The document discusses liens and lien holder's caveats under Malaysian land law. It provides definitions and discusses key cases that have helped define:

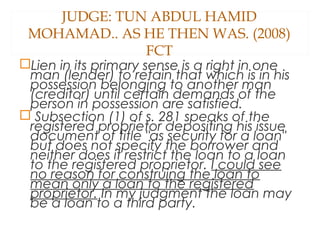

- What constitutes a valid lien under section 281 of the National Land Code, including whether the loan can be to a third party rather than just the registered proprietor.

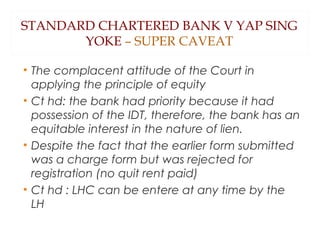

- The effect of a lien holder's caveat, including that it has a similar prohibitive effect as a private caveat in preventing subsequent dealings on the land.

- Issues around who can create and enter a lien holder's caveat, as well as the requirements and procedures around creating and removing caveats. Cases have found equitable rights can still exist even if statutory requirements are not fully met.

![WHAT IS A LIEN?

• A security transaction

• Elements of lien:

• Depositing of land title or duplicate lease with the lender

• Intention to create a lien

• Entry of lien holder’s caveat

• Paramoo v. Zeno Ltd. [1968] 2 M.L.J. 230,

• Zeno Ltd. v. Prefabricated Construction Co. (Malaya) Ltd. & Anor.

[1967] 2 M.L.J. 104, at page 105, where Raja Azlan Shah J

(as His Majesty then was) observed that the intention to

create a lien may be inferred from all the relevant

circumstances of the case.](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-2-320.jpg)

![NATURE AND EFFECT OF LIEN

HOLDER’S CAVEAT

• PERWIRA AFFIN BANK BHD v. SELANGOR PROPERTIES

SDN BHD & ORS

COURT OF APPEAL, PUTRAJAYA [2010] 3 CLJ

• The IDT need not necessarily be deposited by the

registered proprietor

• The word ‘proprietor’ in s. 281(1) of the NLC should

include a beneficial owner. The equitable doctrine

of bare trustee is applicable in Malaysia

• UNITED OVERSEAS BANK (MALAYSIA) SDN BHD v UJA](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-4-320.jpg)

![WHO CAN CREATE LIEN?

• Perwira Habib Bank (M) Bhd lwn Loo & Sons Realty

Sdn Bhd & satu lagi (No 1) [1996] 3 MLJ 409, only the

registered proprietor…](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-7-320.jpg)

![WHO CAN ENTER LHC?

• Who can enter a lien?

• United Overseas Bank v Uja (2010) CA

• Issue: w/er a reg’d owner can create lien on behalf

of third party borrower – extend to third party

• Distinguished with Hong Leong Finance Bhd v

Staghorn Sdn Bhd [2005] CA – only the re’g

proprietor](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-8-320.jpg)

![• Palaniappa Chetty v Dupire [1919] 1 FMSLR 370

• A person who lends money to a borrower (who is

also a registered proprietor of the land) may enter a

LHC

• Perwira Habib Bank (M) Sdn Bhd v Loo & Sons Realty

S.B [1996]](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-9-320.jpg)

![S 331

• Only the original depositee alone has the right to enter LHC

• The caveat may be entered at any time because the

retention of title by the depositee creates a right in equity to

the lien

• Case: Mercantile Bank Ltd v The Official Assignee of How Han

Teh [1969] 2 MLJ 196

• the lien-holder who retains possession of the issue document

of title or the duplicate lease or even a copy of the issue

document of title may feel free to enter the lien-holder’s

caveat at any time during the currency of the loan without

losing priority over subsequent purchasers of the land or lease

– the subject matter of the lien.

• Case: Mercantile Bank Ltd. v. The Official Assigneee of The

Property of How Han Teh [1969] 2 M.L.J. 196.](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-11-320.jpg)

![PRIORITIES IN CLAIMS

• However as the interest is ‘equitable’ thus the

principles of first in time prevails, all other things are

equal applies – RAS

• This case followed the decision in Vallipuram

Sivaguru v Palaniappa Chetty [1937]MLJ 59](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-12-320.jpg)

![EFFECT OF LHC

• Chew Sze Sun v Muthiah Chettiar [1983] 1 MLJ 390

Abdul Razak J – a LHC entered earlier in time will

prohibit the subsequent entry of a private caveat .

• S 330(5) effect of LHC](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-14-320.jpg)

![IT IS THE DUTY OF THE PERSON WHO APPLIES FOR

LHC TO PROVE THAT THE TITLE IS HELD

THROUGH A PROPER MANNER

• Case: Nallamal & Anor v Karuppan Anor [1993]

• - to guard agst any fraud, misrepn,

• - the provision for lien in the NLC must be strictly

construed](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-15-320.jpg)

![HONG LEONG FINANCE BHD V.

STAGHORN SDN BHD [1995] 3 CLJ 368. CA

where the ambit of the provisions in the National

Land Code 1965 on statutory liens over land was

discussed.

Staghorn wanted to purchase a piece of land but

later Teck Lay Realty appeared as purchaser and

deposited the IDT for loan.

HL Finance entered a LHC based on a loan for Teck

Lay Realty.

Borrower defaulted, HL Finance granted OFS, but

Staghorn objected and HCT granted its objection.](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-20-320.jpg)

![APPEAL TO FED COURT – CONSIDER

PROCEEDING FOR OFS FOR LIEN

In proceedings for an order for the sale of land [pursuant to a

lien-holder's caveat]:

(a) Whether the Court, after the order for sale is made, may

permit or allow a party which is found to have no proprietary

rights in the said land, to intervene in the said proceedings with

a view to setting aside the said order;

(b) Whether an order for sale may be set aside on the

application of an intervener who is found to have no

proprietary interest in the said land and in the absence of any

challenge by the registered proprietor and/or the beneficial

owner of the said land.

2. Whether sections 281(1) and 330 of the National Land Code

(NLC) envisage that a registered proprietor of land may

deposit his issue document of title as security for a loan only to

the said proprietor and never to a third party.](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-26-320.jpg)

![UNITED OVERSEAS BANK (MALAYSIA) SDN BHD V.

UJA SDN BHD & ANOTHER APPEAL [2010] 6 CLJ 204 CA

UJA was the registered proprietor of a piece of land. A

company, Union Plastics Sdn Bhd, wanted to borrow money

from United Overseas Bank.

UJA deposited the title to its land with the bank as for the

loan. The bank entered a lien’s holder caveat against the

title to the land in question and lent money to Union Plastics.

Union Plastics defaulted in making repayment of the loan.

The bank thus acted under s. 281(2) and moved for an order

for sale. The High Court struck out the bank’s summons on

the ground that a lien under s. 281 could be created by a

registered proprietor of land when and only when he or she

was also the borrower.

The issue that arose herein was whether the registered proprietor

of land may create a lien over his or her title in favour of a third

party borrower

Hd: S 281 is not limited to the creation of a security by way of a

lien on title only for the benefit of a registered proprietor. It

extends to third party borrowers as well.](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-28-320.jpg)

![WHAT IS THE EFFECT OF LHC?

• The like effect of a private caveat

• S 330(5)

Sayang Plantantion v Kokh Siak Poo [2003] CA](https://image.slidesharecdn.com/lienandlienholderscaveat-140513225048-phpapp01/85/Lien-and-lien-holder-s-caveat-32-320.jpg)