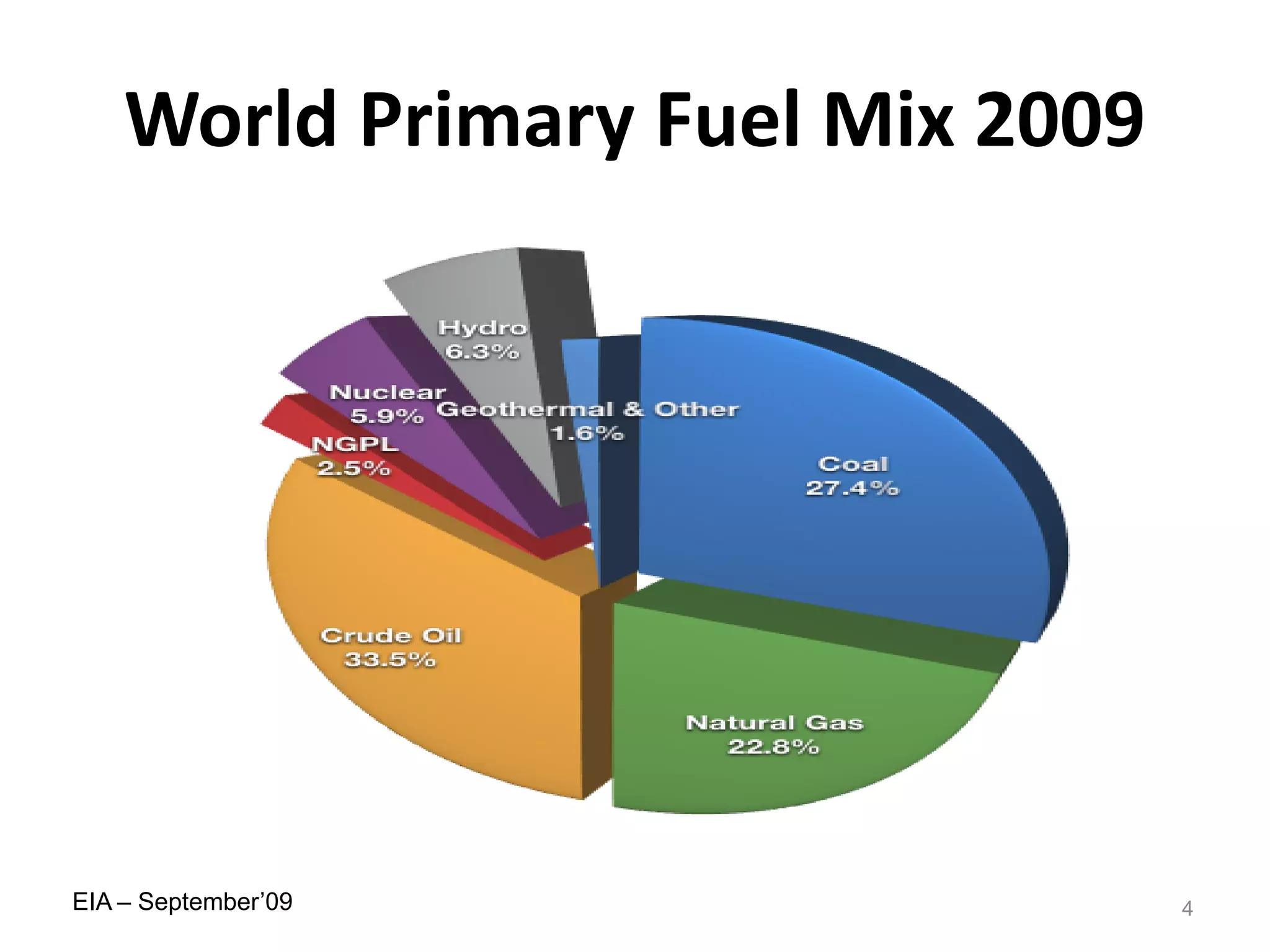

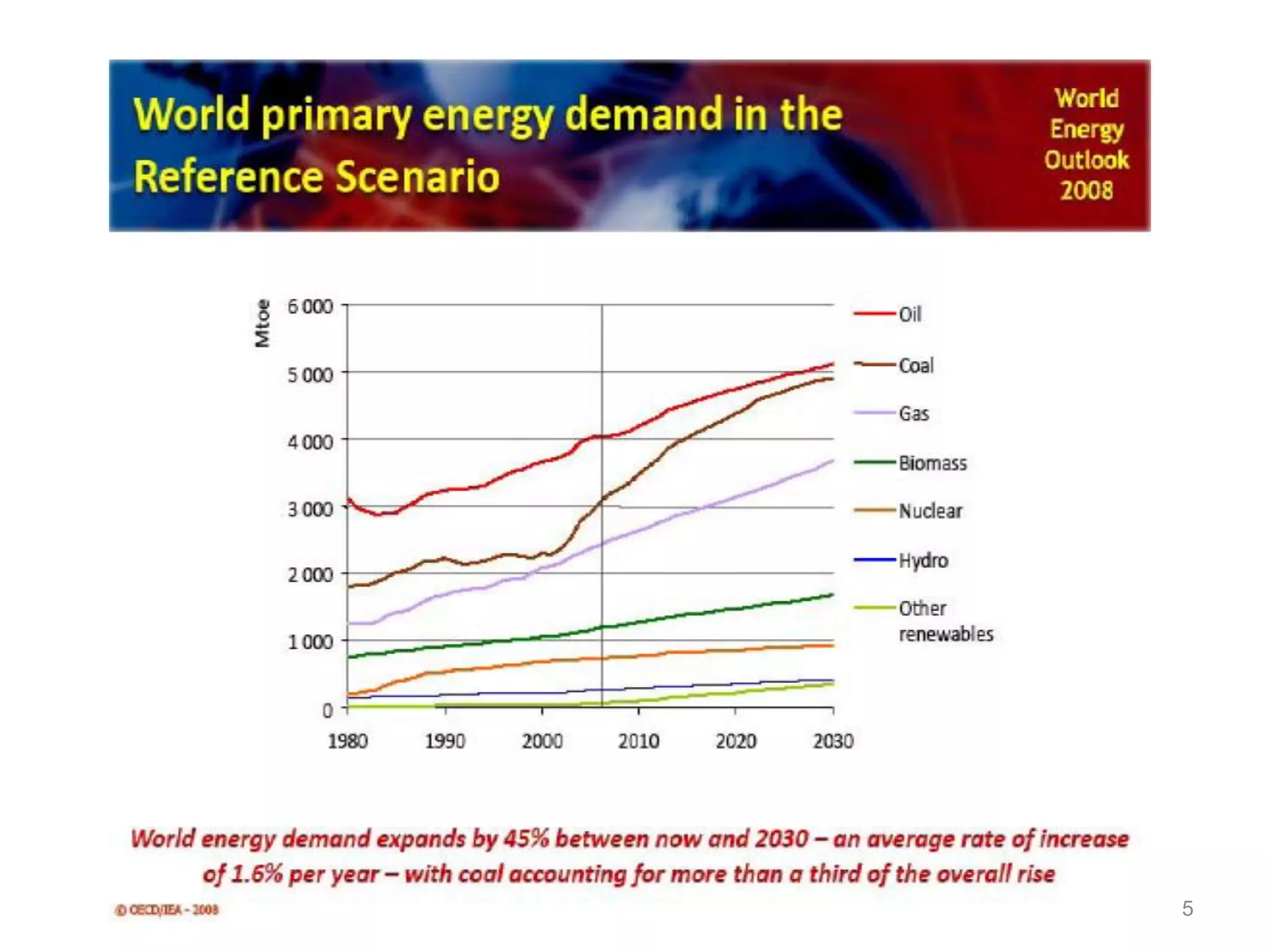

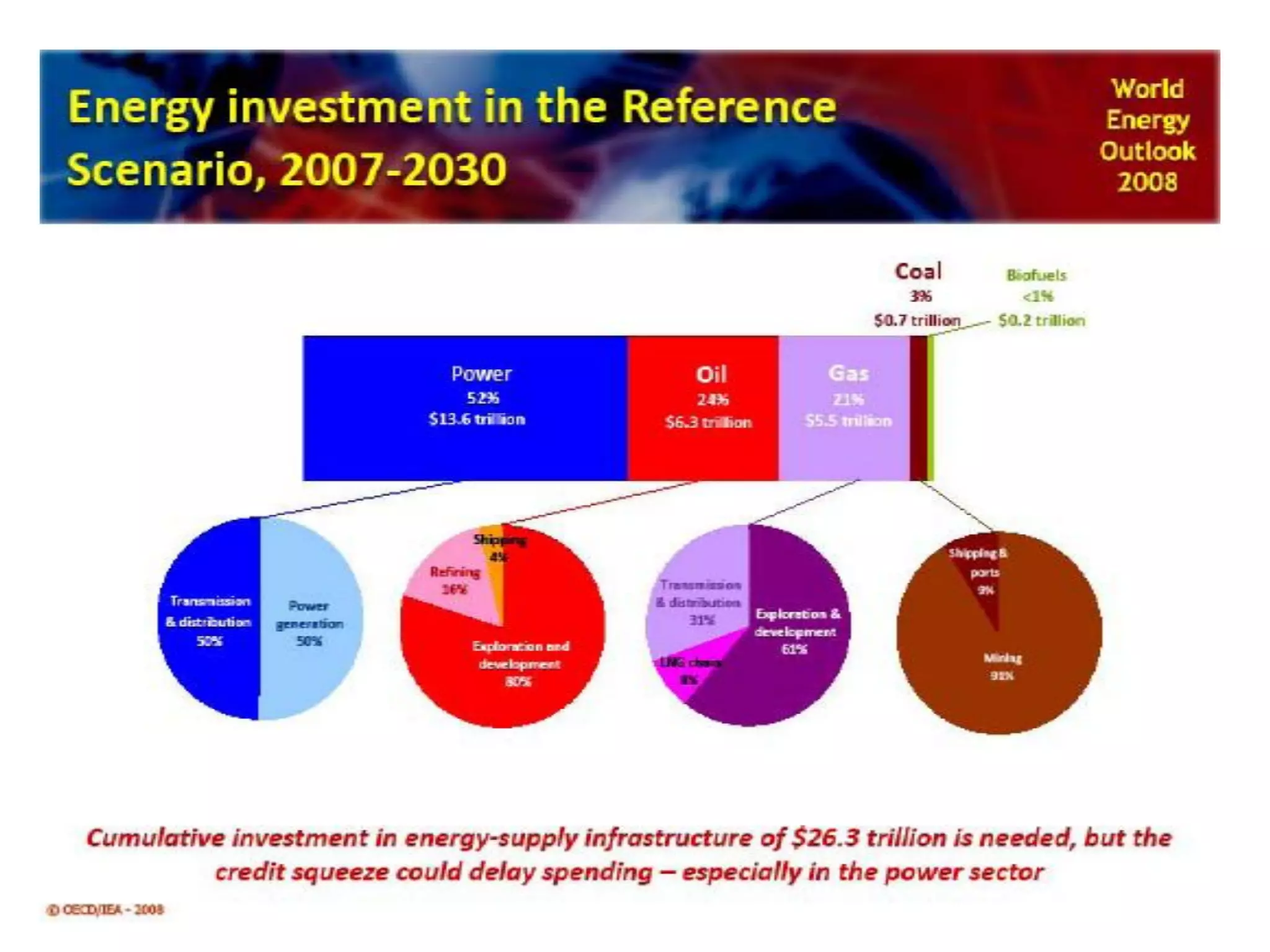

