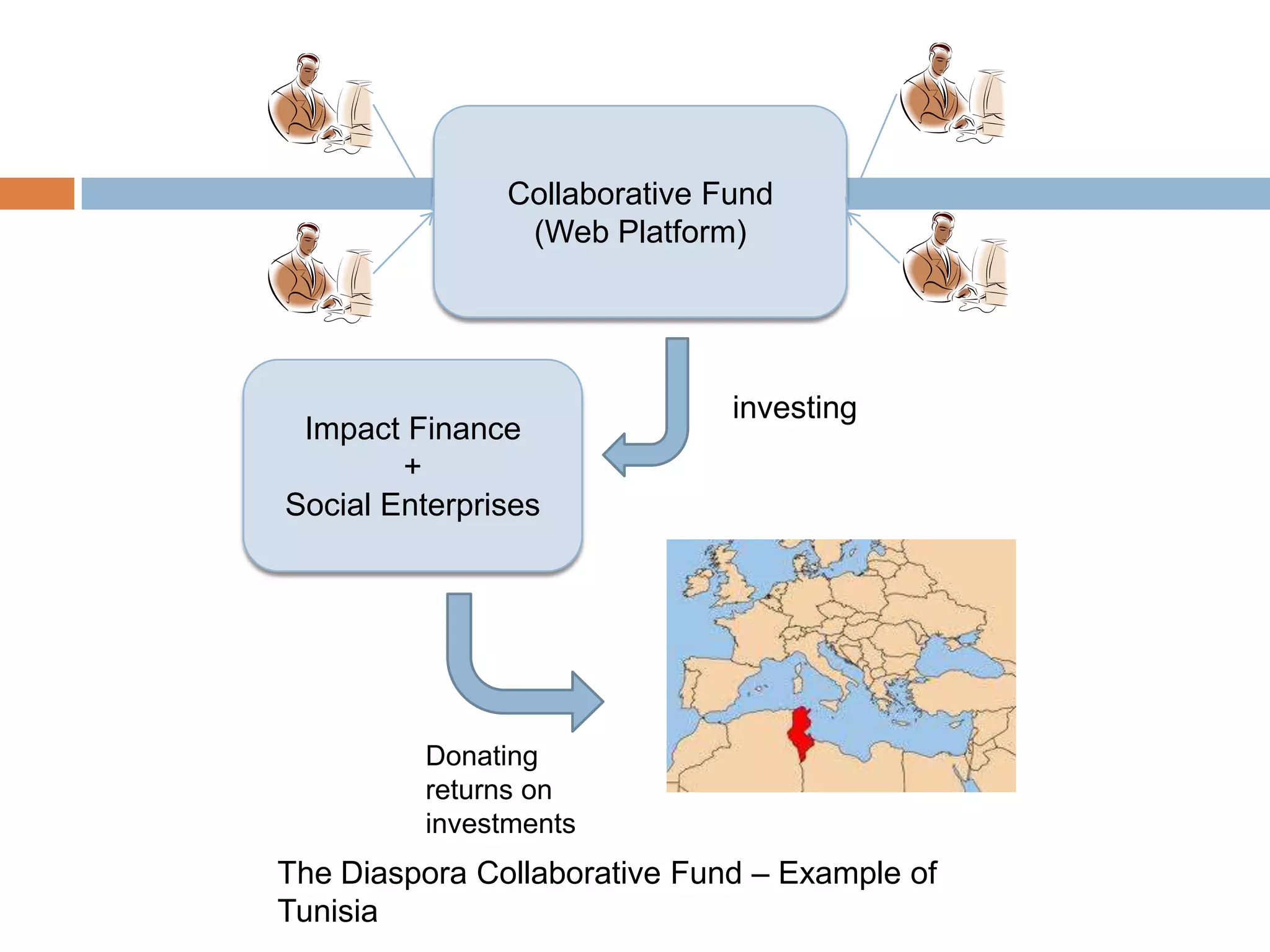

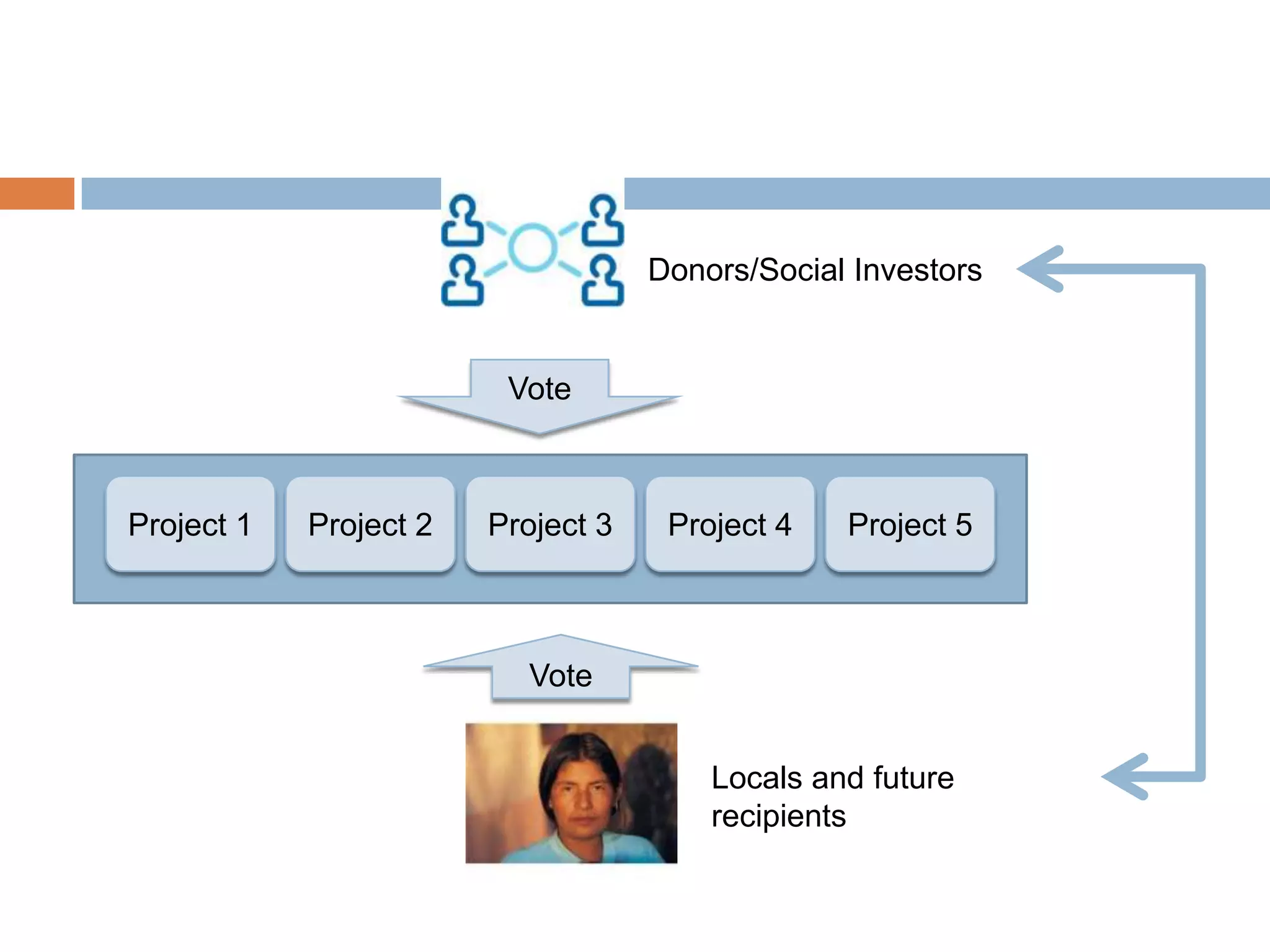

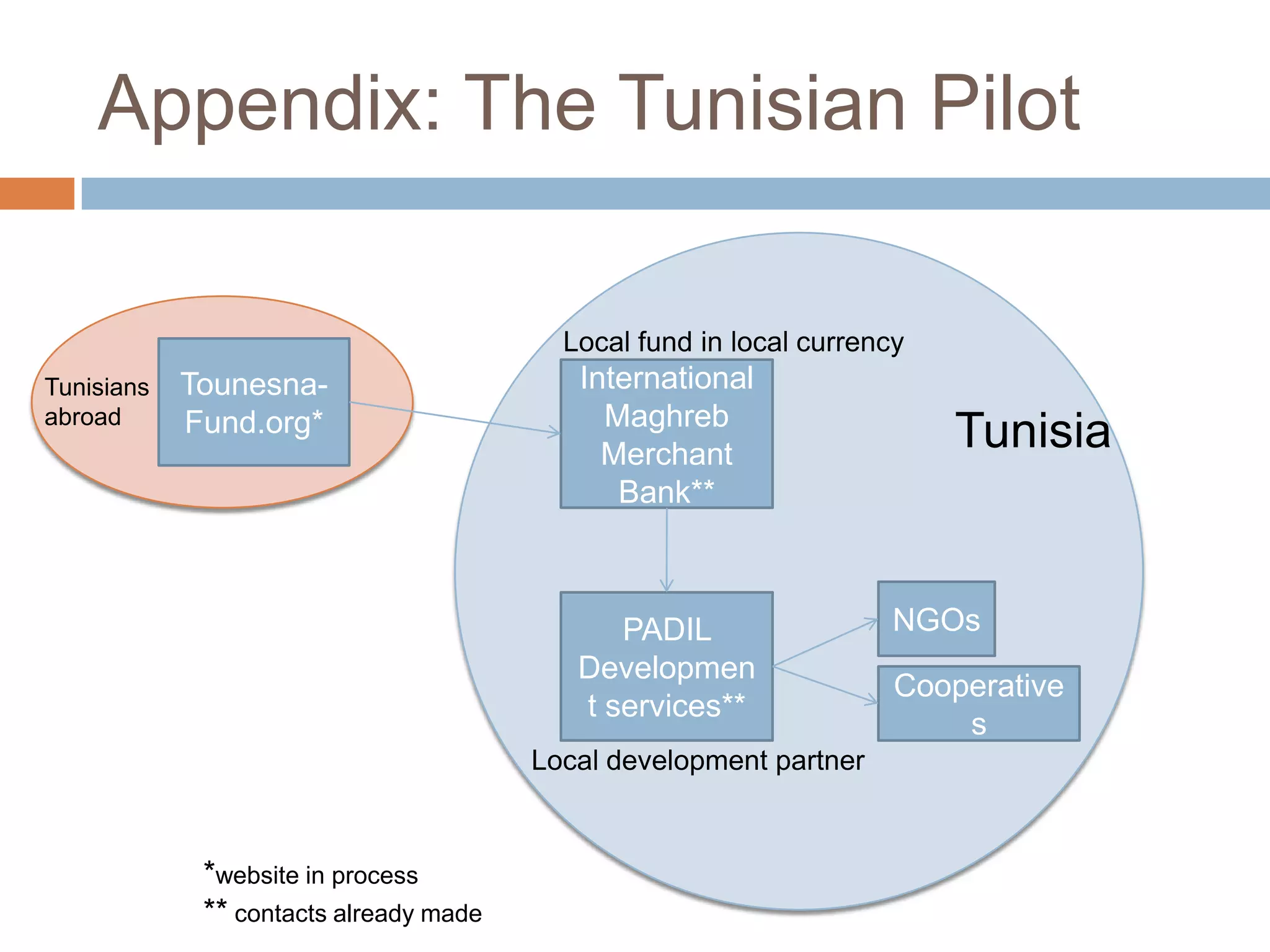

The document proposes the Diaspora Collaborative Fund, which would target expatriates from a specific country and allow them to donate amounts from $1,000-$100,000. The funds would be invested and only the returns donated to development projects in the home country. A website would connect donors to select projects vetted by local experts, and donors could discuss projects directly with locals. The fund aims to leverage diaspora financing and expertise, promote accountability through transparency and a "refund" policy, and pilot the concept with a Tunisia-focused fund invested in social enterprises and financial markets for maximum impact.