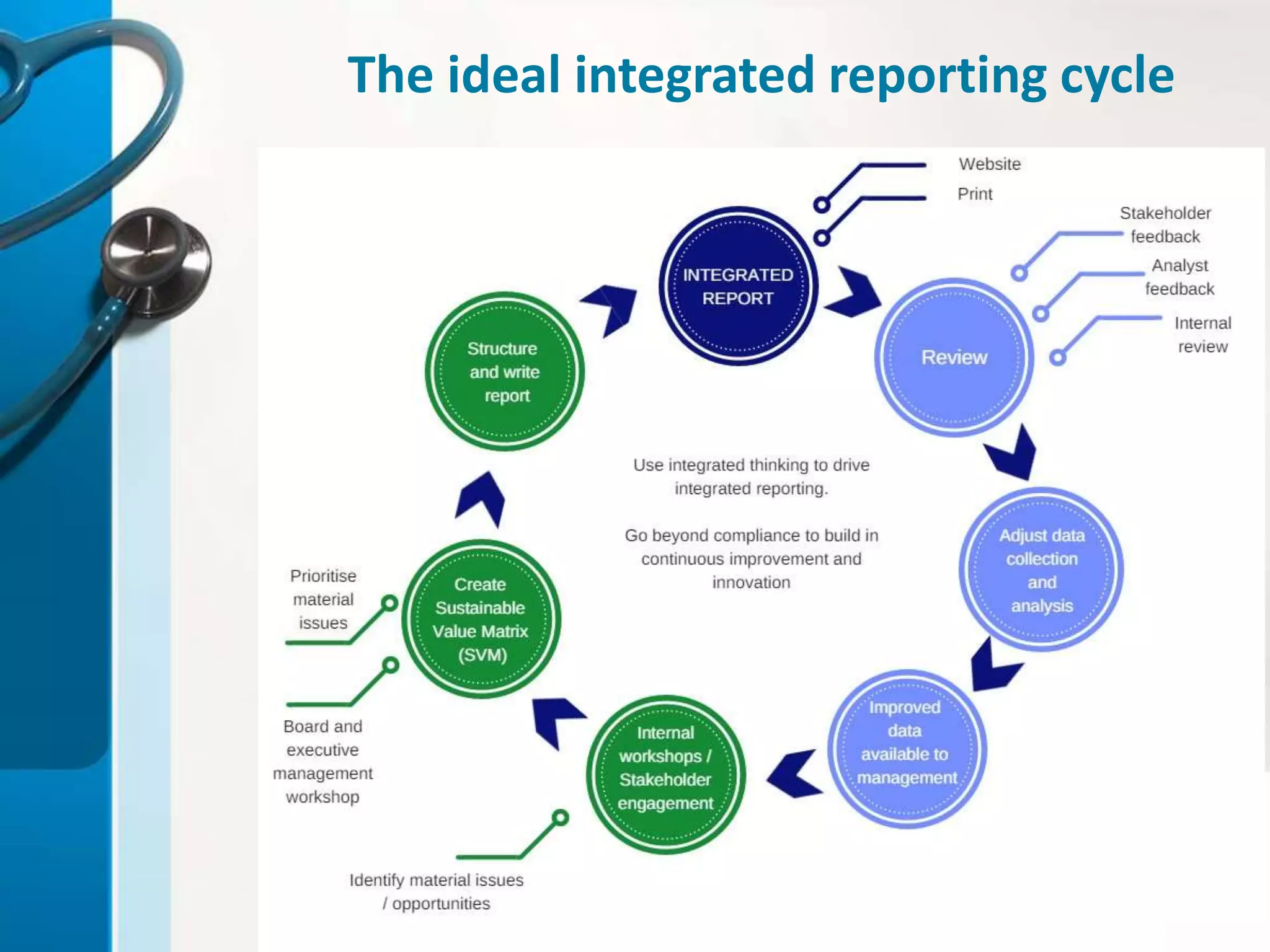

This document discusses integrated reporting and thinking. It begins by explaining that integrated reporting places organizational performance and strategy in the context of social and environmental issues. It then discusses how integrated thinking promotes a holistic assessment to create better businesses and societies by considering internal/external factors and interdependencies when making decisions. The document outlines some of the key benefits of integrated thinking such as improved risk management, quality of information, and internal cohesion. It emphasizes the importance of materiality, the six capitals, business models, and integrated reporting going beyond just compliance to be a strategic management tool.