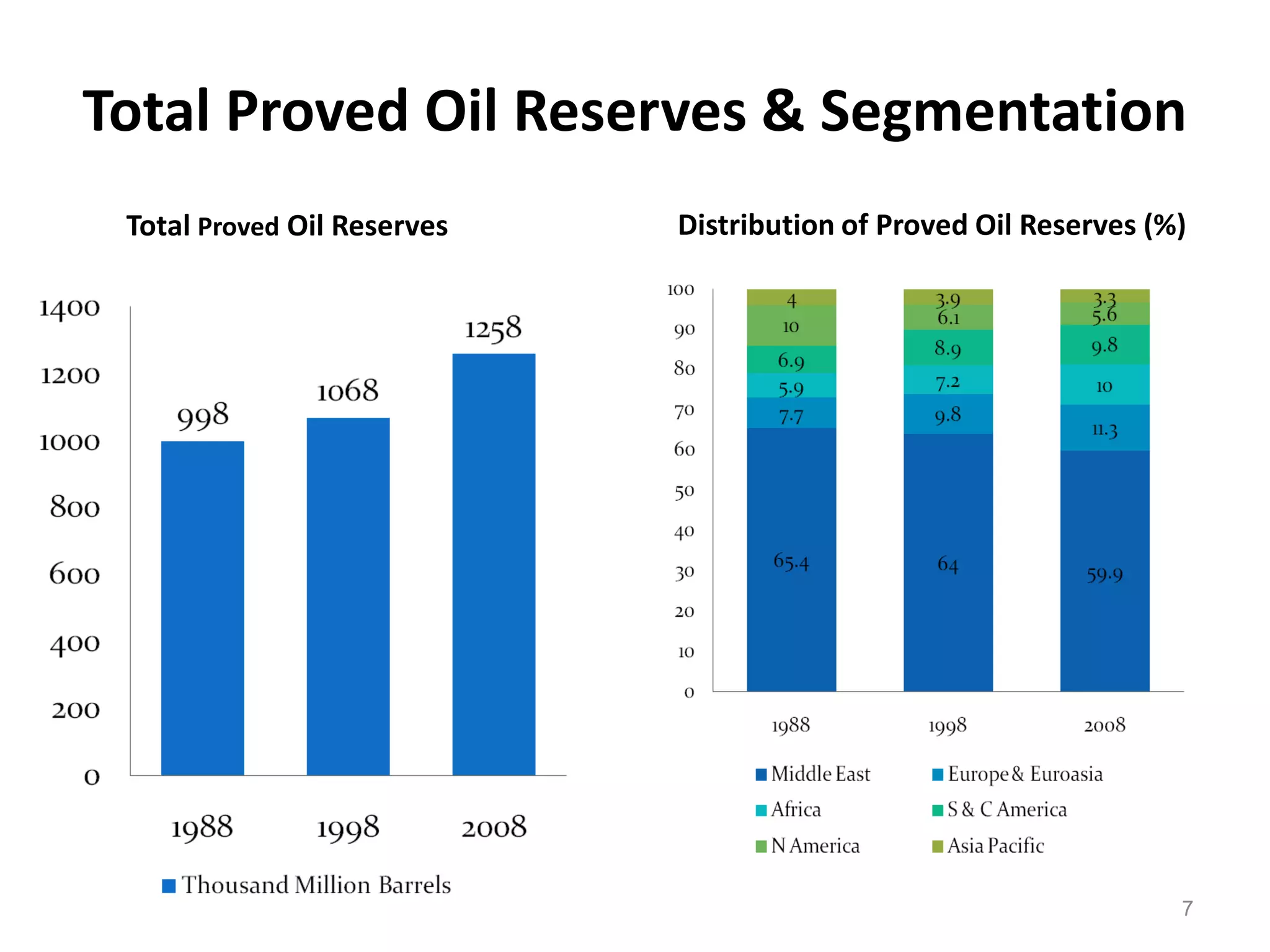

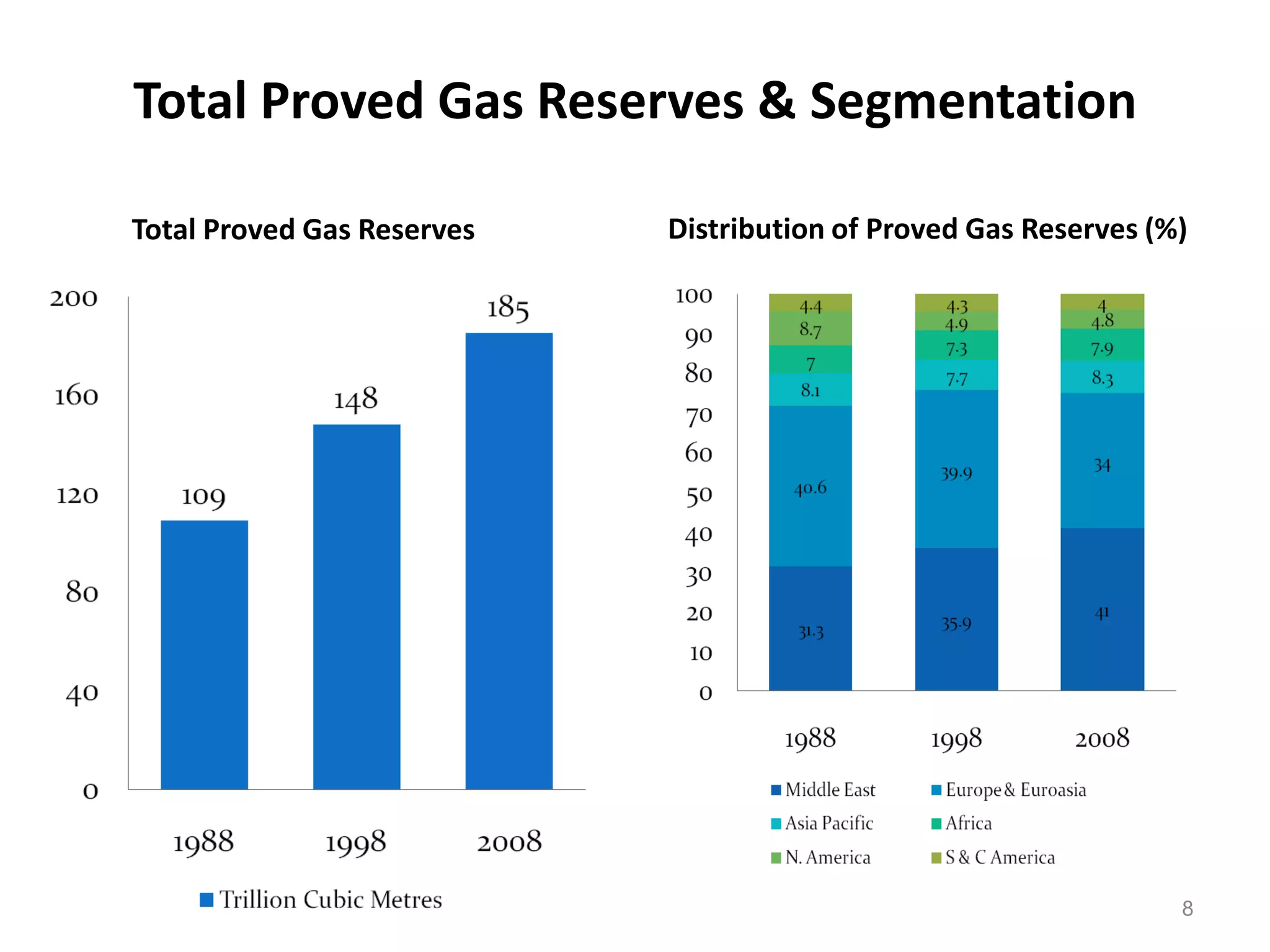

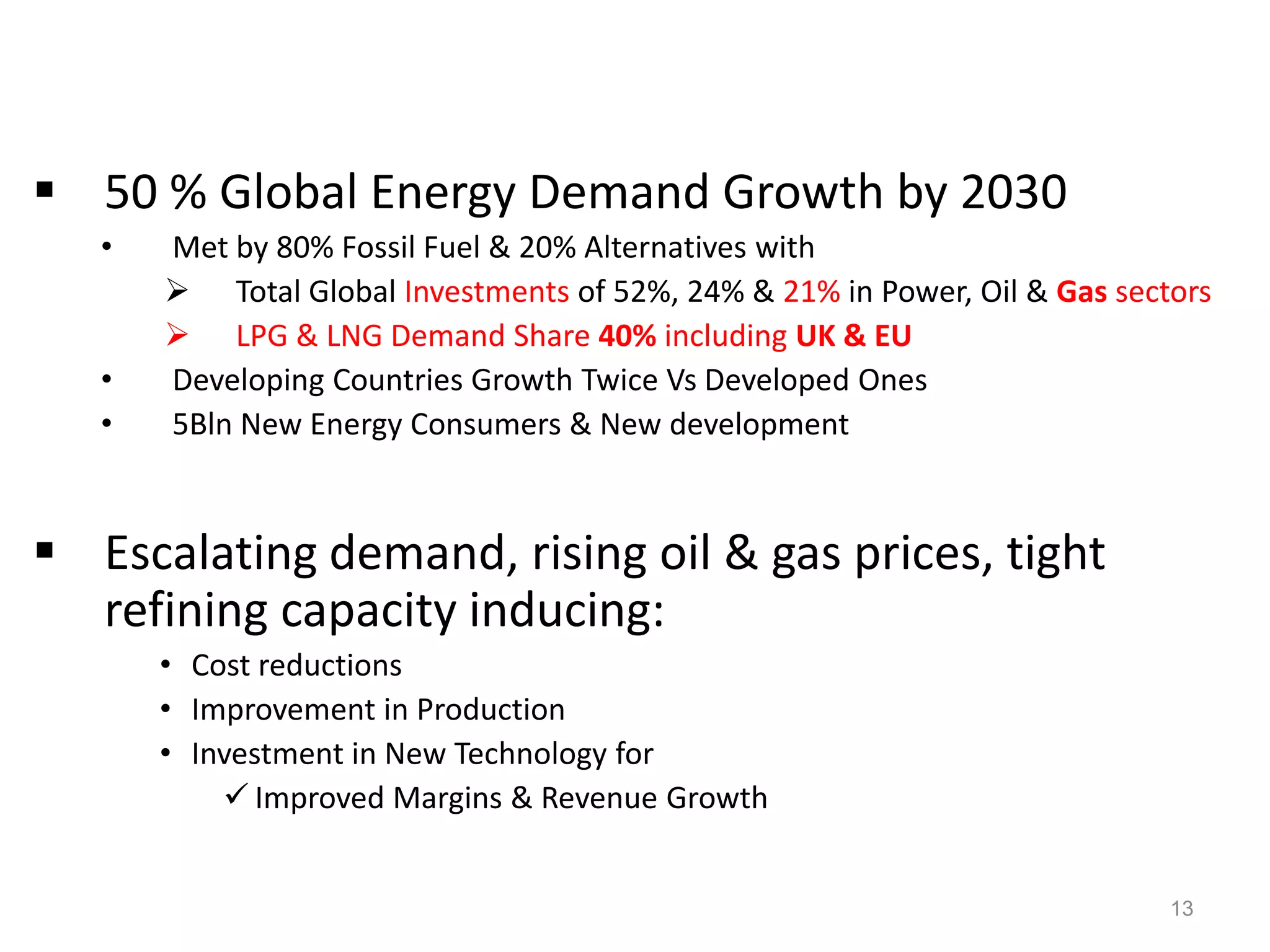

