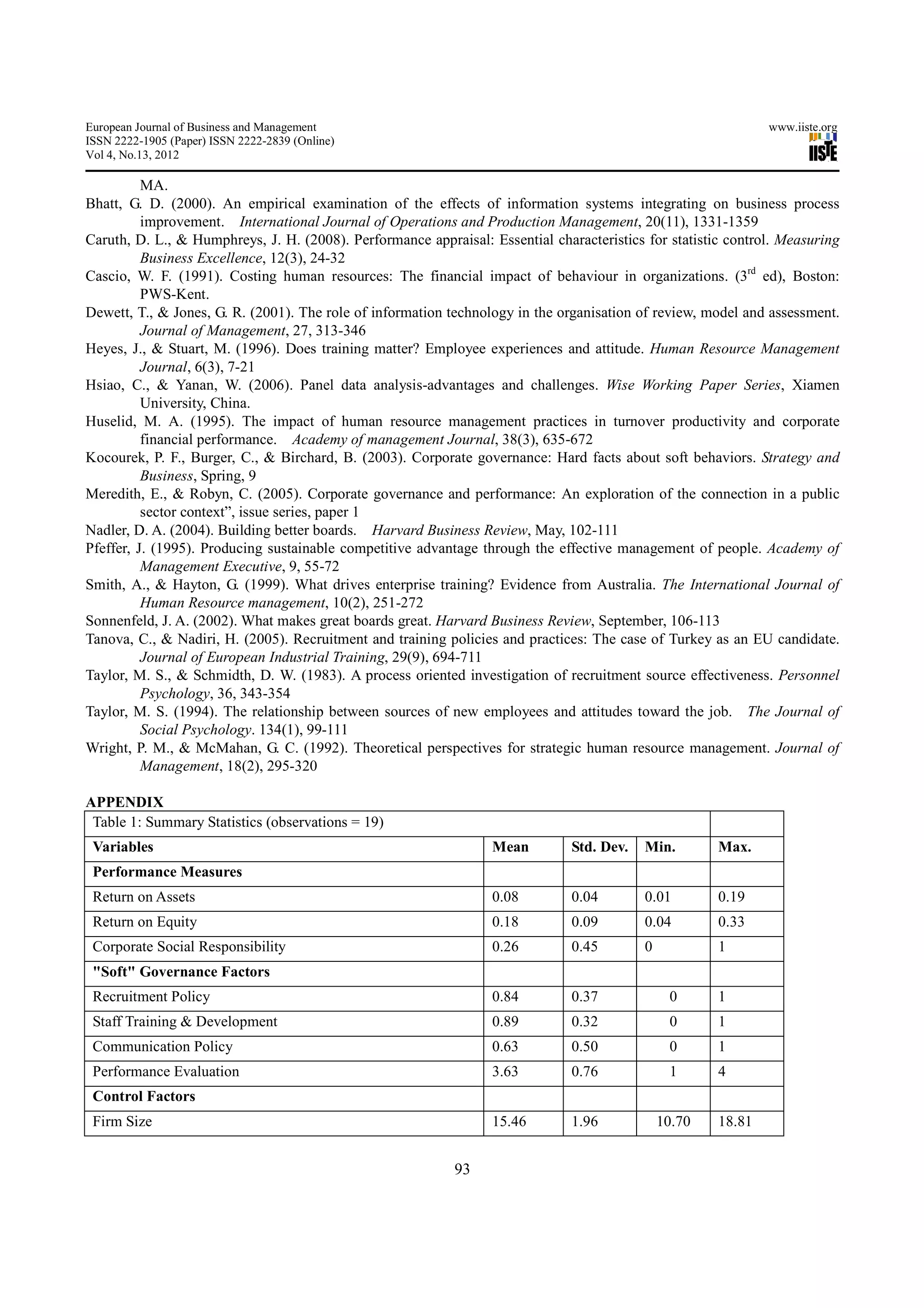

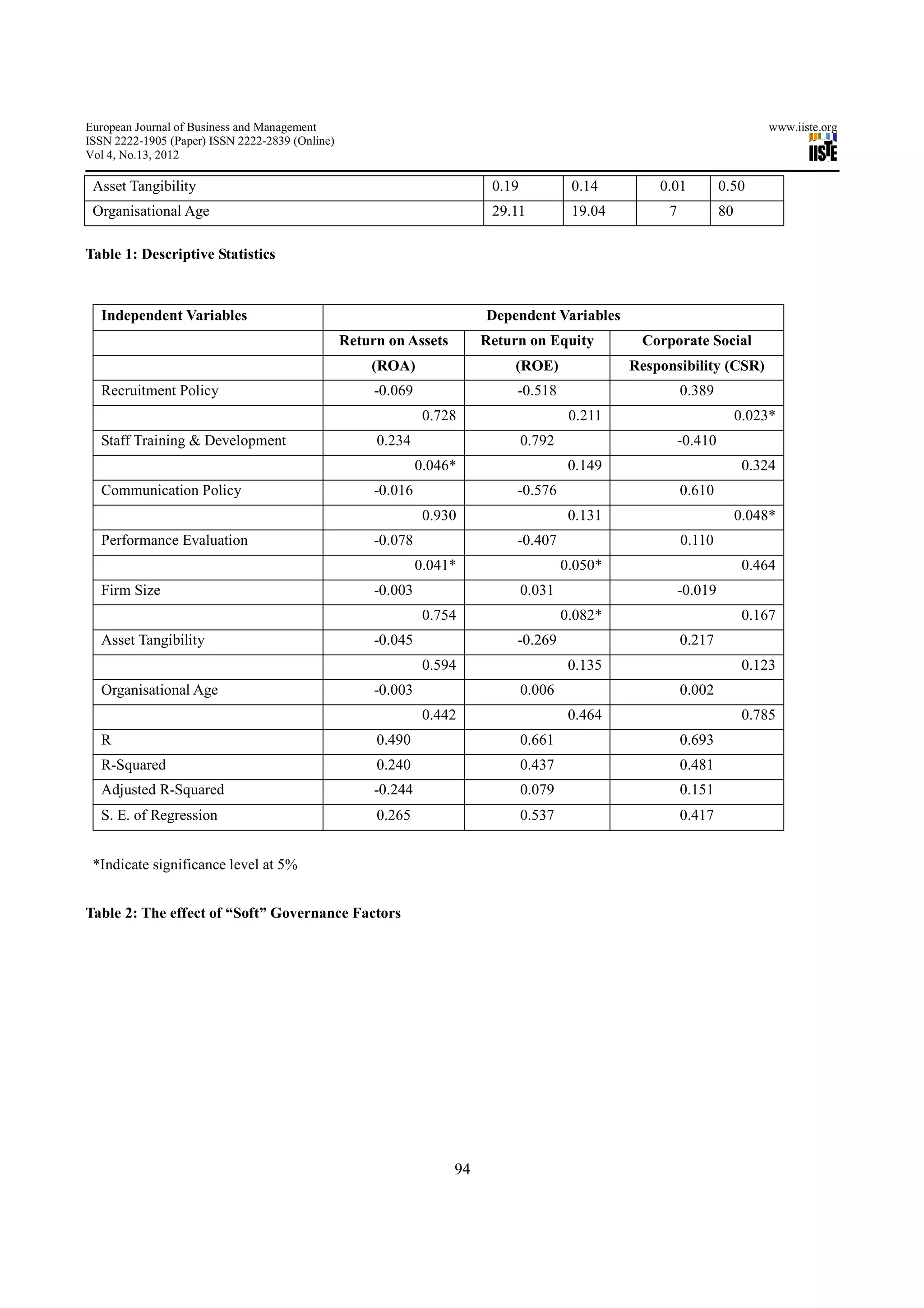

This document summarizes a study that investigated the relationship between "soft" governance factors and the performance of insurance companies in Ghana from 2005-2009. The study hypothesized that factors like recruitment policy, staff training, communication policy, and performance evaluation would have a positive relationship with firm performance. A questionnaire was used to collect data on these soft governance factors, while return on assets, return on equity, and corporate social responsibility were used to measure firm performance. Regression analysis found statistically significant positive relationships between the soft governance factors of recruitment policy, staff training, communication policy, and performance evaluation, and the performance of the insurance companies. The study recommends treating soft governance as a strategic issue and fully implementing related policies to maximize performance benefits.