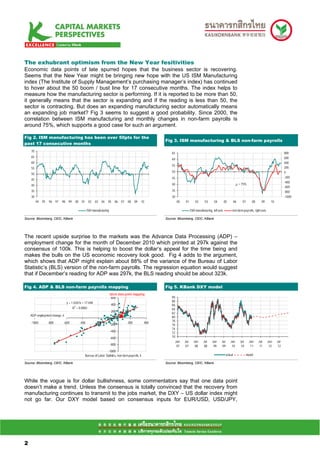

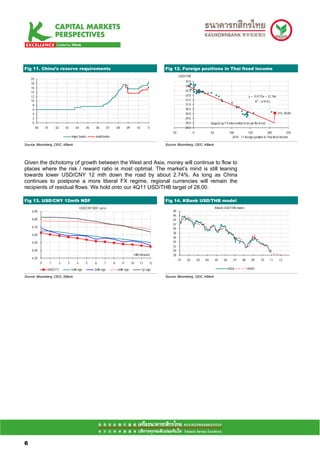

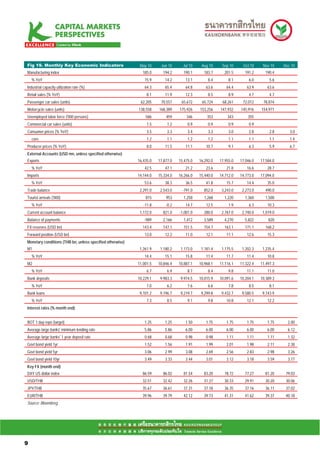

The document discusses recent economic data that has improved optimism about the US economic recovery. It notes that manufacturing data and employment data like the ADP report suggest non-farm payrolls could be higher than expected in December. However, it also notes the view that more quantitative easing is still needed given unemployment remains high. While the dollar may benefit short-term from better data, the document argues the dollar index may be capped around 80.53 based on their model. It also discusses that Thailand is likely to continue running large current account surpluses, which typically puts downward pressure on the USD/THB rate. Their model suggests a 4Q11 target of 28.00 for USD/THB.