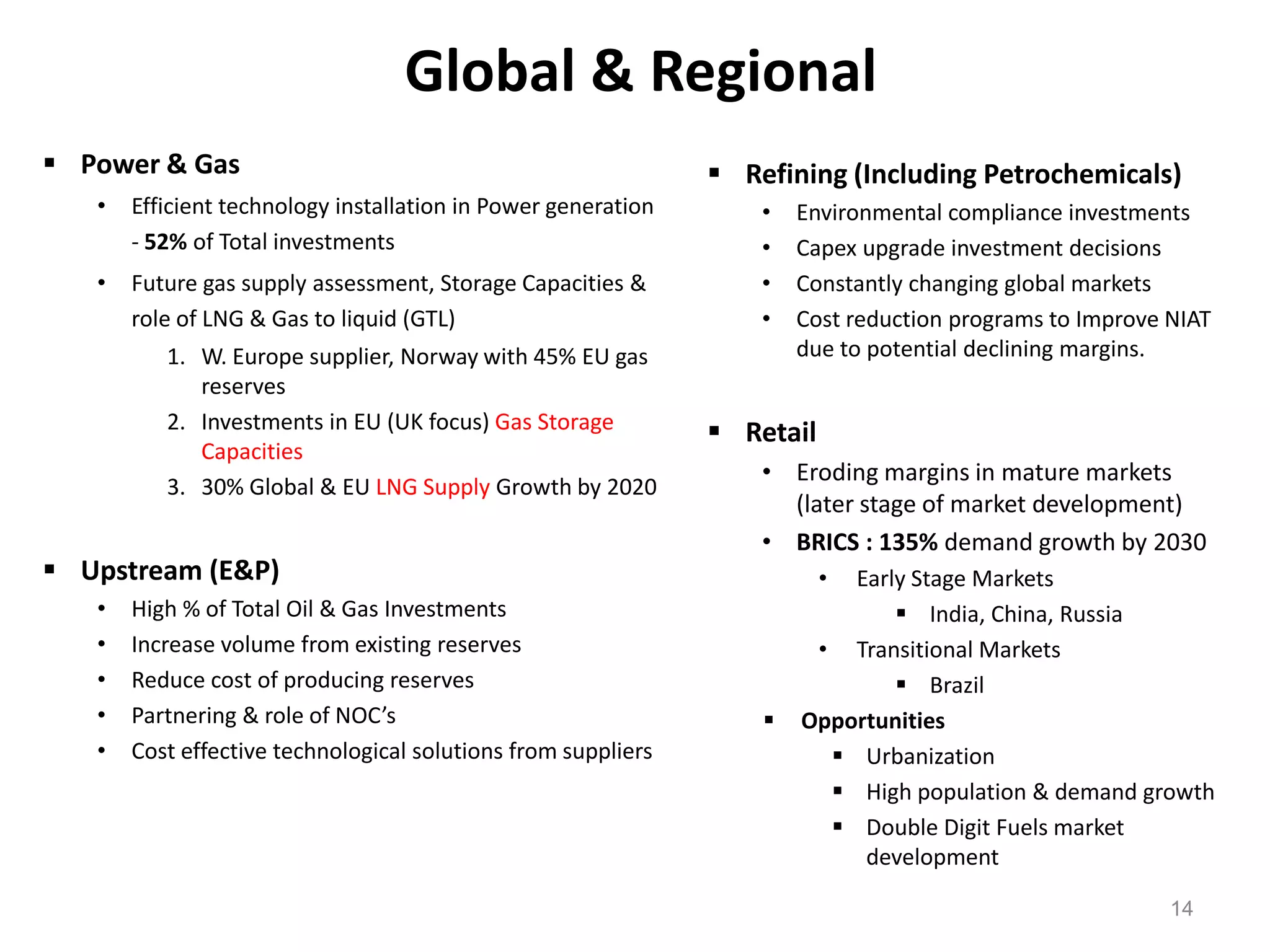

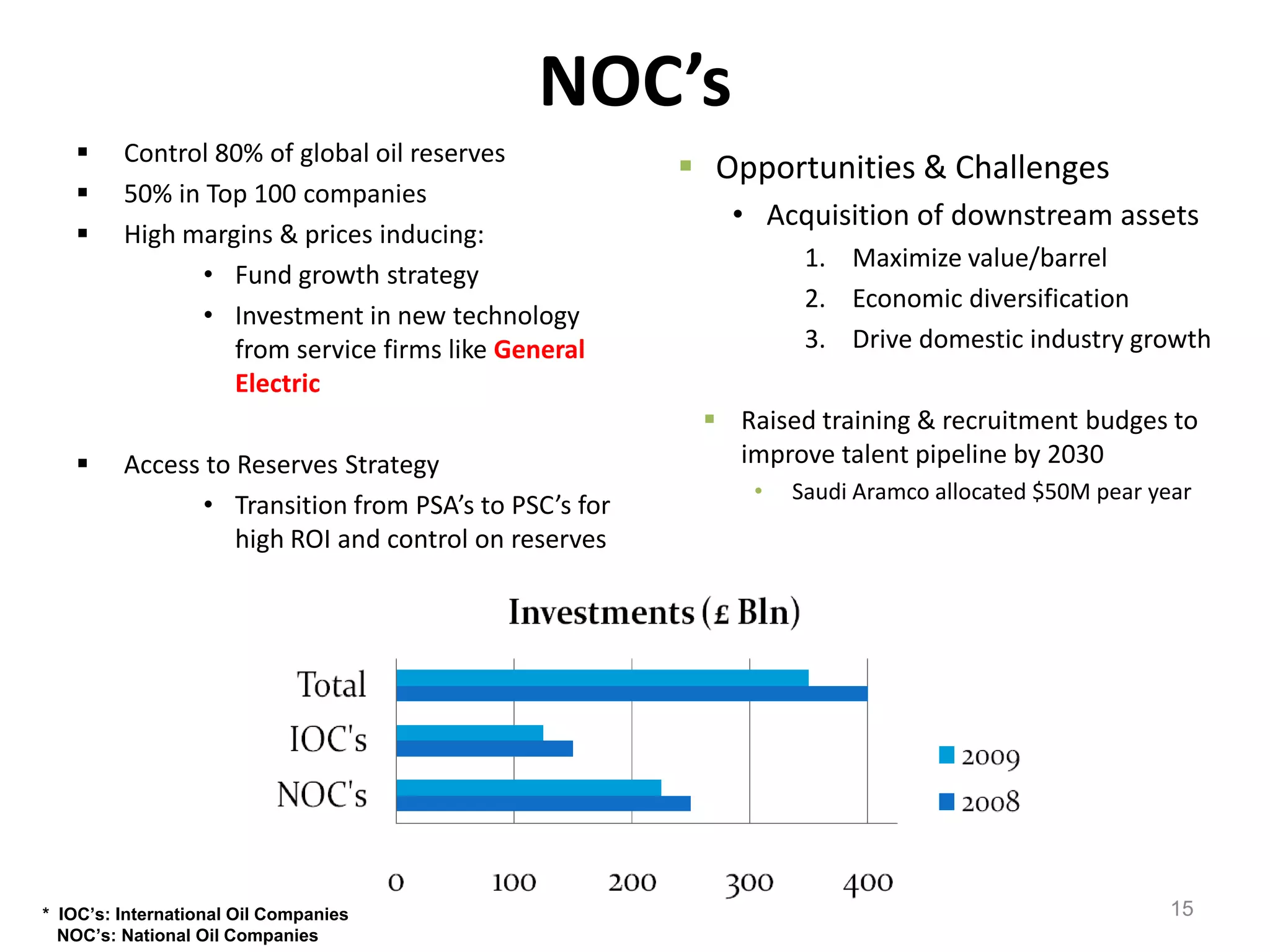

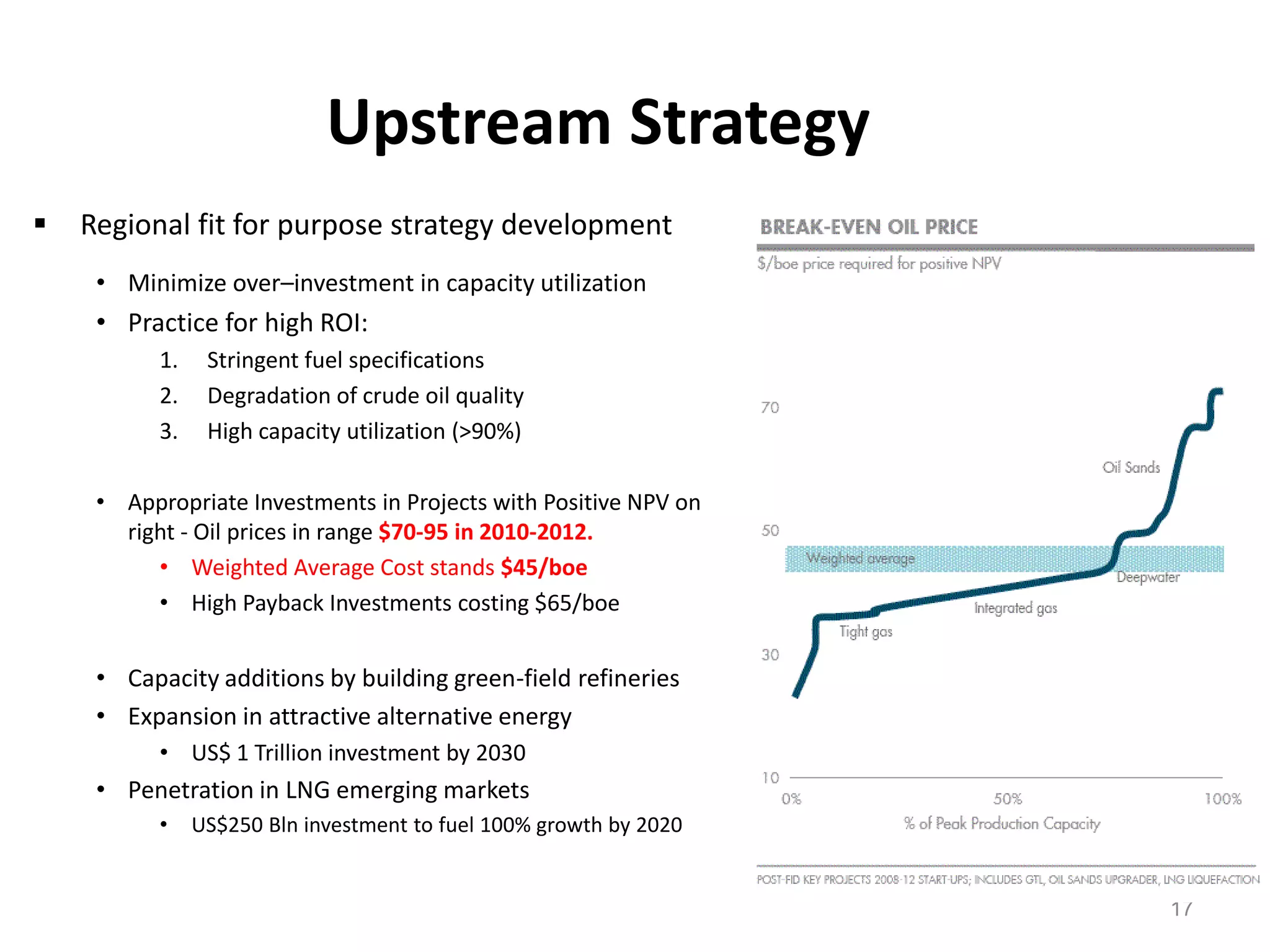

