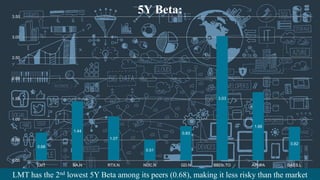

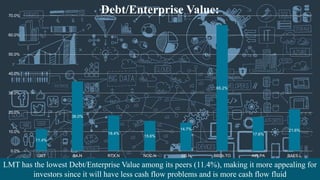

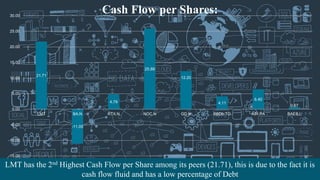

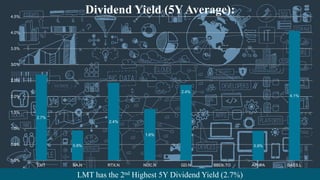

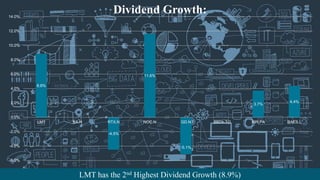

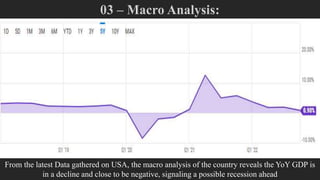

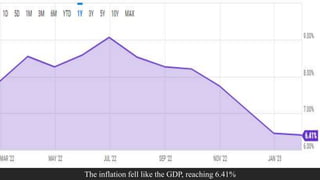

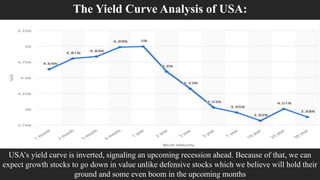

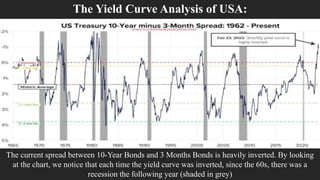

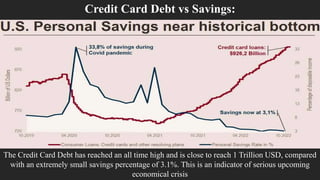

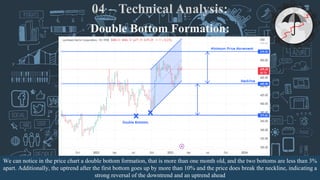

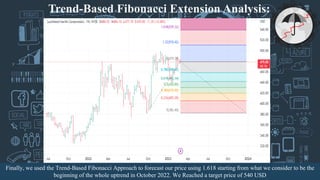

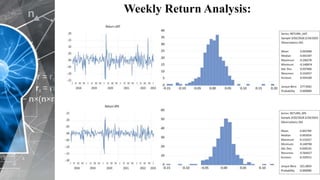

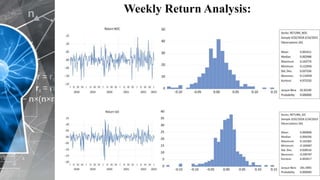

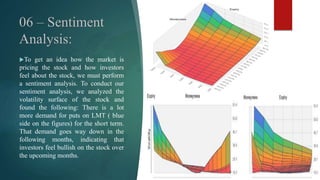

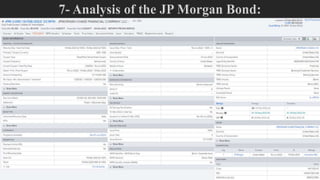

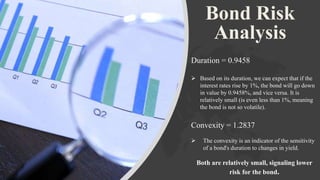

This document provides an investment analysis of Lockheed Martin (LMT) stock and a JP Morgan corporate bond. It begins with an overview of LMT, highlighting recent contracts and sales. Fundamental analyses show LMT outperforming peers on metrics like earnings per share. Macroeconomic analyses indicate a potential US recession. Technical analyses of LMT's stock chart show an upward trend. The bond proposed for the portfolio has low duration and convexity, signaling lower risk. Overall, the analysis recommends LMT stock as a strong buy and the JP Morgan bond as a good defensive holding.