The document discusses different types of business entities that can be formed in the UAE:

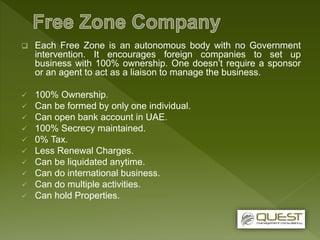

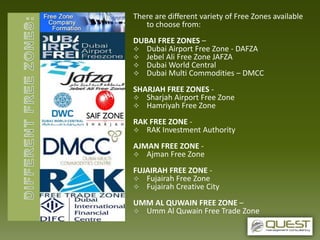

1) A free zone company registered with a free zone authority allows for 100% foreign ownership and does not require a local sponsor.

2) A limited liability company (LLC) registered with the department of economic development requires at least 51% local UAE citizen ownership.

3) An offshore company incorporated in certain offshore jurisdictions allows for 100% foreign ownership and 0% tax liability in the country of incorporation.

The document provides details on benefits, requirements and procedures for forming these different types of companies in the UAE. It also lists services provided to companies, including business support and partnerships.