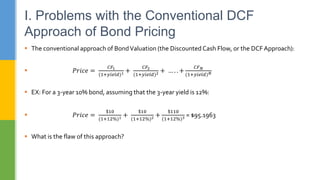

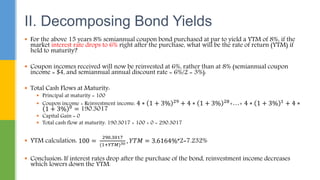

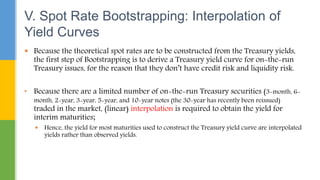

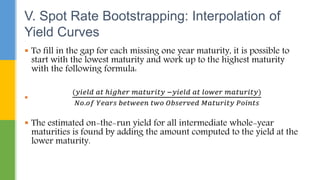

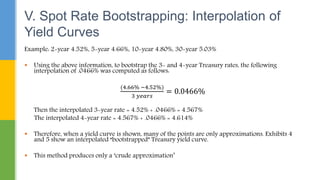

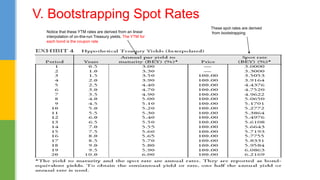

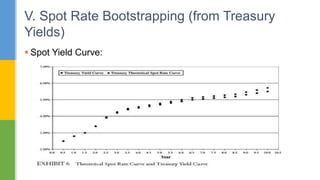

The document discusses problems with the conventional discounted cash flow approach to bond valuation and introduces the arbitrage-free spot rate bootstrapping approach. Specifically:

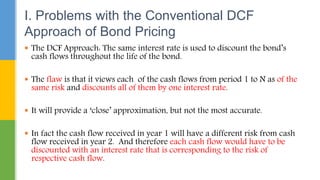

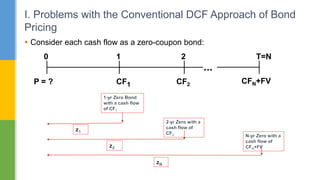

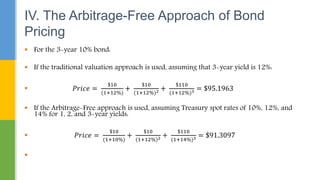

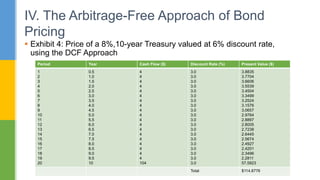

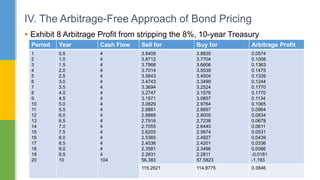

- The conventional approach discounts all cash flows using a single yield, but each cash flow has a different risk profile and should be discounted using a corresponding spot rate.

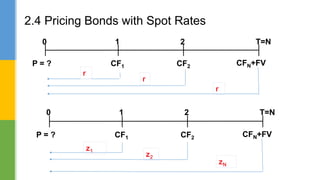

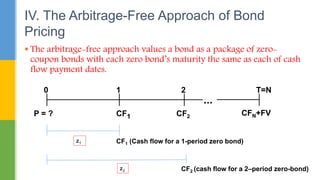

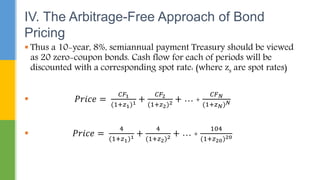

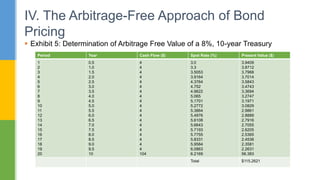

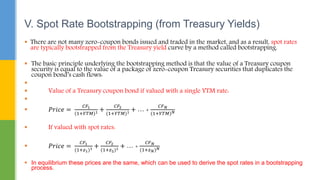

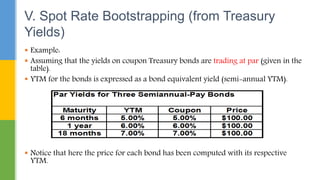

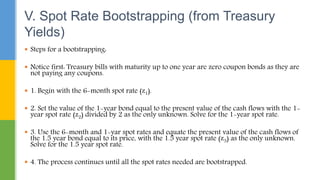

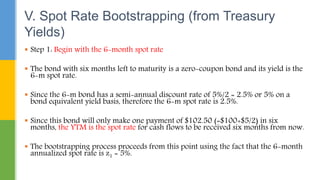

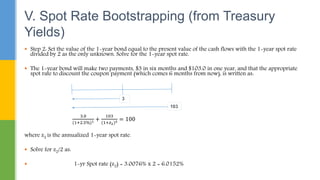

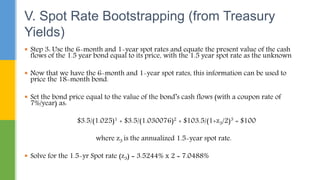

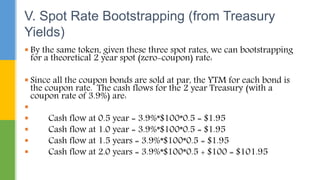

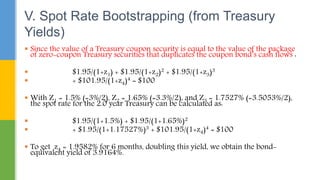

- Spot rate bootstrapping values a bond as a package of zero-coupon bonds, with each cash flow discounted using the spot rate for its corresponding maturity.

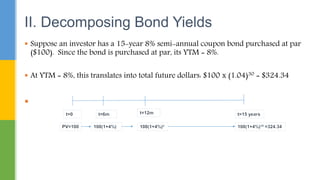

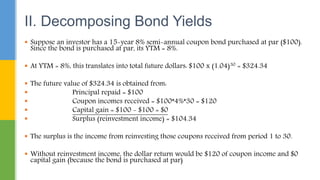

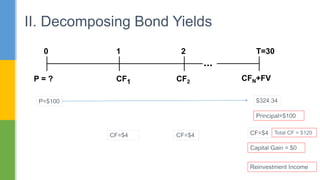

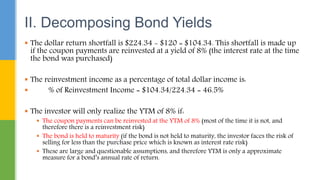

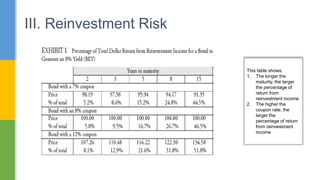

- Reinvestment risk arises because the conventional approach assumes coupon payments can be reinvested at the yield to maturity, which may not be realistic if rates change over time. Longer-term and higher-coupon bonds have greater dependence