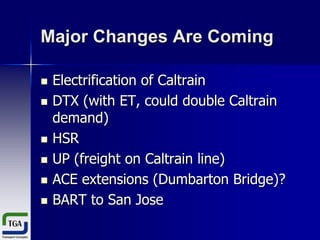

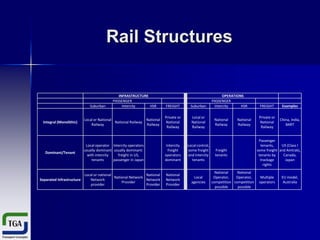

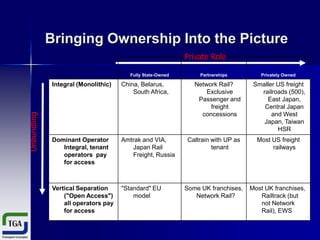

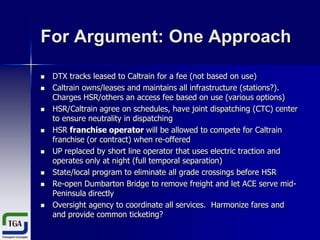

Caltrain faces major changes as it considers new governance structures. It operates well but heavy rail and HSR projects will impact it. Key issues include funding these projects, managing joint operations on shared lines, ensuring accessible stations, and eliminating grade crossings. Options discussed include various ownership models from public to private. The UK franchise model is examined as one potential approach, with privately operated trains paying to access a publicly owned network. The document proposes one hypothetical approach making Caltrain responsible for infrastructure and charging access fees to other operators.