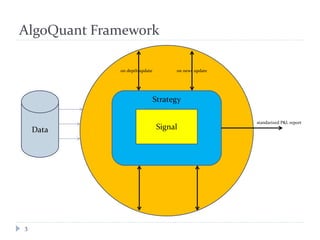

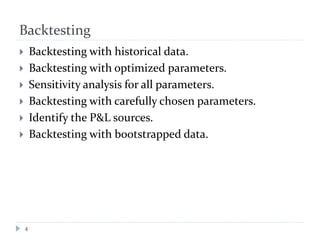

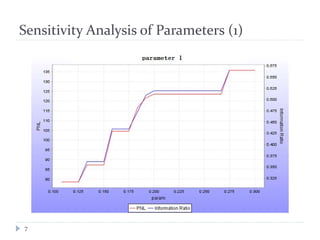

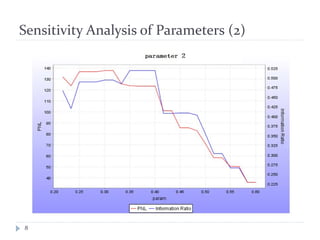

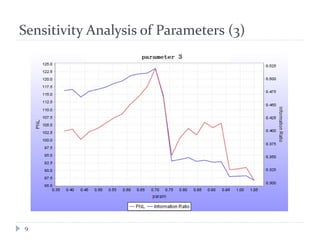

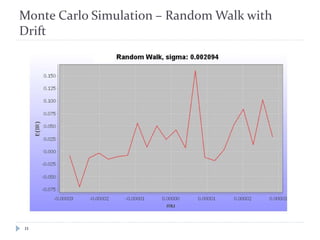

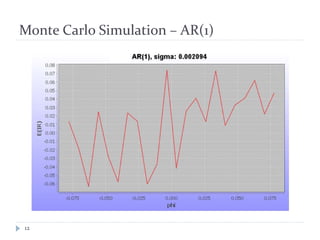

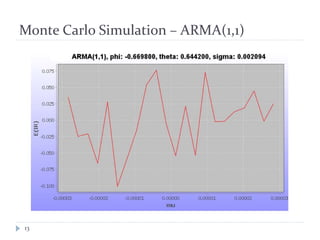

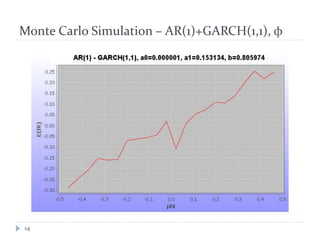

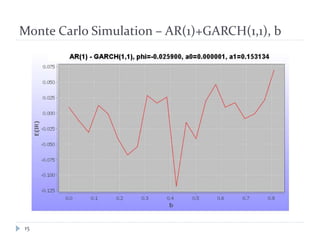

This document discusses backtesting strategies for algorithmic trading. It outlines several methods for backtesting including using historical data, optimizing parameters, and sensitivity analysis. It also describes using bootstrapped data and Monte Carlo simulations with different models like random walk, AR, and GARCH to further analyze strategies. The document notes backtesting requires significant computing power to run all tests in parallel on a grid.