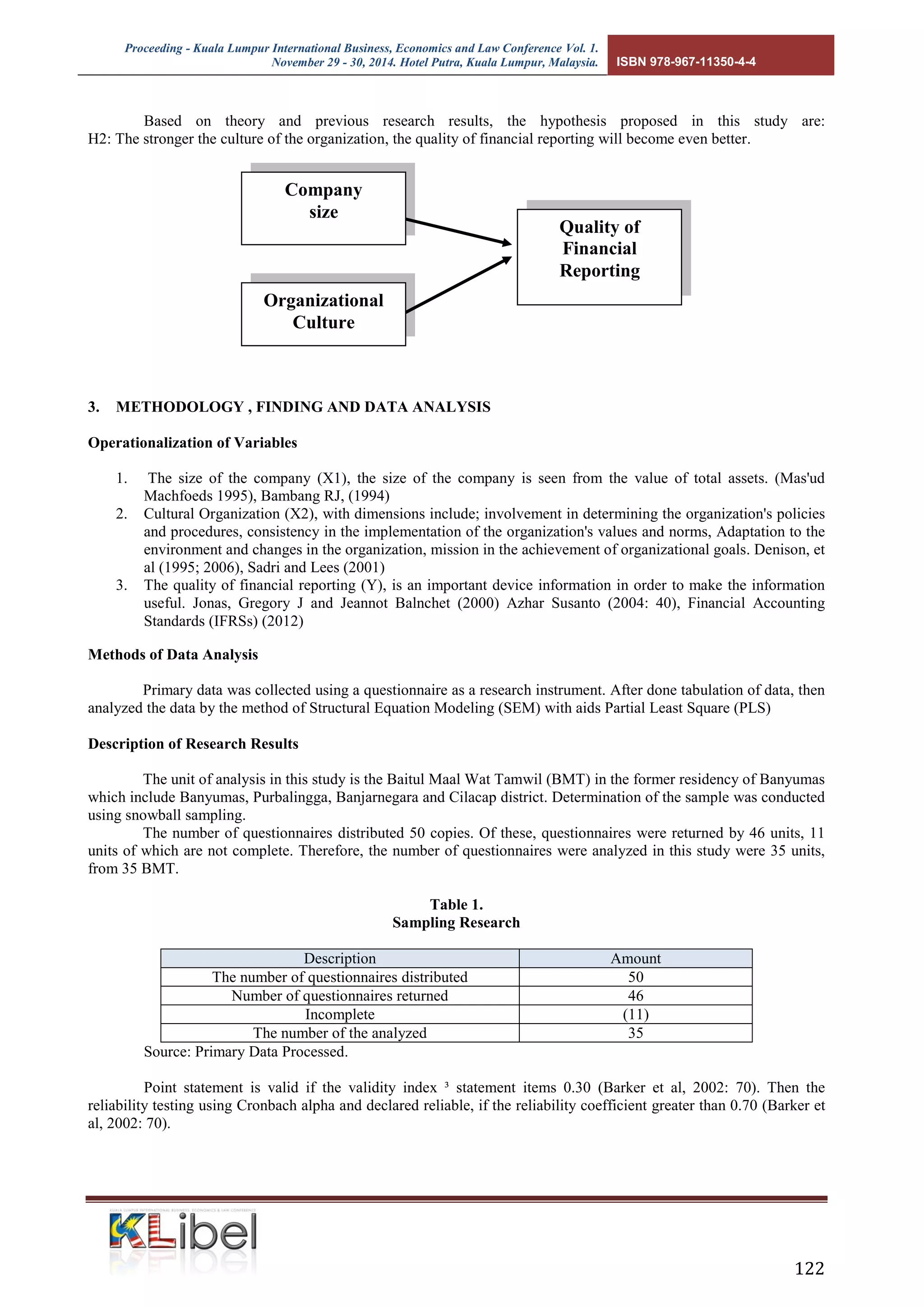

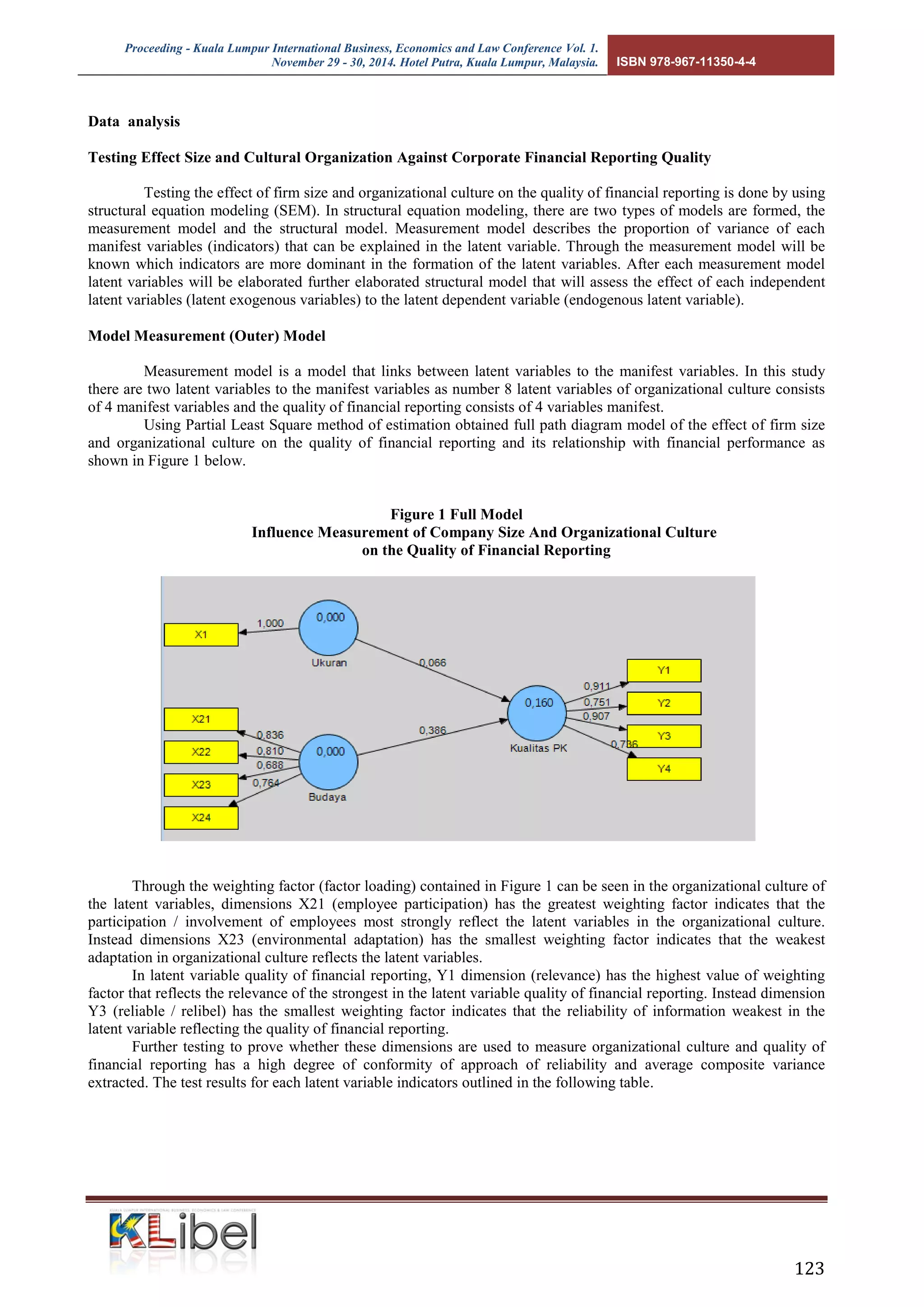

This study investigates the effect of firm size and organizational culture on the quality of financial reporting in Islamic microfinance institutions (Baitul Maal wa Tamwil) in Indonesia. The findings indicate that firm size does not significantly influence financial reporting quality, but organizational culture does have a positive impact. The study utilized a questionnaire with 35 respondents from different BMTs, analyzed through partial least square (PLS) methodology.