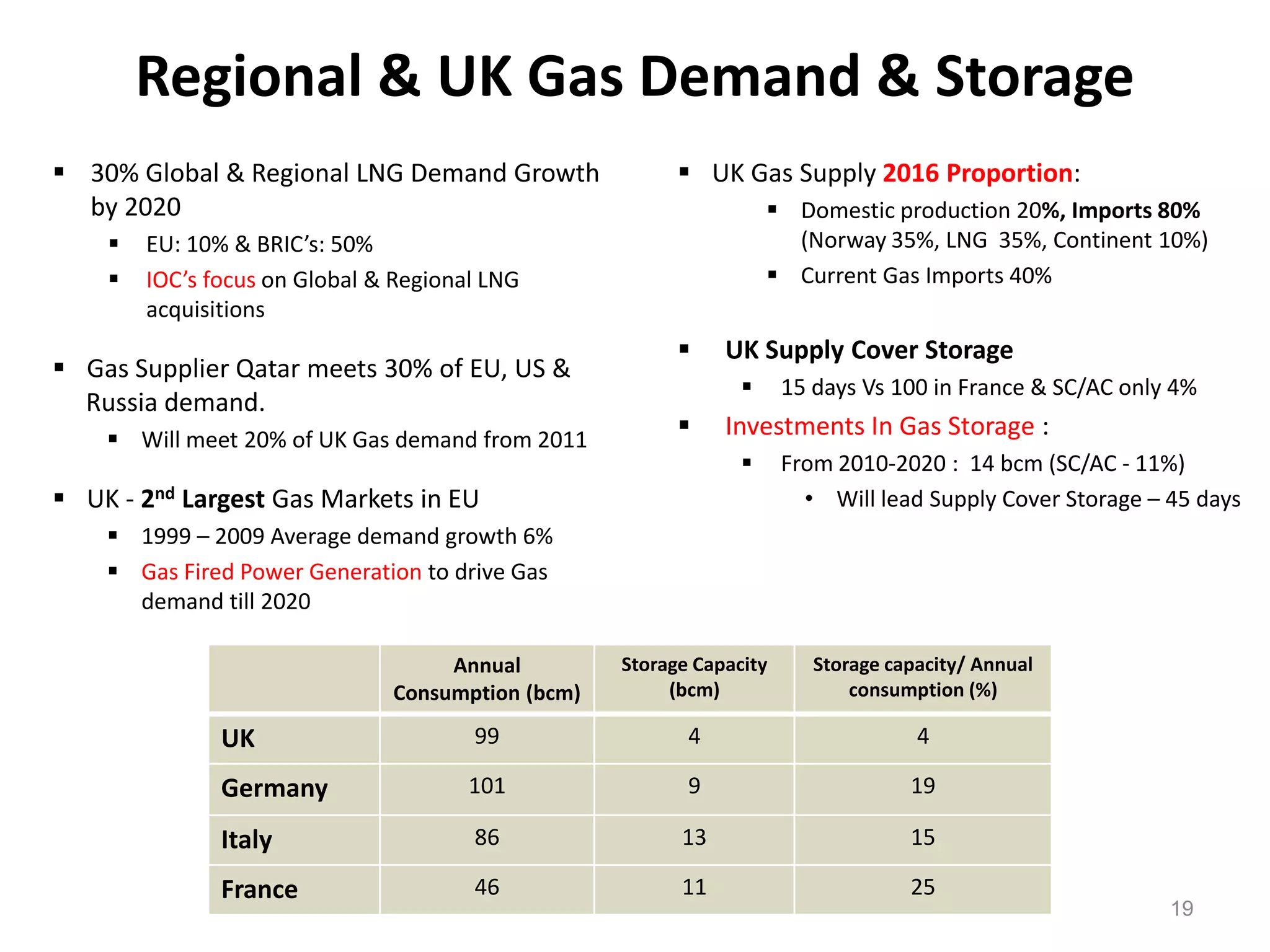

Global energy demand is projected to grow 50% by 2030, met primarily through fossil fuels. This will require $52 trillion in investments across the power, oil, and gas sectors. Emerging markets will see twice the growth of developed markets. National oil companies control 80% of oil reserves but international oil companies can access reserves through partnerships. Both will need to invest in new technologies and reduce costs to meet escalating demand and higher prices. Downstream strategies should focus on high growth emerging markets and efficiency in mature markets.