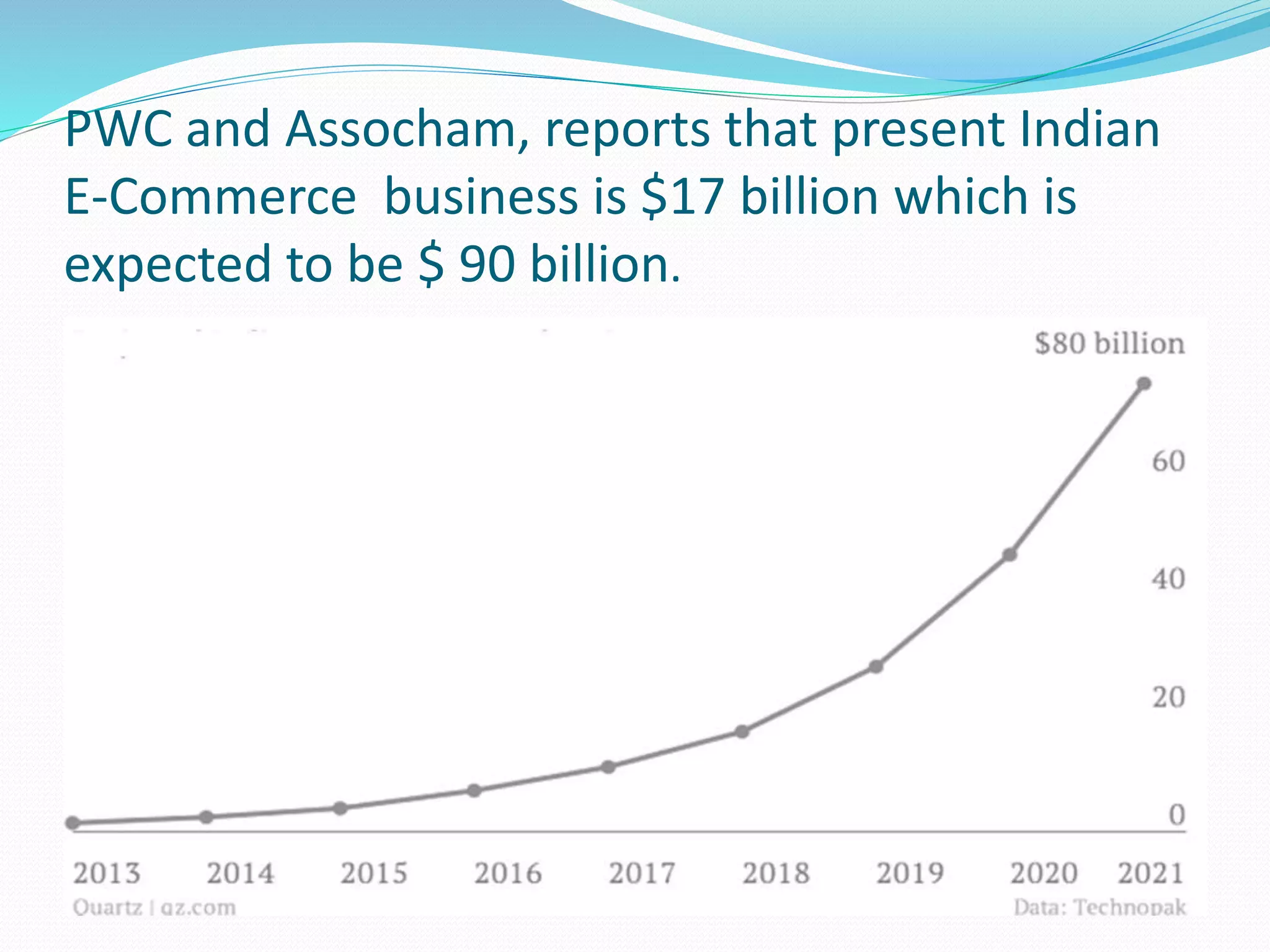

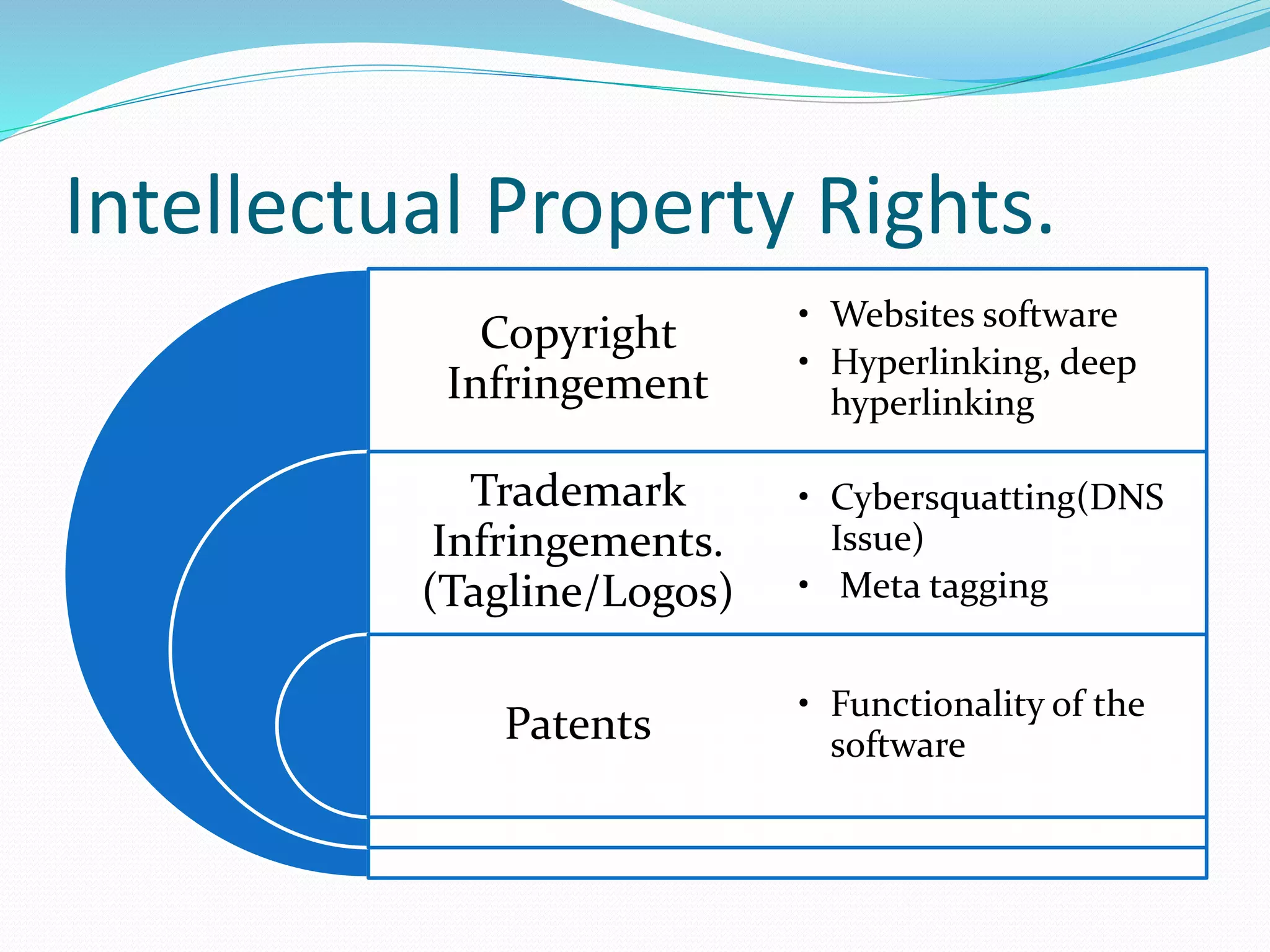

This document provides an overview of e-commerce in India. It discusses the growth of e-commerce, e-contracts, jurisdiction issues, the role of international bodies and frameworks, consumer protection, and a case study on Flipkart's Big Billion Sale. The document outlines the classification of e-commerce, essential elements of e-contracts, challenges regarding cross-border transactions and determining applicable law, and issues around intellectual property rights, digital goods/services, contracts with minors, and taxation in e-commerce. It also examines frameworks established by bodies like UNCITRAL and OECD and initiatives in India to regulate e-commerce and protect consumers.