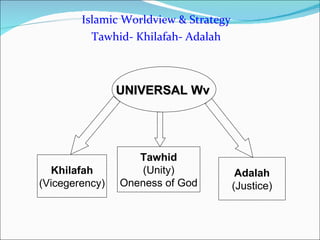

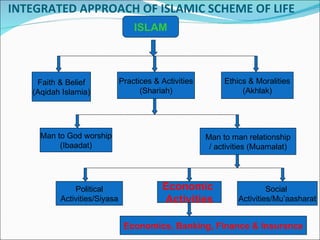

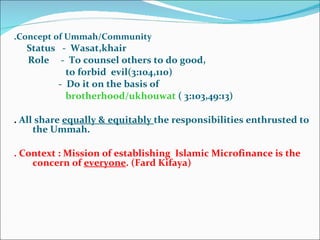

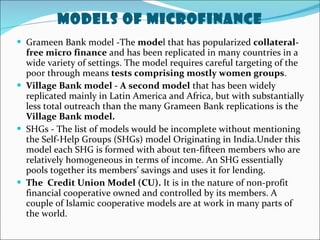

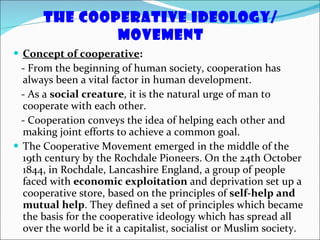

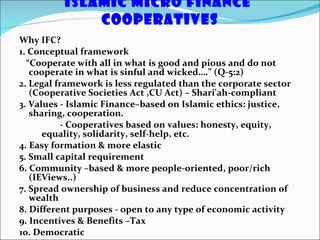

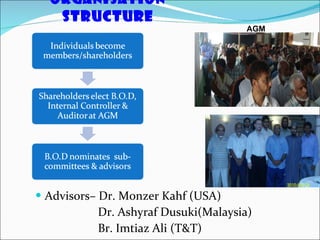

The document summarizes an international conference on Islamic microfinance. It discusses various models of microfinance and their achievements. It emphasizes the importance of the cooperative model, highlighting the case study of Al Barakah Multi-purpose Cooperative Society, an Islamic microfinance cooperative in Mauritius. The conference explores concepts like ownership, accountability and worldviews from an Islamic perspective in the context of establishing sustainable Islamic microfinance.

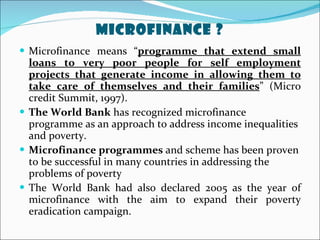

![Mamode Raffick Nabee Mohomed Founder/Secretary Al Barakah M.C.S.L E-mail: [email_address] www.albarakahcoop.org Tel: (230) 6275766](https://image.slidesharecdn.com/lecture-presentation-20june2011brotherrafiq-110707053726-phpapp01/85/Lecture-presentation-20-june-2011-brother-rafiq-40-320.jpg)

![CENTER OF ISLAMIC BANKING & ECNOMICS Head Office: 192- Ahmad Block, New Garden Town , Lahore, Pakistan Ph: +92-42-35913096-8, 35858990, 38407850 Fax: +92 -42-35913056 E-mail : [email_address] Web: http://www.alhudacibe.com](https://image.slidesharecdn.com/lecture-presentation-20june2011brotherrafiq-110707053726-phpapp01/85/Lecture-presentation-20-june-2011-brother-rafiq-41-320.jpg)