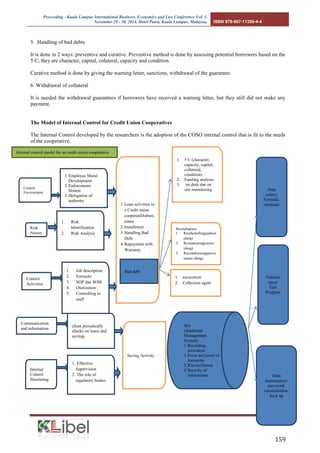

This document discusses the development of an internal control system for credit union cooperatives in Indonesia. It provides context on the important role of cooperatives in the Indonesian economy. It then reviews weaknesses found in existing cooperative internal controls, such as a lack of written procedures and job descriptions. The objectives of the study are to design an improved internal control system for credit union cooperatives. It reviews components of internal control systems and risks relevant to cooperatives based on prior literature.

![Proceeding - Kuala Lumpur International Business, Economics and Law Conference Vol. 1.

November 29 - 30, 2014. Hotel Putra, Kuala Lumpur, Malaysia. ISBN 978-967-11350-4-4

156

completeness and accuracy of the records. COSO’s definition of “internal control is the process effected by an entity’s board of directors, management and other personnel, designed to provide reasonable assurance regarding to the achievement of the following categories:

1) effectiveness and efficiency of operations;

2) reliability of financial reporting and,

3) compliance with applicable laws and regulations

Internal control is an integral part of an organization’s governance system ability to manage the risk, which is understood, effected, and actively monitored by the governing body/ management and other personnel to take advantage of the opportunities and to counter the threats to achieve the organization’s objectives.

SAS 78/ COSO stated five internal Control Components:

1.Control environment

1) Integrity and ethics of management,

2) Organizational structure,

3) Role of the board of directors and the audit committee,

4) Management’s policies and philosophy,

5) Delegation of responsibility and authority,

6) Performance evaluation measurement,

7) External influences—regulatory agencies,

8) Policies and practices managing human resources.

2. Risk assessment

Is to identify, analyze and manage the risks which are relevant to the financial report, such as:

1) changes in external environment,

2) risky foreign markets,

3) significant and rapid growth that strain the internal controls,

4) new product lines,

5) restructuring, downsizing,

6) changes in accounting policies.

7)

3. Information and Communication

The AIS should produce high quality information by :

1) identifying and recording all valid transactions,

2) providing timely information in appropriate detail to permit proper classification and financial reporting,

3) accurately measuring the financial value of transactions,

4) accurately recording transactions in the time period in which they occurred.

5)

Auditors must have sufficient knowledge of the IS to understand:

a. the classes of transactions ;

i. how these transactions are initiated [input]

ii. the associated accounting records and accounts used in processing [input]

b. the transaction processing steps from the initiation of a transaction to its inclusion in the financial statements [process]

c. the financial reporting process to compile financial statements, disclosures, and estimates [output]

4. Monitoring

The process for assessing the quality of internal control design and operation by;

1) procedures Separating

a. test of controls by internal auditors

2) Ongoing monitoring:

a. computer modules integrated into routine operations

b. management reports which highlight the trends and exceptions from normal performance](https://image.slidesharecdn.com/klibel5acc40-141126233355-conversion-gate02/85/Klibel5-acc-40_-3-320.jpg)