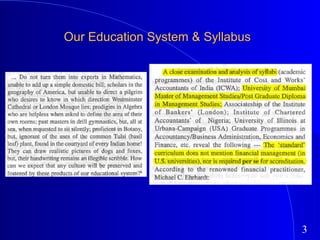

The document discusses various topics related to finance and management including:

1. The limitations of balance sheets in assessing business performance and the importance of business plans.

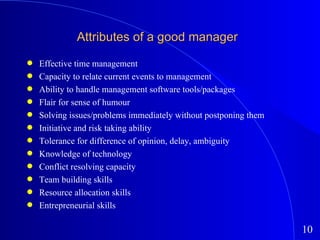

2. Attributes of good managers such as planning skills, communication skills, and ability to handle challenges.

3. Tools and methods for equity research and analysis including macroeconomic factors, industry analysis techniques, and financial statement analysis.