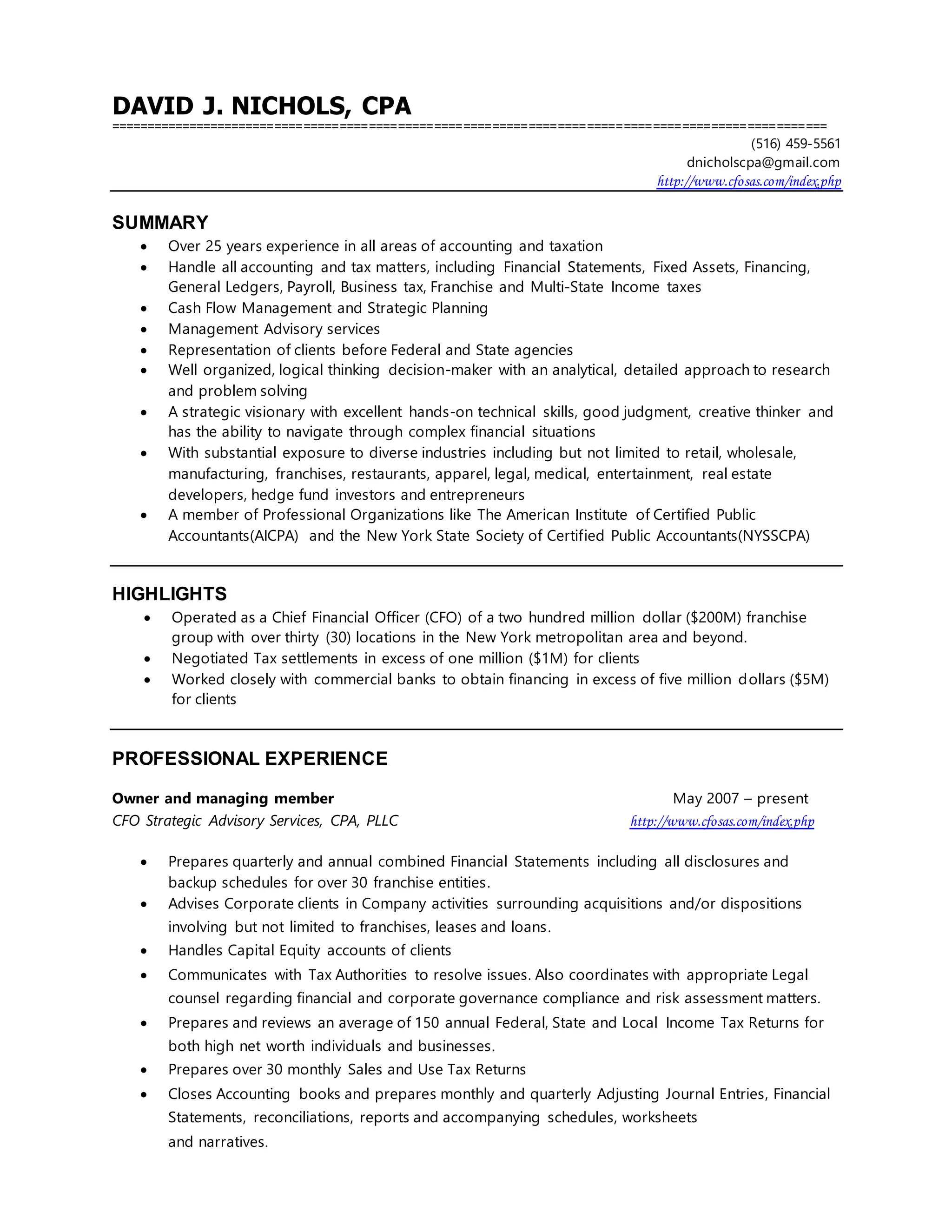

David J. Nichols is a CPA with over 25 years of experience in accounting, taxation, and management advisory services. He has expertise in financial statements, tax filings, cash flow management, and strategic planning. Nichols has worked with a diverse range of industries and provides services such as accounting, auditing, tax preparation and representation before government agencies.