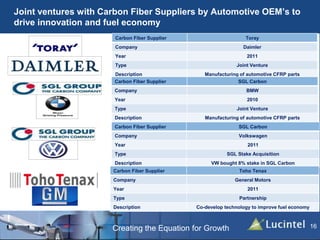

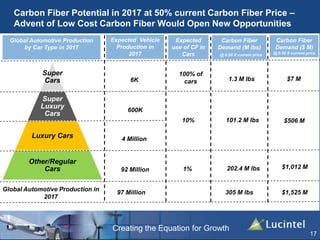

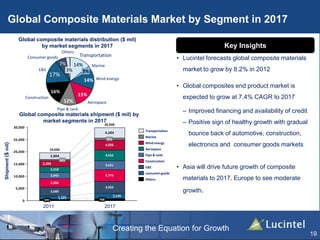

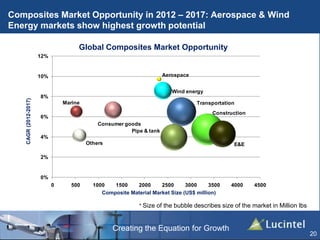

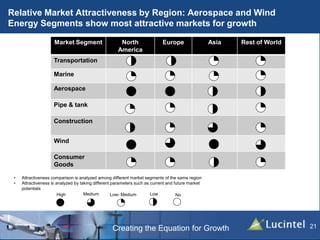

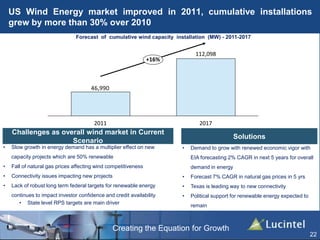

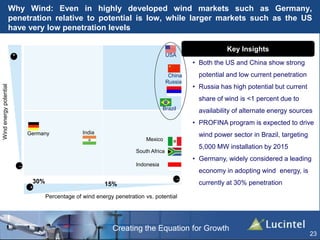

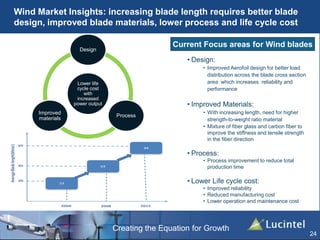

The document summarizes growth opportunities in the global composites industry from 2012 to 2017. It finds that the global composite materials industry reached $19.6 billion in 2011 and is expected to reach $29.9 billion by 2017, representing a compound annual growth rate of around 7%. Key growth drivers include increasing demand from industries like automotive, aerospace, and wind energy. The automotive composites market in particular is forecast to grow from $2.8 billion to $4.3 billion over this period, driven by interest from automakers in using carbon fiber to reduce vehicle weight.