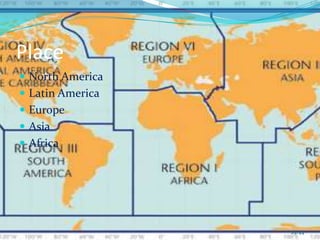

The document discusses the Indian alcohol beverage industry and United Spirits Ltd. It provides details on:

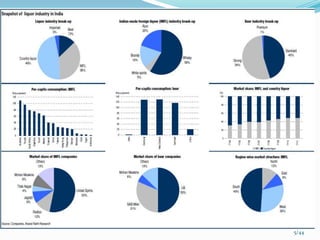

- India being the 3rd largest market for branded alcohol globally

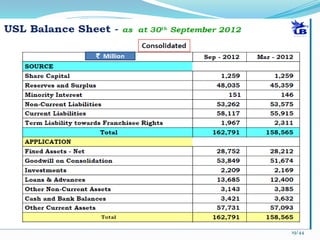

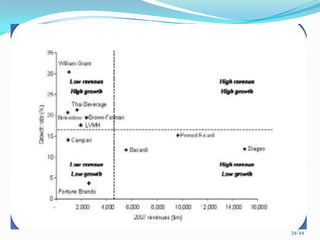

- United Spirits Ltd being the largest spirits company in India with a 59% domestic market share

- United Spirits Ltd's portfolio including popular brands like Bagpiper, McDowell's whisky, Honey Bee brandy, and Romanov vodka

- Competition from global leader Diageo which owns popular brands like Johnnie Walker, Smirnoff, and Captain Morgan