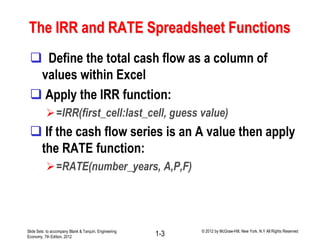

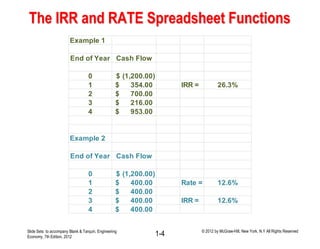

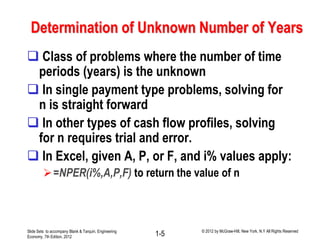

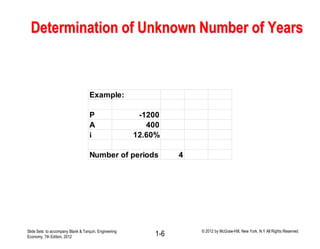

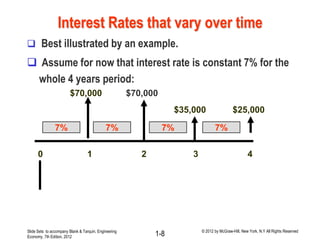

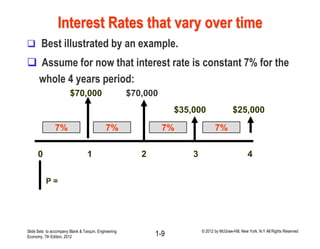

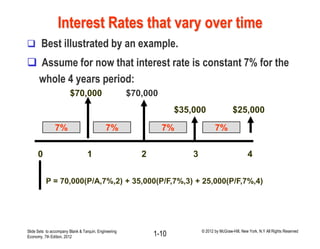

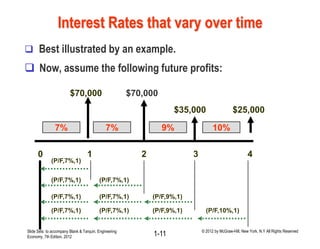

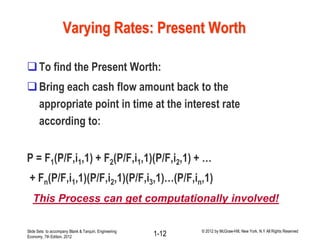

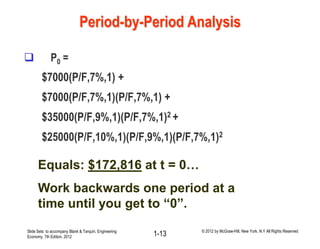

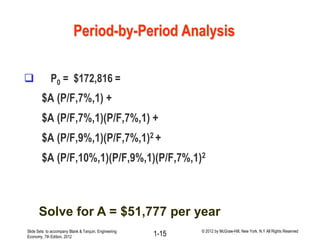

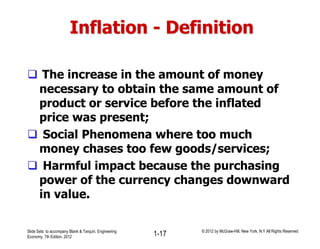

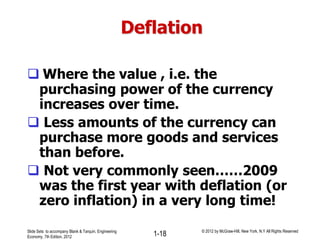

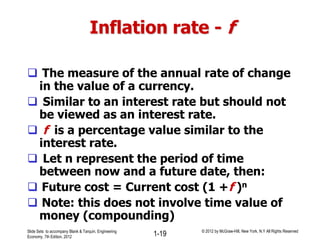

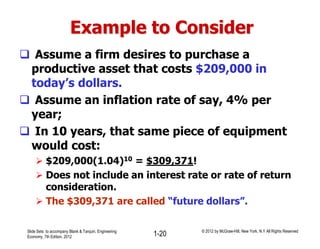

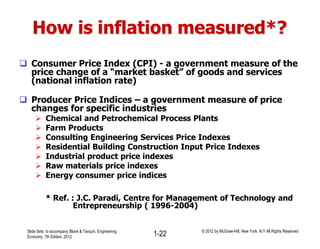

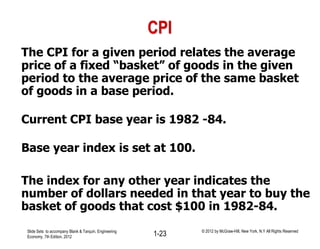

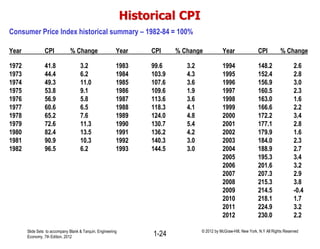

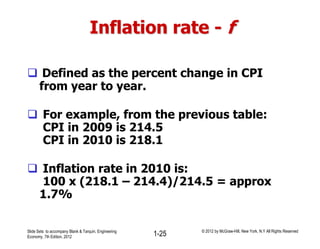

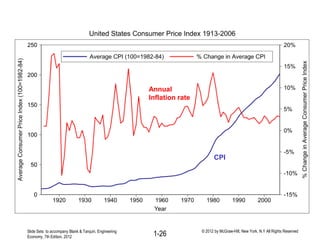

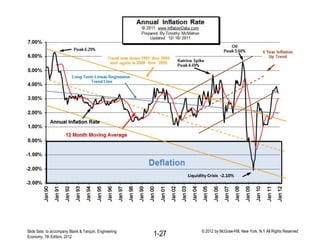

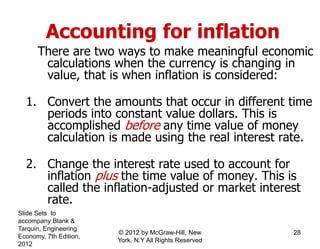

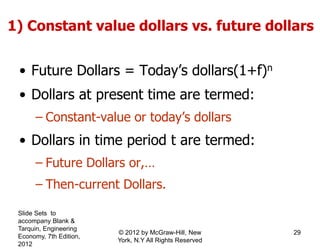

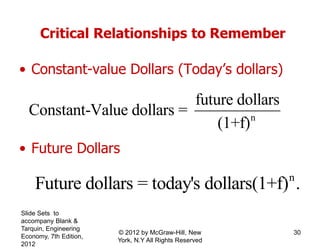

