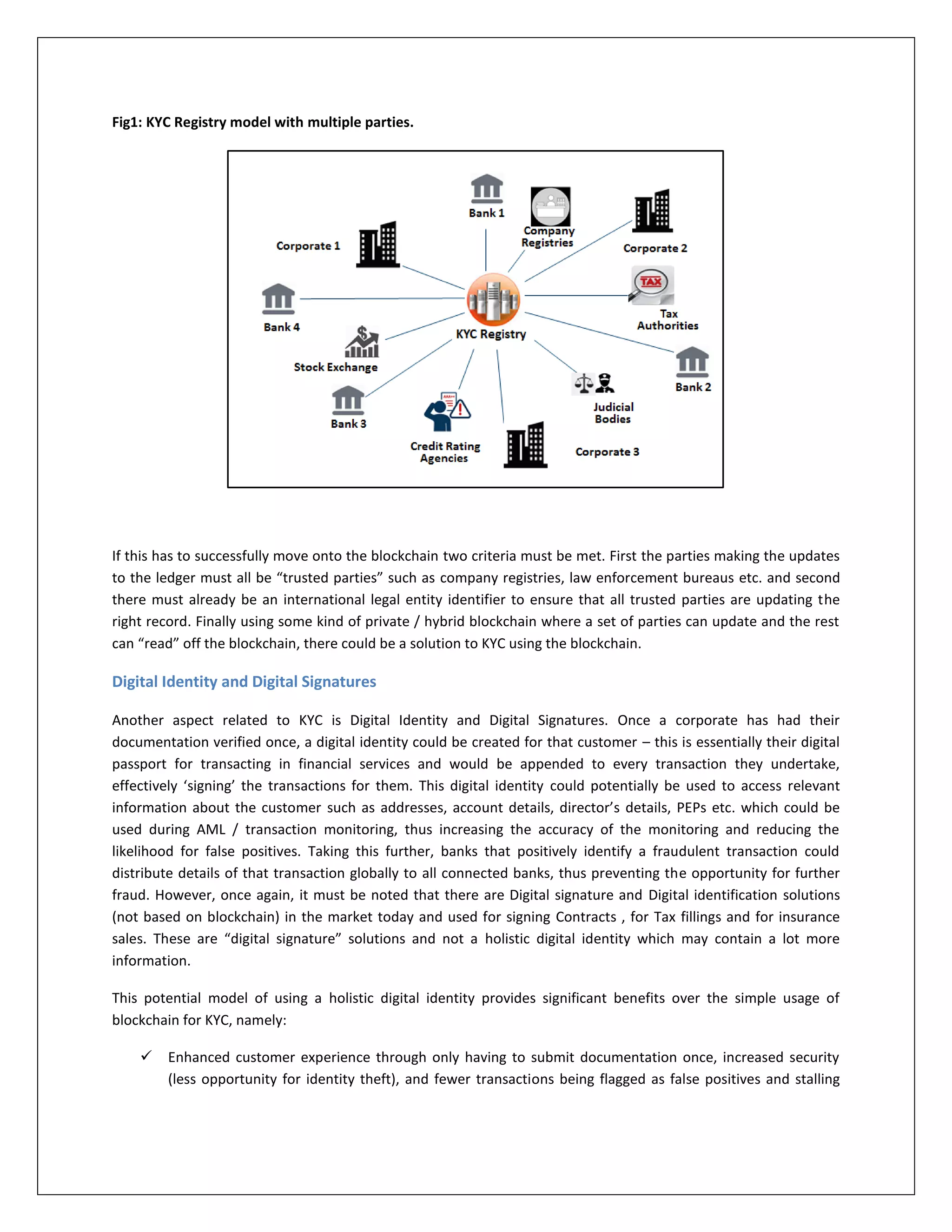

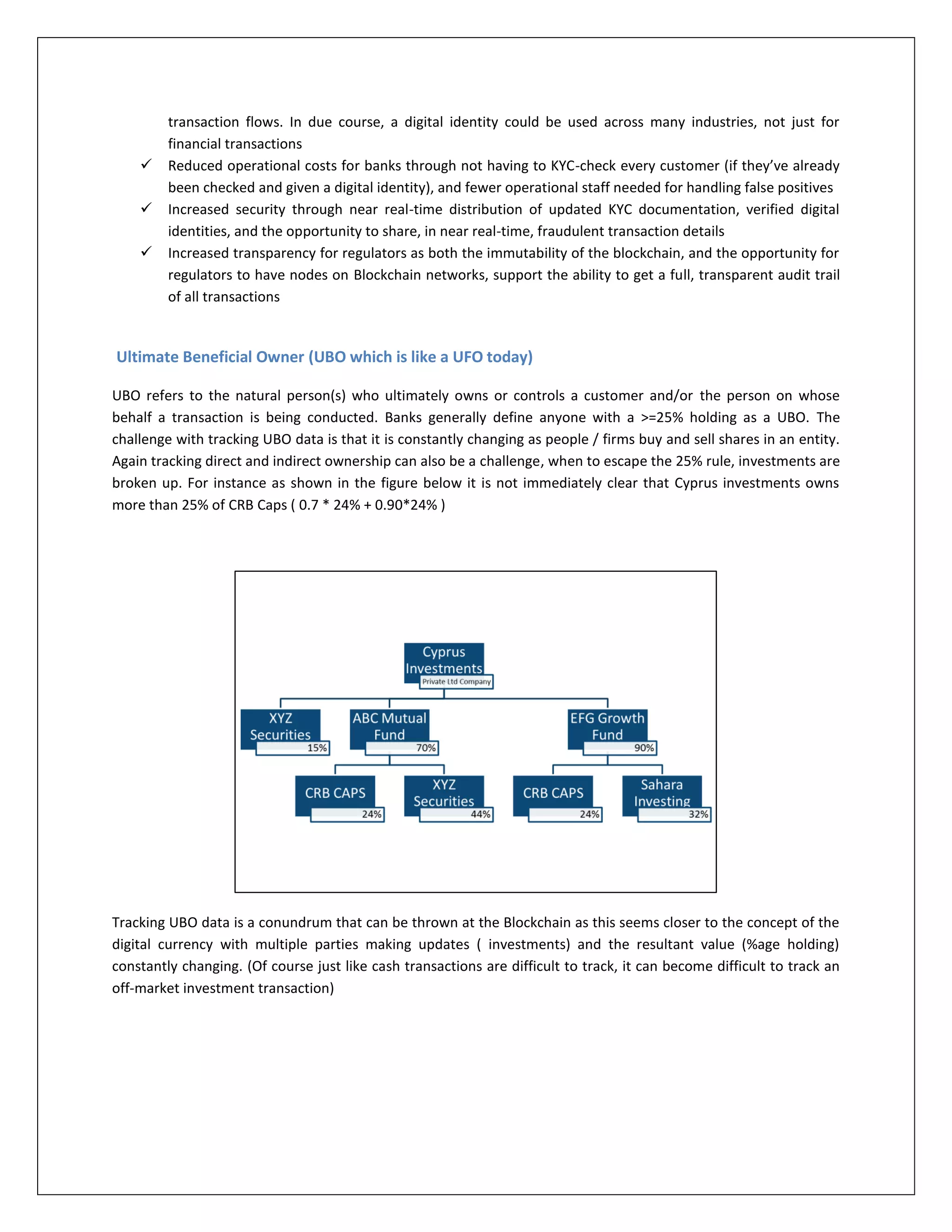

Blockchain has the potential to help solve banks' Know Your Customer (KYC) and anti-money laundering (AML) challenges by creating an immutable shared ledger for customer identity information. This could reduce duplication of KYC checks across banks and allow for real-time updates to customer details. However, key questions remain around who would validate updates to the ledger and whether a central party is still needed. A blockchain-based digital identity system may provide even greater benefits by allowing customers to submit documentation once and share identity details across industries, improving security, transparency and reducing costs for banks. Ultimately it is unclear how blockchain may evolve in solving KYC, whether as a single centralized registry, private blockchains, or a