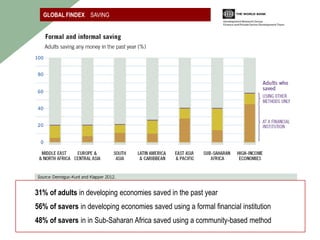

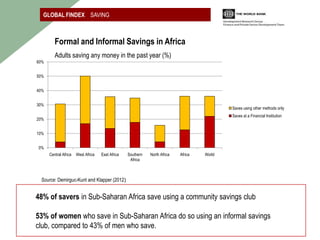

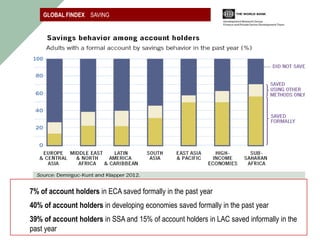

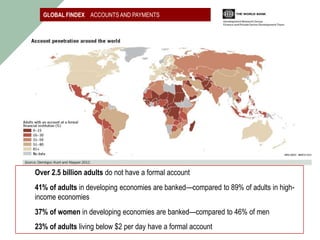

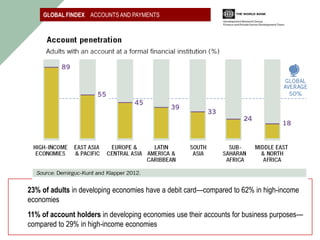

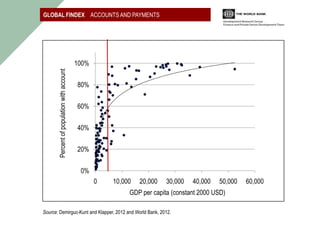

This document provides an overview of the Global Findex, a survey that measures financial inclusion around the world. It aims to collect comparable cross-country data on the use of formal and informal financial services. Key findings include that over 2.5 billion adults do not have a bank account, women and the poor have less access to financial services, and savings rates are low in many developing countries. The data can help inform financial inclusion policies and strategies to expand access to financial services.

![GLOBAL FINDEX ACCOUNTS AND PAYMENTS

31 percent of unbanked in Sub-Saharan Africa choose ―Too far away‖

31 percent of unbanked in Europe and Central Asia choose ―[I] don’t trust banks‖

40 percent of unbanked in Latin America and the Caribbean choose ―They are too expensive‖](https://image.slidesharecdn.com/klapperlsavingsplenarypresenter1-121205114020-phpapp02/85/Klapper-l-savings-plenary_presenter1-7-320.jpg)