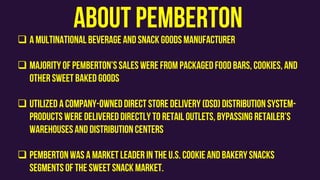

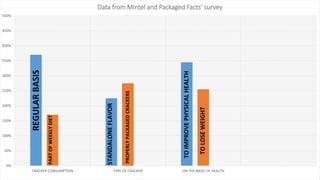

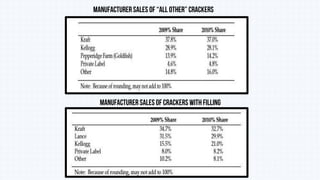

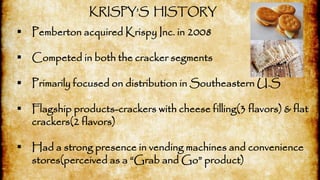

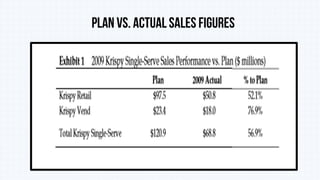

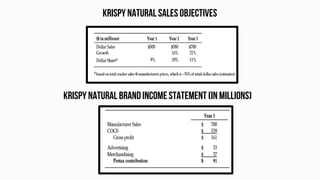

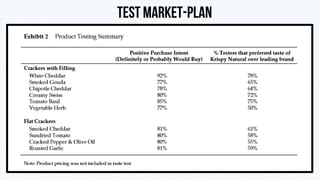

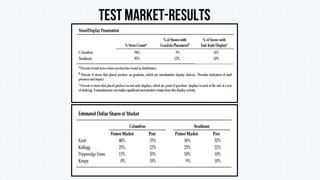

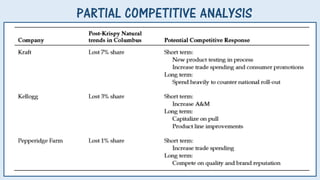

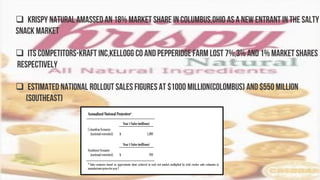

This document summarizes Krispy's plan to launch a new natural cracker line called Krispy Natural. It discusses the U.S. cracker market and Krispy's failed prior product line. Krispy Natural will feature new flavors, packaging, and marketing focusing on health. A test market in Columbus, Ohio was successful, with Krispy Natural gaining 18% market share and outperforming competitors. The document concludes Krispy Natural has potential for national expansion based on the test market results.

![CANDLER

ENTERPRISES

[2011

REVENUE-$18

BILLION]

BEVERAGE DIVISION

PETCARE

DIVISION

QUICK-SERVICE

RESTAURANT DIVISION

PEMBERTON PRODUCTS](https://image.slidesharecdn.com/krispynatural1-170629143220/85/Krispy-Natural-Case-Analysis-3-320.jpg)