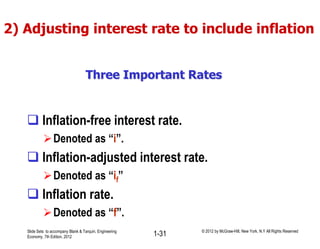

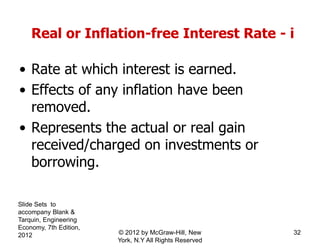

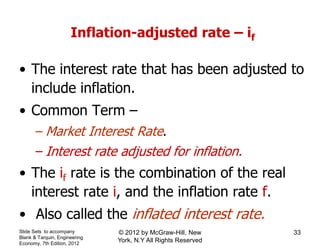

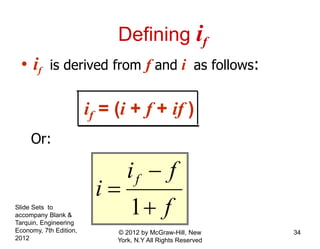

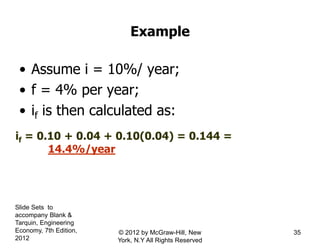

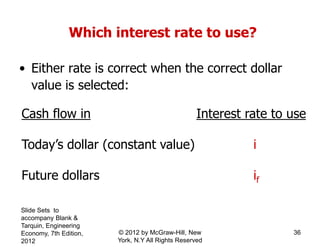

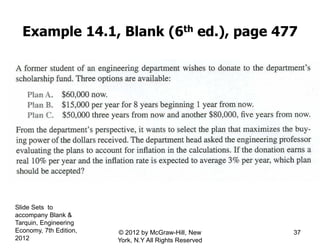

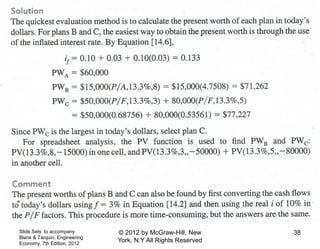

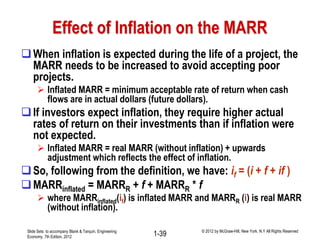

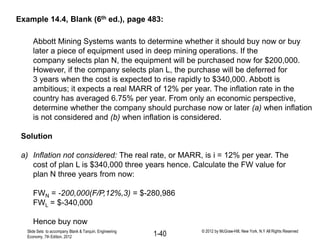

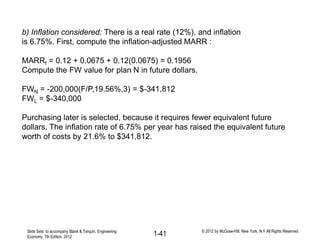

This document summarizes key concepts for determining unknown interest rates, inflation rates, and numbers of periods in engineering economy problems. It discusses using the IRR, RATE, and NPER functions in Excel to calculate unknown values. It also covers handling varying interest rates over time through period-by-period analysis or approximation using an average rate. The effects of inflation are explained, including how future costs are estimated using an inflation rate. Common inflation measures like the Consumer Price Index are also introduced.