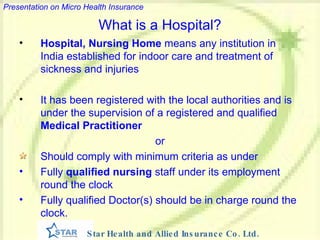

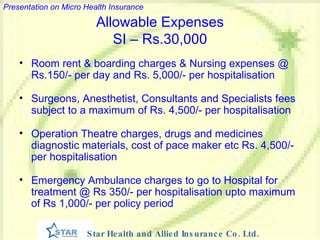

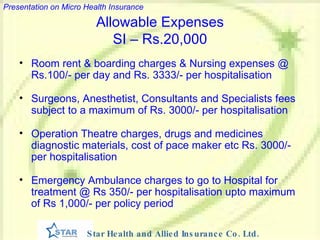

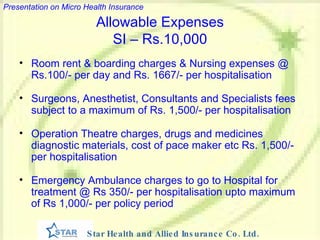

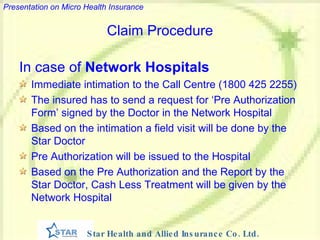

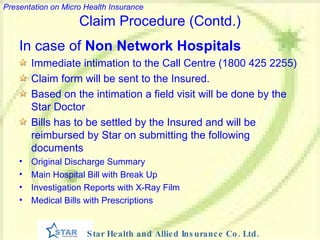

This document provides an overview of micro health insurance coverage offered by Star Health Insurance. It covers hospitalization expenses for illness, disease, or accidents for individuals aged 5-50 years. Coverage amounts of Rs. 10,000, Rs. 20,000, and Rs. 30,000 are offered. The document outlines allowable room rates, fees, and procedure costs based on coverage level. Premium rates vary from Rs. 95-500 based on age. The policy also provides certain tax benefits and health services. Exclusions include pre-existing conditions, cataracts, and injuries from war. Claims procedures differ for network versus non-network hospitals.